Calculating days cash on hand involves understanding the average daily cash balance (ADC). ADC is calculated by adding opening cash balance and ending cash balance, then dividing by 2. Days cash on hand is then calculated by dividing ADC by total cash outflows. This metric measures the number of days a company can operate using its current cash reserves, assessing cash flow stability and short-term liquidity. Effective cash flow management involves monitoring days cash on hand, reducing expenses, increasing revenue, and optimizing payment terms to ensure financial stability.

The Significance of Cash Flow Management:

- Emphasize the importance of tracking and managing cash flow for business stability.

The Significance of Cash Flow Management: A Lifeline for Business Stability

In the dynamic world of business, cash flow is the lifeblood that keeps the engine running. Managing cash flow effectively is crucial for maintaining business stability and ensuring long-term success. Businesses that fail to prioritize cash flow management often face unexpected financial challenges and may even be forced to close their doors.

Understanding Cash Flow Management

Cash flow management involves tracking and managing the movement of money in and out of a business. It includes monitoring cash inflows (revenue, investments, loans) and cash outflows (expenses, taxes, debt payments). By understanding cash flow patterns, businesses can identify potential cash shortages, adjust their spending accordingly, and make informed financial decisions.

Why Cash Flow Management is Critical

Maintaining a healthy cash flow is essential for several reasons:

-

Avoids unexpected shortages:

Tracking cash flow can help businesses identify potential funding gaps and take proactive steps to secure additional capital before it becomes a crisis. -

Provides flexibility:

Adequate cash reserves provide businesses with flexibility to handle unexpected expenses, seize growth opportunities, or negotiate better deals with suppliers. -

Supports financial stability:

Businesses with strong cash flow are more likely to withstand economic downturns and financial shocks, ensuring their long-term stability. -

Enhances investor confidence:

Investors and lenders place a high value on companies that demonstrate consistent and positive cash flow, as it indicates financial health and stability.

Understanding Days Cash on Hand: A Critical Metric for Financial Stability

In the world of business, cash flow is oxygen—it’s what keeps your operations running and your doors open. And days cash on hand is a crucial metric that measures the lifeblood of your company’s financial health.

What is Days Cash on Hand?

Imagine this: You’re stranded on a desert island with limited water supplies. Days cash on hand is like the number of days you can survive solely on the water you currently have.

For a business, days cash on hand measures the number of days it can operate exclusively using its current cash reserves. It’s a snapshot of your financial endurance, indicating how long you can withstand unexpected expenses or downturns in revenue.

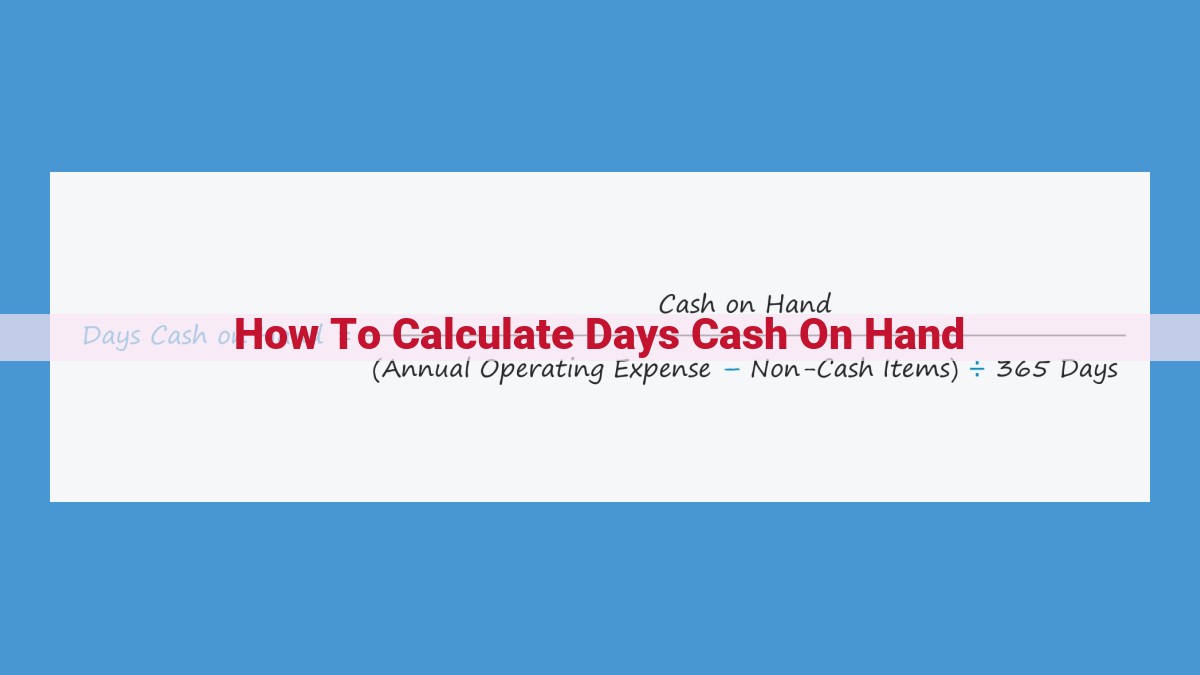

Calculating Days Cash on Hand

To determine your days cash on hand, you’ll need to calculate your average daily cash balance. This is done by taking your opening cash balance (the cash you have at the beginning of a period) and adding it to your ending cash balance (the cash you have at the end of the period). Then, divide this sum by the number of days in the period.

Once you have your average daily cash balance, calculate your days cash on hand using this formula:

Days Cash on Hand = Average Daily Cash Balance ÷ Daily Cash Outflows

Importance of Days Cash on Hand

Understanding your days cash on hand is essential for several reasons:

- Assessing Cash Flow Stability: It provides a clear picture of how well you’re managing your cash flow. A high number of days cash on hand indicates financial stability, while a low number may signal potential cash flow shortages.

- Identifying Potential Shortages: By monitoring your days cash on hand, you can proactively identify when you may run out of cash. This gives you time to implement strategies to address the issue.

- Making Informed Financial Decisions: Days cash on hand helps you make informed decisions about investments, expansion, and other financial commitments. It ensures you have sufficient cash to support your plans.

Key Concepts for Calculating Days Cash on Hand

In the realm of business finance, tracking and managing cash flow is paramount for ensuring stability and success. Understanding days cash on hand is a crucial metric that provides insights into a company’s ability to operate solely on its current cash reserves. To calculate this valuable indicator, we need to grasp some essential concepts:

-

Opening Cash Balance: The amount of cash available in a company’s accounts at the beginning of the period.

-

Ending Cash Balance: The amount of cash in the company’s accounts at the end of the period.

-

Total Cash Inflows: All the cash a company receives during the period, including sales revenue, investments, and loans.

-

Total Cash Outflows: All the cash a company spends during the period, including expenses, purchases, and investments.

Calculating Average Daily Cash Balance

Understanding the Significance

Tracking your company’s cash flow is crucial for maintaining stable operations. *Average daily cash balance* is a metric that provides a comprehensive view of your cash position, allowing you to assess your company’s ability to meet its short-term obligations.

Calculating Average Daily Cash Balance

The formula for calculating average daily cash balance is:

Average Daily Cash Balance = (Opening Cash Balance + Ending Cash Balance) / 2

Opening cash balance refers to the amount of cash available at the beginning of a specific period, while ending cash balance represents the cash remaining at the end of the period.

Significance of Average Daily Cash Balance

Average daily cash balance serves as a snapshot of your company’s cash position. It helps you understand:

- Cash Availability: How much cash is readily available on a day-to-day basis.

- Cash Flow Stability: Whether your cash inflows are sufficient to cover outflows over a sustained period.

- Financial Flexibility: Your ability to handle unexpected expenses or business fluctuations.

Practical Applications

By understanding your average daily cash balance, you can:

- Forecast Cash Flow: Estimate future cash needs and anticipate potential shortages.

- Negotiate Payment Terms: Negotiate favorable terms with suppliers and customers to optimize cash flow.

- Identify Cash Management Opportunities: Identify areas where expenses can be reduced or revenue can be increased to improve cash flow.

Calculating and monitoring your average daily cash balance is essential for effective cash flow management. It provides valuable insights into your company’s cash position, enabling you to make informed financial decisions and maintain a stable, thriving business.

Days Cash on Hand Formula: A Lifeline for Your Company’s Financial Stability

In the realm of business, cash flow is the lifeblood that sustains every operation. To ensure the longevity of your enterprise, it’s imperative to have a firm grasp on your cash flow management. One crucial metric that provides invaluable insights into your company’s financial health is Days Cash on Hand (DCOH).

Calculating Days Cash on Hand

The DCOH formula is a simple yet powerful tool for measuring how many days your company can operate solely on its current cash reserves. It is calculated using the following formula:

DCOH = (Average Daily Cash Balance) / (Daily Cash Expenses)

Average Daily Cash Balance

The average daily cash balance represents the average amount of cash your company has on hand each day during a specific period, typically a month. To calculate this, you’ll need:

- Opening Cash Balance: The amount of cash in your business’s account at the start of the period.

- Ending Cash Balance: The amount of cash in your account at the end of the period.

- Total Cash Inflows: The sum of all cash received during the period, including sales revenue, investments, and loans.

- Total Cash Outflows: The sum of all cash expenses paid during the period, including salaries, rent, and inventory.

Calculating Average Daily Cash Balance = (Opening Cash Balance + Ending Cash Balance + Total Cash Inflows – Total Cash Outflows) / Number of Days in the Period

Daily Cash Expenses

Daily cash expenses represent the average amount of cash your company spends each day on essential operating costs. This includes fixed expenses like rent and utilities, as well as variable expenses like supplies and marketing.

Understanding DCOH

Once you have calculated your average daily cash balance and daily cash expenses, you can determine your DCOH. A higher DCOH indicates that your company has a greater cushion to meet its short-term obligations, while a lower DCOH suggests a need for more prudent cash flow management.

Applications and Importance

DCOH is a valuable tool for:

- Assessing Cash Flow Stability: It indicates how long your company can operate without external financing.

- Identifying Potential Shortages: A low DCOH can highlight potential cash flow issues, allowing you to take proactive measures.

- Making Informed Financial Decisions: DCOH can help you understand the impact of business decisions on your cash flow and make sound financial choices.

Best Practices

To enhance your cash flow management and improve your DCOH, consider implementing these best practices:

- Reduce Expenses: Identify and cut unnecessary spending to conserve cash.

- Increase Revenue: Explore new revenue streams or optimize existing ones to generate more cash.

- Negotiate Payment Terms: Negotiate extended payment terms with suppliers to improve your cash flow.

- Monitor Cash Flow Regularly: Track your cash flow closely to identify potential problems early on.

By optimizing your DCOH, you empower your company with the financial resilience it needs to thrive in any business climate.

Applications and Significance of Days Cash on Hand

Understanding days cash on hand provides valuable insights into a company’s financial health and liquidity. This metric offers a clear picture of a company’s ability to meet its short-term obligations and maintain stable operations.

Assessing Cash Flow Stability: Days cash on hand helps businesses evaluate the consistency of their cash inflows and outflows. Companies with a higher days cash on hand typically have a stronger cash flow position, indicating their capability to fund ongoing expenses and invest in growth opportunities.

Identifying Potential Shortages: Calculating days cash on hand can uncover potential cash shortages, allowing businesses to take proactive measures before they materialize. By monitoring this metric, companies can identify periods of low cash reserves and plan accordingly.

Making Informed Financial Decisions: Days cash on hand plays a crucial role in making informed financial decisions. It can guide investments, acquisitions, and other capital allocation decisions by providing a clear understanding of the company’s liquidity position.