To calculate capital gains yield, determine the sale and purchase prices of the asset. Calculate capital gain by subtracting the purchase price from the sale price. Divide the capital gain by the purchase price and multiply by 100% to find the percentage yield. This metric measures the return on investment over a holding period, providing insights into the profitability of investments and aiding financial decision-making.

Unlocking the Potential of Capital Gains Yield: A Comprehensive Guide

In the realm of investing, discerning the true worth of your investments goes beyond mere price appreciation. Capital Gains Yield emerges as an indispensable metric that unveils the hidden earning power of your assets, guiding you towards informed investment decisions. This comprehensive article will serve as your trusted compass, navigating the intricacies of calculating capital gains yield, empowering you to unlock the full potential of your investments.

As you embark on your investing journey, understanding the significance of capital gains yield is paramount. It measures the percentage return on an investment over a specific holding period. By comparing your capital gains yield against market benchmarks or other investment options, you gain invaluable insights into the profitability and efficiency of your investments.

This article aims to demystify the concept of capital gains yield and equip you with the tools to effortlessly calculate it. With precision and clarity, we will dissect each step of the calculation process, ensuring you master this essential financial metric.

Demystifying Capital Gains Yield: A Comprehensive Guide to Investment Returns

In the world of investments, understanding the nuances of profitability is crucial. One key metric that savvy investors rely on is capital gains yield. It’s a powerful tool that measures the return on your investments, indicating how much profit you’ve made over a specific period. This guide will take you through a step-by-step journey of calculating capital gains yield, empowering you to assess the performance of your investments and make informed financial decisions.

Concept Breakdown:

Let’s dissect the key terms involved in calculating capital gains yield:

- Sale Price: This is the amount you sell an asset for, whether it’s a stock, real estate, or any other investment.

- Purchase Price: When you acquired the asset, this is the initial cost you paid, including the down payment and acquisition expenses.

- Holding Period: Time is money, especially in investments. This refers to the duration you held the asset before selling it.

- Capital Gain: When you sell an asset for a price higher than you purchased it, you’ve made a capital gain. It represents the profit you’ve realized.

- Capital Gains Yield: This is the star of the show. It measures the return on your investment over a specified holding period. It’s expressed as a percentage, providing a clear view of your profitability.

Calculating Capital Gains Yield: A Step-by-Step Guide

When evaluating the performance of your investments, capital gains yield is a crucial metric to consider. It reveals the percentage return you’ve earned on an asset over a specific holding period. Comprehending this concept is essential for savvy investors, and this article will provide a comprehensive guide to calculating capital gains yield.

Step 1: Determine Sale and Purchase Prices

The first step involves gathering the sale price and purchase price of the asset. The sale price represents the market value or transaction price when you sold the asset, while the purchase price is the initial cost of acquiring it, including down payments and acquisition costs.

Step 2: Calculate Capital Gain

Once you have the sale and purchase prices, you need to calculate the capital gain. This is simply the difference between the sale price and the purchase price. A positive capital gain indicates a profit from selling the asset, while a negative capital gain indicates a loss.

Step 3: Calculate Holding Period

The holding period is the duration you owned the asset before selling it. This is an important factor because it affects the tax implications of capital gains. Long-term capital gains, which result from holding an asset for more than a year, typically qualify for lower tax rates than short-term capital gains.

Step 4: Calculate Capital Gains Yield

Now, you can calculate the capital gains yield. To do this, divide the capital gain by the purchase price and multiply the result by 100%. This will give you the percentage yield, which represents the annualized rate of return on your investment over the holding period.

Here’s a quick example to illustrate the process:

- Sale Price: $10,000

- Purchase Price: $8,000

-

Holding Period: 2 years

-

Capital Gain: $10,000 – $8,000 = $2,000

- Capital Gains Yield: ($2,000 / $8,000) x 100% = 25%

This means that you earned a 25% annualized return on your investment over the two-year holding period.

Understanding how to calculate capital gains yield is essential for making informed investment decisions. By following these steps, you can accurately assess the profitability of your investments and maximize your returns. Remember, capital gains yield is a valuable tool for investors, and utilizing it effectively can help you achieve your financial goals.

Calculating Capital Gains Yield: A Comprehensive Guide

Are you curious about the hidden treasure that can unlock the true potential of your investments? It’s called capital gains yield, and it’s a metric that can transform investment decisions into golden opportunities.

What is Capital Gains Yield?

Imagine your beloved car that you’ve owned for years. When you finally decide to sell it, you’re not just interested in the sale price, you also want to know how much profit you’ve made since you bought it. That’s where capital gains yield comes in. It tells you the exact percentage return you’ve earned over the holding period you’ve owned the asset.

How to Calculate Capital Gains Yield

Calculating capital gains yield is as simple as a summer breeze:

- Determine the Sale and Purchase Prices: Gather the prices you paid for the asset and the amount you sold it for.

- Calculate Capital Gain: Subtract the purchase price from the sale price. This will give you the profit you’ve made.

- Calculate Holding Period: Determine how long you’ve owned the asset.

- Calculate Capital Gains Yield: Divide the capital gain by the purchase price and multiply by 100 to get the percentage yield.

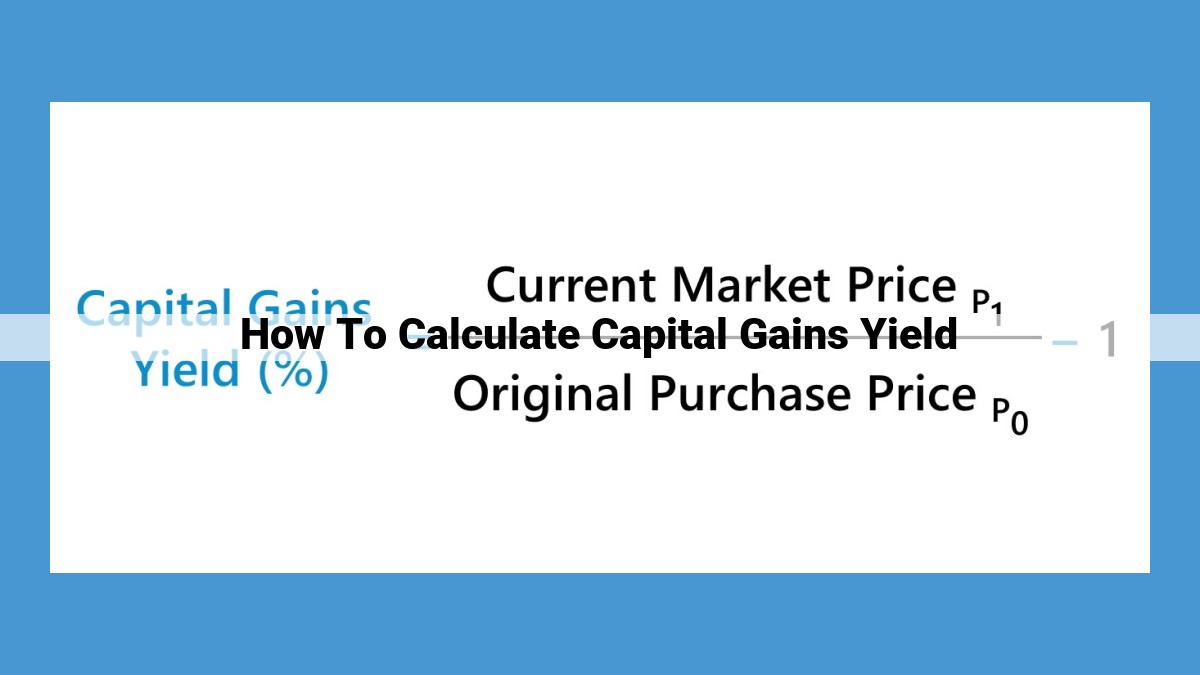

Formula: Unlocking the Secret

The magic formula for capital gains yield is:

Capital Gains Yield = (Capital Gain / Purchase Price) x 100%

Plug in the numbers, and presto! You’ll have your capital gains yield in a snap.

Why is Capital Gains Yield Important?

Picture this: you’re shopping for a new investment with a glowing track record. But how do you know if it’s truly worth your hard-earned money? Capital gains yield gives you the cold, hard facts you need to make an informed decision. It helps you compare investment opportunities, identify hidden gems, and maximize your returns.

Unlocking the power of capital gains yield is like finding a hidden key to financial success. By following the steps outlined in this guide, you can calculate capital gains yield with ease and empower yourself to make smart investment decisions.

So, grab your calculator and explore the world of capital gains yield today. It’s the passport to profitability and financial freedom.