Microsoft Excel empowers you to effortlessly manage your expenses. It offers customizable templates for organized tracking, integrates with expense management software for seamless synchronization. The automation feature simplifies calculations and report generation, while budgeting tools enable tailored budgeting based on historical data and real-time monitoring for sound financial control. Additionally, Excel’s forecasting capabilities provide invaluable insights into spending patterns, enhancing decision-making.

Expense Tracking with Microsoft Excel: A Game-Changer for Organized Finance

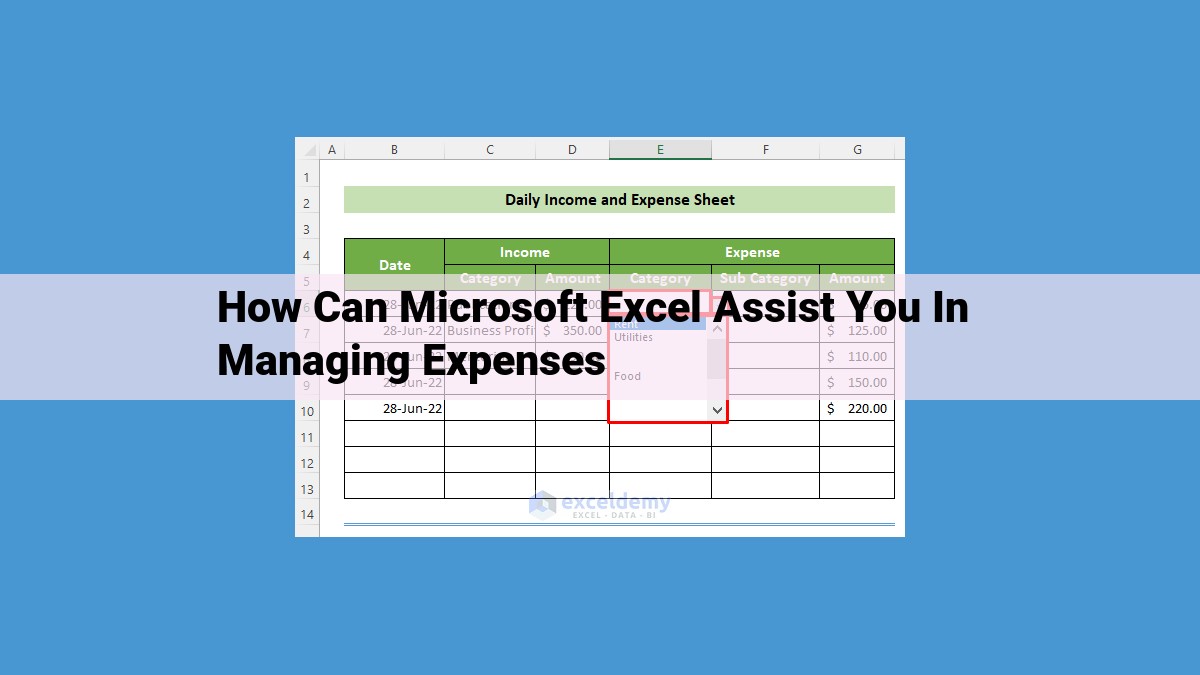

Managing expenses can be a daunting task, but Microsoft Excel offers a powerful solution. Its seamless integration with expense management software allows you to effortlessly track expenses and generate insightful reports.

Excel provides a suite of customizable templates to help you organize your expenses. You can easily categorize expenses, add notes, and track important details. The software’s automation features simplify calculations and report generation, saving you valuable time.

With Excel, you can automate expense entry by importing receipts or invoices. This eliminates manual data entry errors and streamlines your workflow. The software also integrates seamlessly with other business systems, ensuring efficient data exchange.

Highlighted Benefits:

- Centralized and organized expense tracking

- Automated calculations and report generation

- Customizable templates for tailored expense management

- Time-saving automation and error reduction

- Seamless integration with expense management software

Budgeting with Excel: Your Ultimate Guide to Financial Control

In the realm of personal finance, budgeting is the cornerstone of financial security and achieving your financial goals. Microsoft Excel, the ubiquitous spreadsheet software, offers a powerful suite of tools that can elevate your budgeting game to new heights. Let’s delve into how Excel empowers you to create realistic budgets, stay within your limits, and collaborate effectively for sound financial planning.

Crafting Realistic Budgets with Historical Data

Excel’s budgeting prowess starts with its ability to leverage historical data. By analyzing your past spending patterns, Excel can create budgets that are tailored specifically to your individual needs. It considers your income, expenses, and savings, providing a comprehensive overview of your financial landscape. This data-driven approach ensures that your budget is not merely a guesstimate but a well-informed plan that aligns with your actual financial behavior.

Real-Time Monitoring for Staying on Track

Budgeting isn’t just about creating a plan; it’s also about staying within limits. Excel’s real-time monitoring feature allows you to continuously track your expenses against your budget. As you input your transactions, Excel automatically compares them to your budgeted amounts, providing you with immediate feedback on whether you’re on target or heading towards overspending. This real-time visibility empowers you to make adjustments as needed, ensuring that your expenses never spiral out of control.

Collaboration and Sharing for Effective Budget Review

Budgeting is not a solo endeavor. Whether you’re sharing finances with a spouse, partner, or roommate, Excel facilitates collaboration and sharing to streamline budget review. Shared workbooks allow multiple users to access and update the budget simultaneously, providing everyone with a clear understanding of the financial situation. Comments and notes can be added to specific line items for clarification and discussion, fostering transparent and informed decision-making.

By harnessing the power of Excel, you can elevate your budgeting practices to new heights. Embrace its ability to create data-driven budgets, stay within limits through real-time monitoring, and collaborate seamlessly for effective financial planning. With Excel as your ally, financial control and financial security become achievable goals.

Forecasting with Excel

- Explain the trend analysis and predictive models used for expense forecasting.

- Discuss how Excel integrates with financial analysis tools for accurate projections.

- Emphasize the enhancement of decision-making by providing insights into spending patterns.

Forecasting with Excel: Empowering Expense Management Decisions

Embark on a forecasting journey with Excel, where you’ll unveil spending patterns and anticipate future expenses. Excel arms you with powerful trend analysis tools that decipher historical data, revealing hidden trends and patterns that shape your expenses.

Beyond trend analysis, Excel integrates seamlessly with professional financial analysis tools, empowering you with precise projections. These tools leverage sophisticated algorithms to forecast expenses with remarkable accuracy, enabling you to make informed decisions that drive financial success.

But Excel’s forecasting capabilities don’t end there. It provides insights into your spending patterns, highlighting areas for optimization and potential savings. By understanding the factors that influence your expenses, you gain the foresight to adjust your budget, allocate resources wisely, and maximize profitability.

Financial Analysis with Excel: Uncover Cost Drivers and Optimize Spending

Excel, with its robust analytical capabilities, transforms expense data into invaluable insights for data-driven decision-making. By analyzing trends, outliers, and potential savings, Excel empowers businesses to optimize spending and drive financial success.

Through trend analysis, Excel reveals patterns in historical expense data, enabling businesses to forecast future spending and identify areas for cost reduction. By flagging outliers, Excel highlights unusual or excessive expenses, prompting further investigation and potential savings opportunities.

Moreover, Excel’s visualization capabilities translate complex data into visually appealing charts and graphs, making it easy to identify spending patterns and cost drivers. These insights guide businesses in making informed decisions about resource allocation, reducing waste, and improving profitability.

Data Visualization with Excel: Unlocking Insights and Clarity

Excel’s data visualization capabilities are a game-changer for expense management. It allows you to transform complex data into visually appealing charts and graphs, making it easier to spot trends, identify areas for optimization, and present findings to stakeholders.

Visualizing expense data is crucial for understanding how your money is being spent. Charts can clearly show trends over time, allowing you to track changes in spending patterns. By color-coding different categories, you can quickly identify areas where expenses are highest. This information can help you make informed decisions about where to cut costs and optimize your budget.

Moreover, data visualization enhances collaboration and decision-making. Visual presentations are more easily understood than raw data, enabling team members to quickly grasp the important insights and make informed decisions based on a shared understanding of the financial situation. This can lead to more effective budgeting and expense management practices.

Simplify Expense Management with Excel Collaboration

When it comes to managing expenses, collaboration is key. Real-time, seamless collaboration empowers teams to streamline their expense reporting and approval processes, ensuring accuracy, efficiency, and transparency.

Shared workbooks act as a central hub for expense reporting, allowing multiple stakeholders to simultaneously access, review, and edit expense submissions. This eliminates the need for time-consuming email chains or manual data entry, facilitating a more collaborative and efficient workflow.

Stakeholders can easily access expense reports, review line items, and provide approvals in a centralized and secure environment. Approvers can quickly and confidently make decisions based on the readily available information, expediting the expense approval process.

Collaborating in Excel also enhances accountability and transparency. Shared workbooks provide a transparent audit trail, ensuring that all expense-related activities are documented and accessible to authorized personnel. This transparency helps organizations identify potential fraud or misuse of funds, fostering trust and accountability within the team.

By leveraging the power of Excel for collaboration, organizations can streamline their expense management processes, improve communication, and drive greater efficiency. Shared workbooks empower stakeholders to collaborate effectively, ensuring accurate and timely expense reporting and approvals, while fostering transparency and accountability throughout the organization.

Automation with Excel: Streamlining Expense Management

In the ever-evolving landscape of business, efficiency is paramount. When it comes to expense management, Microsoft Excel has emerged as a powerful tool that can revolutionize the process. Its automation capabilities have significantly reduced the burden of manual data entry, making expense management more accurate, efficient, and less time-consuming.

Automating Expense Entry

One of the most significant benefits of using Excel for expense management is its ability to automate the entry of expense data. With the use of Optical Character Recognition (OCR) technology, Excel can extract key information from receipts or invoices, eliminating the need for manual input.

This automation not only saves time but also minimizes errors. Human error is a common challenge in manual data entry, but Excel’s automated process ensures accuracy and reduces the risk of incorrect entries.

Integration with Business Systems

Excel seamlessly integrates with other business systems, such as accounting software and enterprise resource planning (ERP) systems. This allows for the automatic transfer of expense data from Excel into these systems, saving time and eliminating the need for double entry.

By automating the expense entry process and integrating with other business systems, Excel streamlines the entire expense management workflow. Businesses can now manage their expenses more efficiently, reduce costs, improve accuracy, and gain valuable time to focus on strategic initiatives.