To calculate direct materials used, begin by recognizing that they are materials directly consumed in production, unlike indirect materials used to support operations. Next, track materials usage to maintain accurate inventory records. The calculation itself involves three components: beginning inventory, purchases, and ending inventory. The formula is: Direct Materials Used = Beginning Inventory + Purchases – Ending Inventory. For instance, if you have a beginning inventory of $10,000, purchases of $20,000, and an ending inventory of $5,000, direct materials used would be $25,000 ($10,000 + $20,000 – $5,000). Accurate calculation ensures proper inventory management, accurate cost of goods sold determination, and optimized production efficiency.

Direct Materials: The Building Blocks of Production

In the tapestry of manufacturing, direct materials stand as the fundamental threads that weave together a tangible product. They are the essential components that directly enter and can be easily traced to the finished goods, forming the backbone of production.

Unlike indirect materials, which play a supporting role and contribute subtly to the final product, direct materials are more tangible and visible. Think of the flour that becomes bread, the lumber that transforms into a chair, or the raw cotton that weaves into fabric. These primary ingredients, without which the end product could not exist, are the very essence of direct materials.

Distinguishing between direct and indirect materials is crucial for ensuring accurate inventory tracking and efficient cost accounting. By segregating these two categories, manufacturers can precisely calculate the material costs directly attributable to each unit of production. This knowledge empowers them to optimize resource allocation, minimize waste, and maximize profitability.

Materials Accountability: The Key to Inventory Accuracy

In the realm of manufacturing, direct materials hold immense significance in the production process. Understanding their whereabouts and usage is crucial for maintaining accurate inventory records, a cornerstone of effective inventory management.

The Perils of Negligent Tracking

Without proper tracking mechanisms, direct materials can vanish into thin air, leaving a gaping hole in your inventory. This can lead to costly production delays, erroneous cost of goods sold calculations, and ultimately, reduced profitability.

The Benefits of Diligence

On the other hand, meticulous tracking of direct materials usage ensures that every ounce of material is accounted for. This empowers businesses with:

- Precise Inventory Counts: Accurate records provide a clear picture of available stock, eliminating the risk of running out of critical materials at crucial moments.

- Reduced Production Delays: Knowing your material whereabouts allows for proactive planning and prevents costly disruptions due to material shortages.

- Improved Cost Management: Precise knowledge of direct materials usage leads to accurate cost of goods sold calculations, enabling businesses to optimize pricing strategies.

Embracing Accountability for Materials

Implementing a robust materials accountability system is essential. This involves:

- Establishing Clear Material Tracking Procedures: Define the process for receiving, storing, issuing, and returning materials.

- Utilizing Inventory Management Software: Leverage technology to automate tracking, enhance visibility, and minimize errors.

- Empowering Employees: Train and empower team members to adhere to established procedures and report any discrepancies promptly.

- Conducting Regular Inventory Verifications: Periodically verify inventory levels against actual counts to ensure accuracy and reduce the risk of theft or loss.

By embracing materials accountability, businesses can gain control over their inventory, minimize waste, and optimize production efficiency. It’s an investment in accuracy that pays dividends in the long run.

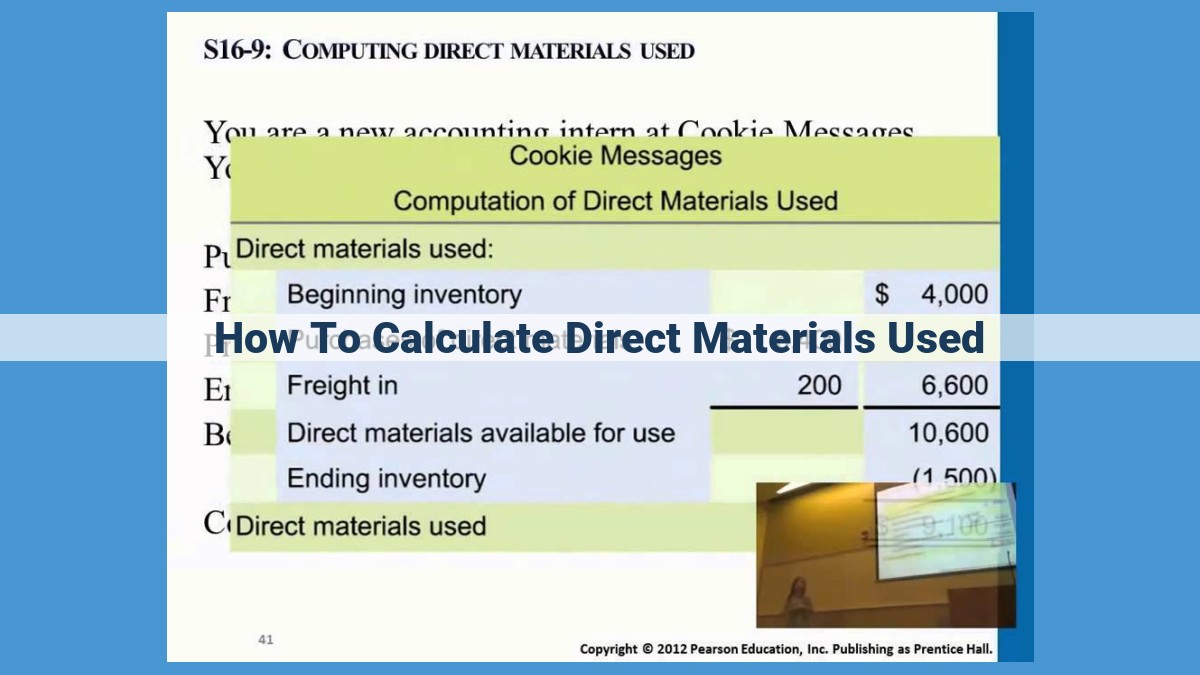

Components of Direct Materials Used Calculation: A Detailed Explanation

Understanding the components of direct materials used calculation is crucial for maintaining accurate inventory records and ensuring efficient production. Direct materials are raw materials that are directly incorporated into a finished product, unlike indirect materials used in the manufacturing process but not directly part of the end result. Tracking direct materials usage is essential for managing inventory levels effectively.

The beginning inventory represents the quantity of direct materials on hand at the start of a specific accounting period. This figure is carried forward from the ending inventory of the previous period. Purchases refer to the quantity of direct materials acquired during the period, either through purchases from suppliers or internal production. Finally, ending inventory represents the quantity of direct materials remaining on hand at the end of the accounting period. This figure is carried forward as the beginning inventory for the next period.

These three components play a vital role in calculating the direct materials used during the period. The formula used for this calculation is:

Direct Materials Used = Beginning Inventory + Purchases – Ending Inventory

By understanding the significance of each component, manufacturers can accurately determine the amount of direct materials consumed in the production process. This information enables better inventory management, cost of goods sold calculation, and production efficiency optimization.

Unveiling the Formula for Calculating Direct Materials Used

In the realm of manufacturing, understanding the intricacies of direct materials usage is crucial for inventory management and accurate costing. Direct materials, the raw materials directly transformed into finished goods, play a pivotal role in determining production efficiency and cost of goods sold. To gain a precise understanding of direct materials consumption, we must delve into the formula that illuminates this essential calculation.

The formula for calculating direct materials used is a straightforward equation that combines three key components: beginning inventory, purchases, and ending inventory. Each component plays a distinct role in unraveling the amount of direct materials consumed during the production process.

Beginning Inventory: This represents the value of direct materials available at the start of the accounting period. These materials have not yet been allocated to production.

Purchases: This encompasses all direct materials acquired during the accounting period. These purchases increase the total direct materials available for production.

Ending Inventory: This signifies the value of direct materials still on hand at the end of the accounting period. These materials have not been fully consumed in production.

With these components in mind, we can assemble the formula:

Direct Materials Used = Beginning Inventory + Purchases – Ending Inventory

The formula is a simple subtraction equation. By subtracting the ending inventory from the sum of beginning inventory and purchases, we arrive at the amount of direct materials that have been consumed during the production process.

Understanding this formula is pivotal for several reasons:

-

Accurate Inventory Management: A precise calculation of direct materials used allows businesses to maintain up-to-date inventory records. This information is vital for planning production schedules, preventing stockouts, and optimizing inventory costs.

-

Precise Cost of Goods Sold: The cost of goods sold calculation heavily relies on accurate direct materials usage data. By knowing how much direct materials were used, businesses can determine the associated costs and accurately reflect them in their financial statements.

-

Enhanced Production Efficiency: By tracking direct materials used, businesses can identify areas of waste and inefficiency in the production process. This data can inform improvements to optimize production efficiency and minimize material consumption.

Calculating Direct Materials Used: A Comprehensive Guide

As a business owner, understanding the ins and outs of inventory management is crucial for maintaining profitability and optimizing production efficiency. Among the various elements of inventory, direct materials play a significant role in the manufacturing process. In this blog post, we’ll dive into the world of direct materials, exploring their definition, importance, and the formula for calculating direct materials used.

Definition of Direct Materials

Direct materials are the raw materials that are directly used in the production of a finished product. They can include a wide range of items, from fabric and wood to electronic components and chemical substances. Unlike indirect materials, which are used in the production process but not directly incorporated into the finished product, direct materials are an essential part of the final output.

Materials Accountability

Tracking direct materials usage is vital for maintaining accurate inventory records. When direct materials are not properly accounted for, it can lead to inaccuracies in production planning, cost calculations, and inventory valuation. To ensure accuracy, it’s important to establish a robust system for tracking materials from the point of purchase to the point of consumption.

Components of Direct Materials Used Calculation

The calculation of direct materials used involves three key components:

- Beginning Inventory: The amount of direct materials on hand at the start of the accounting period.

- Purchases: The amount of direct materials purchased during the accounting period.

- Ending Inventory: The amount of direct materials on hand at the end of the accounting period.

Formula for Calculating Direct Materials Used

The formula for calculating direct materials used is as follows:

**Direct Materials Used = Beginning Inventory + Purchases - Ending Inventory**

Each component of the formula plays a crucial role in determining the amount of direct materials that were consumed during the accounting period:

- Beginning Inventory: Represents the materials available for production at the start of the period.

- Purchases: Accounts for the additional materials that were acquired during the period.

- Ending Inventory: Deducts the materials that were not used in production and remain on hand at the end of the period.

Example

To illustrate the application of the formula, let’s consider the following example:

- Beginning Inventory: 100 units

- Purchases: 250 units

- Ending Inventory: 75 units

Using the formula:

Direct Materials Used = 100 units + 250 units – 75 units = 175 units

Therefore, the company used 175 units of direct materials in the production of finished goods during the accounting period.

Importance of Accurate Direct Materials Calculation

Accurately calculating direct materials used is essential for several reasons:

- Inventory Management: Ensures that inventory records are up-to-date and reliable, enabling better inventory planning and control.

- Cost of Goods Sold: Allows for the accurate calculation of the cost of goods sold, which is a critical factor in determining profitability.

- Production Efficiency: Provides insights into materials usage, helping businesses identify potential inefficiencies and areas for improvement in production processes.

The Importance of Accurate Direct Materials Calculation

Maintaining accurate records of direct materials is crucial for the smooth operation of manufacturing and warehousing businesses. Direct materials are indispensable components that are directly incorporated into the finished product, unlike indirect materials that support the production process but are not part of the final output.

Inventory Management:

Accurate direct materials calculation ensures optimal inventory levels, preventing both overstocking and shortages. Maintaining adequate inventory minimizes the risk of production delays due to unavailability of materials, while avoiding excessive storage costs associated with overstocking. A clear understanding of direct materials usage patterns allows for efficient planning of purchases and inventory replenishment.

Cost of Goods Sold:

Direct materials represent a significant portion of the cost of goods sold (COGS). Accurate calculation is essential for determining the actual cost of production. Errors in materials accounting can distort COGS, leading to incorrect financial reporting and potentially misleading decision-making. Precise calculation ensures that the COGS reflects the actual materials consumed in the production process.

Production Efficiency:

By tracking direct materials usage, businesses can identify inefficiencies and optimize production processes. A detailed understanding of materials consumption patterns allows for the identification of areas where waste or inefficiencies occur. By addressing these issues, businesses can improve production efficiency, reduce waste, and enhance overall profitability.

In conclusion, accurate direct materials calculation is paramount for maintaining optimal inventory levels, ensuring accurate cost of goods sold, and improving production efficiency. It provides businesses with a clear understanding of their materials usage, enabling them to make informed decisions that drive profitability and operational success.