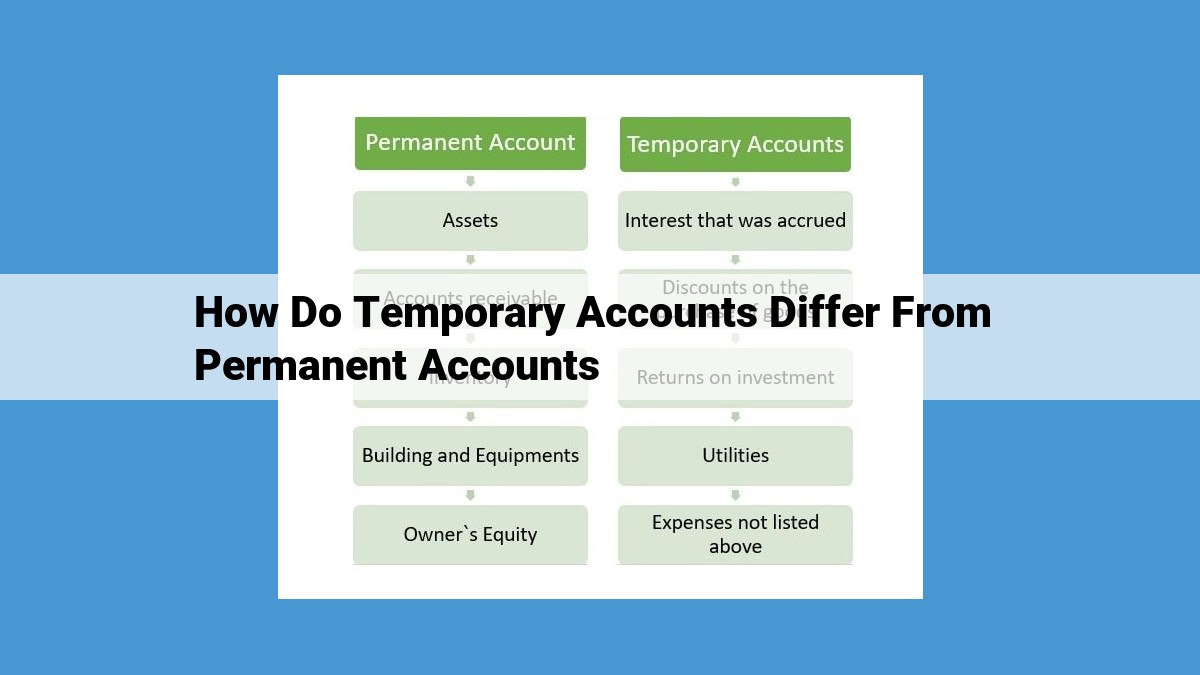

Temporary and permanent accounts serve distinct purposes in accounting. Temporary accounts track transactions over a specific period (e.g., expenses and revenues), closing to zero at the end. Permanent accounts hold ongoing balances (e.g., assets and liabilities), carrying forward their balances. This distinction impacts closing procedures, where temporary accounts balance transfer to permanent accounts, ensuring financial accuracy. Temporary accounts summarize performance in the income statement, while permanent accounts are reported on the balance sheet, providing valuable financial information. Understanding these differences is crucial for effective accounting practices.

The Purpose and Significance of Permanent and Temporary Accounts in Accounting

In the world of accounting, understanding the distinction between permanent and temporary accounts is crucial for maintaining accurate financial records and generating meaningful financial statements. Each type of account serves a unique purpose, contributing to the overall integrity of your accounting system.

Permanent accounts are like the pillars of your accounting framework. They record ongoing business activities that don’t reset at the end of an accounting period. These accounts, such as Cash, Inventory, and Buildings, track the ongoing financial position of your business. They carry their balances forward from period to period, providing a continuous record of your assets, liabilities, and equity.

In contrast, temporary accounts are short-lived, capturing the results of your business operations over a specific period, typically a month, quarter, or year. This includes accounts like Sales, Expenses, and Income. At the end of each period, these accounts are “zeroed out” in a process called closing. Their balances are transferred to permanent accounts, and they are ready to start accumulating data for the next period.

Temporary accounts play a vital role in measuring the performance of your business for a given period. By analyzing the balances in these accounts, you can determine profitability, operating efficiency, and other key metrics that inform decision-making.

Balance Management: A Tale of Two Accounts

In the intricate dance of accounting, the management of balances between permanent and temporary accounts plays a crucial role in maintaining the harmony of financial records. Let’s delve into the world of these accounts and explore the significance of their distinct balance management practices.

Temporary Accounts: A Symphony of Performance Measurement

Imagine a stage where temporary accounts perform a captivating show each accounting period. These accounts, such as Sales, Expenses, and Income, meticulously record the ebb and flow of business transactions. Their primary purpose is to measure the performance of an organization over a specific duration, typically a month or a quarter. However, at the end of each period, these temporary accounts gracefully bow out of the limelight and undergo a metamorphosis.

Their balances, like ephemeral melodies, are reset to zero, a process known as zeroing out. This act ensures that the stage is cleared for a fresh performance in the upcoming period. By starting with a clean slate, temporary accounts maintain an accurate measure of performance during each accounting cycle.

Permanent Accounts: The Pillars of Ongoing Existence

In stark contrast to their temporary counterparts, permanent accounts serve as the enduring pillars of a business’s financial landscape. Accounts like Cash, Inventory, and Long-Term Debt remain open indefinitely, carrying forward their balances from period to period. They accumulate and maintain a running total of assets, liabilities, and equity, providing a comprehensive snapshot of the company’s financial health at any given point in time.

The Significance of Balance Management

The diligent management of balances in both permanent and temporary accounts is paramount for maintaining the accuracy and integrity of financial records. Zeroing out temporary accounts prevents the accumulation of outdated information and ensures that performance is measured only for the relevant period.

Carrying forward balances in permanent accounts allows for a continuous record of assets, liabilities, and equity. It provides a historical perspective and facilitates comparisons over time, enabling businesses to track their financial progress and make informed decisions.

Closing Procedures: A Ritual of Cleansing and Renewal

Once the curtains close on an accounting period, a crucial ritual takes place known as closing procedures. For temporary accounts, it’s a time of release and renewal. Their balances are meticulously transferred to a special account called Income Summary, effectively closing them for the period.

Permanent accounts, on the other hand, remain open, their balances standing as a testament to the ongoing existence of the business. They are witnesses to the ebb and flow of transactions, providing a continuous record of the company’s financial health.

Financial Reporting: A Story Told in Numbers

The culmination of balance management practices finds its expression in financial reporting. Temporary accounts contribute their accumulated performance data to the income statement, which summarizes the revenues and expenses for a specific period. Permanent accounts, on the other hand, find their place on the balance sheet, providing a snapshot of the company’s financial position at a particular point in time. These reports, like a well-orchestrated symphony, tell a captivating story of the company’s financial health and performance.

Closing Procedures:

- Explain the process of closing temporary accounts by transferring their balances.

- Discuss why temporary accounts are closed and how permanent accounts remain open.

- Emphasize the importance of closing for financial accuracy.

Closing Procedures in Accounting: A Guide to Financial Accuracy

In the realm of accounting, temporary and permanent accounts play distinct roles in maintaining financial records. Temporary accounts, like fleeting shadows, measure the performance of a specific period, providing a snapshot of revenue, expenses, and income. Permanent accounts, on the other hand, are like steadfast pillars, tracking ongoing business activities and carrying their balances forward.

As the financial year draws to a close, a crucial process known as “closing” takes place. During this ritual, temporary accounts, burdened with the weight of their ephemeral existence, shed their balances. They transfer their accumulated amounts to permanent accounts, bestowing upon them the responsibility of carrying this financial legacy into the future.

Why Close Temporary Accounts?

Closing temporary accounts is essential for ensuring financial accuracy. Imagine a continuous stream of transactions flowing through a business like an endless river. If temporary accounts were not periodically emptied, this river would overflow, creating a jumbled mass of financial data impossible to decipher. Closing these accounts resets the stage, providing a clean slate for the measurement of performance in the next accounting period.

Permanent Accounts: Guardians of Continuity

In contrast to their transient counterparts, permanent accounts remain open, their balances flowing like an unbroken thread through the passage of time. This continuity allows businesses to track assets, liabilities, and equity, providing a historical perspective on their financial health. Permanent accounts are the foundation upon which financial statements are built, enabling the creation of informative reports for investors, creditors, and other stakeholders.

Closing Procedure: A Methodical Ritual

The closing procedure is a methodical ritual, guided by accounting principles. Temporary accounts are systematically closed through a series of journal entries, transferring their balances to predefined permanent accounts. Expenses, for instance, are closed to an Income Summary account, while revenue finds its way to the same destination. The Income Summary account then summarizes the performance of the period, with its final balance transferred to the Retained Earnings account, a permanent account that tracks the cumulative profits of the business.

Importance of Closing: Clarity in Financial Reporting

Closing temporary accounts is not merely an arbitrary practice; it is a cornerstone of financial reporting. It provides a clear separation between the results of past and future periods, ensuring that financial statements accurately reflect the current state of a business. Without closing, financial statements would be cluttered with outdated information, potentially misleading investors and other users of financial data.

The closing process in accounting is a meticulous dance between temporary and permanent accounts, designed to ensure financial accuracy and clarity. By closing temporary accounts and carrying forward balances in permanent accounts, businesses maintain a historical record of their financial activities and create meaningful financial statements. Understanding the role of closing procedures is essential for anyone seeking to navigate the complexities of accounting.

Financial Reporting:

- Explain how temporary accounts are summarized in the income statement.

- Discuss how permanent accounts are reported on the balance sheet.

- Highlight the role of these accounts in providing financial information.

Permanent and Temporary Accounts: Their Roles in Financial Reporting

In the intricate symphony of accounting, permanent accounts play a fundamental role in capturing the ongoing health of a business, while temporary accounts serve as vital gauges of its performance over specific periods. Understanding their distinct functions is crucial for deciphering the financial story.

Permanent Accounts: Guardians of the Balance Sheet

Imagine permanent accounts as steadfast pillars, providing a snapshot of a company’s financial position at any given moment. They track assets, liabilities, and owner’s equity, painting a picture of the business’s resource capacity and financial obligations. These accounts stand firm, carrying forward their balances from period to period, creating a continuous narrative of the company’s financial well-being.

Temporary Accounts: Measuring Performance on the Income Statement

Temporary accounts, on the other hand, act as measuring sticks, capturing revenue, expenses, and gains and losses over a specific reporting period. At the end of each period, these accounts are zeroed out through a process called closing. Why? Because they fulfill their purpose of providing insight into the performance for that particular period.

From Revenue to Net Income: The Income Statement Tale

The income statement is a vital stage where temporary accounts take center stage. They contribute their numbers, weaving a tale of the company’s revenue generation and expenses incurred, ultimately leading to net income. This financial statement offers a glimpse into the company’s profitability and efficiency.

Permanent Accounts: Building Blocks of the Balance Sheet

Meanwhile, permanent accounts migrate to the balance sheet, where they form the backbone of the company’s financial health. Assets like cash, inventory, and buildings are tallied against liabilities like accounts payable and loans, revealing the company’s net assets or owner’s equity. This statement provides a static picture of the business’s financial position.

Understanding the Difference Between Permanent and Temporary Accounts

In the realm of accounting, accounts are the building blocks that track financial transactions. Understanding the key differences between permanent and temporary accounts is crucial for effective financial reporting and accurate decision-making.

Temporary Accounts

Temporary accounts, also known as nominal accounts, measure the performance of a specific accounting period. They track revenue, expenses, and losses incurred during the period. At the end of each period, the balances in temporary accounts are zeroed out, as they only represent the results for that particular time frame.

Examples of temporary accounts include:

- Sales

- Salaries Expense

- Rent Expense

- Utilities Expense

Permanent Accounts

Permanent accounts, on the other hand, track ongoing activities and carry their balances forward from period to period. They reflect the financial position of a company and include assets, liabilities, and owner’s equity.

Examples of permanent accounts include:

- Cash

- Accounts Receivable

- Inventory

- Long-Term Debt

Significance of Understanding the Difference

Distinguishing between permanent and temporary accounts is essential because it influences how they are managed, closed, and reported. Temporary accounts measure performance and are used to derive the income statement. Permanent accounts reflect financial position and are reported on the balance sheet.

By understanding the difference between these accounts, accountants can accurately prepare financial statements, analyze financial performance, and make informed business decisions.

Key Differences Summary:

- Provide a condensed summary of the key differences between permanent and temporary accounts.

- Highlight the differences in time horizon, closing procedures, and financial reporting.

- Emphasize the importance of understanding these differences for effective accounting practices.

Key Differences: Permanent vs. Temporary Accounts

Understanding the intricacies of accounting isn’t always easy, but grasping the fundamental differences between permanent and temporary accounts is key to unlocking the secrets of financial reporting. Let’s embark on a storytelling journey to demystify this intricate dance of numbers.

Time Horizon: A Tale of the Past and Present

Permanent accounts, like faithful companions, traverse the sands of time, steadfastly recording every transaction that shapes the financial landscape. They harbor the story of the company’s evolution, from the initial investments to the present-day operations, painting a historical canvas of financial activity.

Temporary accounts, on the other hand, are like fleeting glimpses into the present. They capture the ebb and flow of the company’s performance over a specific period, painting a vibrant snapshot of its triumphs and struggles.

Closing Procedures: A Balancing Act

At the end of each accounting period, a ritual unfolds: temporary accounts bid farewell to their balances, shedding their transient numbers like autumn leaves. They surrender their accumulated values to the ether of permanent accounts, where they await reactivation in the next cycle.

Permanent accounts, however, carry forward their balances with unwavering tenacity, like seasoned veterans bearing the weight of experience. They serve as a bridge between the past and the future, preserving the legacy of the company’s financial journey.

Financial Reporting: Unveiling the Truth

When the time comes to communicate the company’s financial health to the world, temporary accounts take center stage in the income statement, their collective performance illuminating the company’s profitability. Permanent accounts, meanwhile, find their home in the balance sheet, their balances offering a panoramic view of the company’s assets, liabilities, and equity.

Grasping the Differences: The Key to Accounting Success

Discerning the nuances between permanent and temporary accounts is not just an academic exercise; it’s the key to unlocking the power of accounting. By comprehending the differences in their time horizon, closing procedures, and financial reporting roles, you gain the ability to interpret financial statements with precision and uncover the insights they hold.

So, as you navigate the world of accounting, embrace the distinction between permanent and temporary accounts. It’s not just about numbers; it’s about unraveling the story of a company’s financial odyssey.