Embrace the digital finance revolution by linking Cash App to Chime. Linking accounts empowers you to transfer funds, make payments, and receive Direct Deposits seamlessly. Follow the simple steps to integrate your accounts: open Cash App, go to the Banking tab, select “Link a Bank,” enter your Chime info, and verify. Enjoy the benefits of financial flexibility, convenience, and enhanced security.

Linking Cash App to Chime: A Comprehensive Guide to Connecting Your Digital Finances

In the realm of modern finance, linking your financial accounts is not just a convenience; it’s a necessity. It allows you to streamline your financial management, unlock a world of payment options, and secure your money. This guide will take you on a step-by-step journey to effortlessly link your Cash App to your Chime account, unlocking a seamless financial ecosystem at your fingertips.

Imagine the ease of transferring funds between your accounts without the hassle of traditional banking methods. With Cash App and Chime connected, you can transfer money instantly, ensuring that your funds are always where you need them. Moreover, linking these accounts enables you to set up Direct Deposit, allowing your paycheck to be deposited directly into your Chime account, providing you with immediate access to your hard-earned money.

By linking your Cash App to Chime, you’re not just integrating two accounts; you’re enhancing your financial experience. Enjoy the convenience of mobile banking at its finest, managing your finances on the go. Utilize your Chime debit card for purchases and cash withdrawals, knowing that your Cash App balance is just a tap away.

Understanding the Key Concepts: Defining the Digital Finance Landscape

In today’s fast-paced digital world, fintech has revolutionized the way we manage our finances. Fintech, short for financial technology, refers to the convergence of technology and finance to provide innovative financial services. Neobanks, like Chime, are digital-only banks that offer modern and convenient banking experiences. Digital wallets, such as Cash App, let you store and manage your funds digitally, eliminating the need for physical cash.

Payment processors, like Cash App, facilitate transactions between buyers and sellers. When you make a purchase using your mobile payment app, the payment processor ensures the funds are transferred securely. Linking accounts connects your financial accounts, like Cash App and Chime, enabling seamless fund transfers and consolidated financial management.

Debit cards and payment cards are tools that allow you to access your funds at point-of-sale (POS) terminals. Direct Deposit allows employers or government agencies to deposit payments directly into your linked account. ACH, short for Automated Clearing House, is a network that facilitates electronic fund transfers.

Mobile apps provide a user-friendly interface (UI) for managing your finances. Their intuitive UX design (user experience design) ensures a seamless and efficient user experience. Verification processes help ensure the security of your accounts by authenticating your identity.

By understanding these key concepts, you can fully appreciate the benefits of linking Cash App to Chime and harness the power of digital finance to manage your money with ease and convenience.

Linking Cash App to Chime: A Step-by-Step Guide to Financial Flexibility

In the dynamic era of digital finance, nothing is more crucial to manage your money than linking your financial accounts. Two prominent players in this arena are Cash App and Chime, renowned for their user-friendly platforms and exceptional features. To unlock the full potential of these apps, you must link them, and this guide will walk you through the seamless process.

Understanding the Financial Landscape

Fintech, neobanks, digital wallets, payment processors, and mobile payments—these terms may sound complex, but they are fundamental concepts in the realm of modern finance. Cash App and Chime are examples of these innovations that empower you with control over your money.

-

Fintech: This umbrella term refers to financial technology companies that leverage technology to provide banking services like Cash App and Chime.

-

Neobanks: These are digital-only banks that offer mobile-first banking services, often with lower fees than traditional banks.

-

Digital wallets: They are electronic platforms, like Cash App, that allows you to store and manage your funds digitally, enabling quick and easy payments.

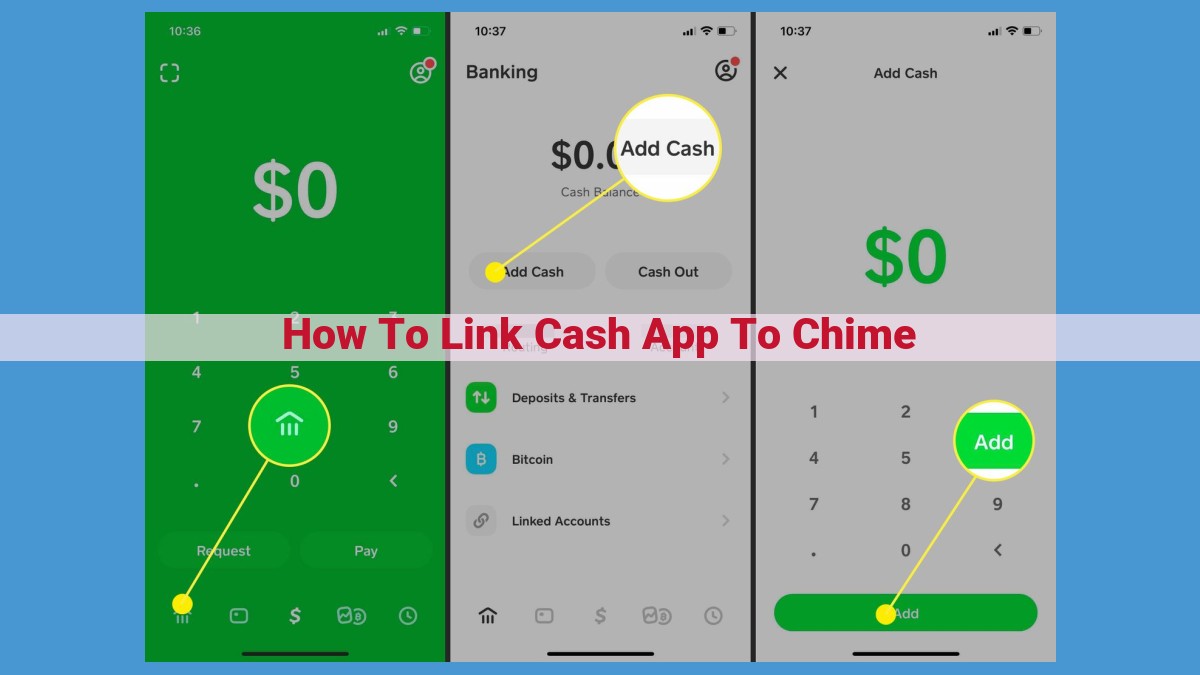

Linking Cash App to Chime: Step-by-Step

Embarking on the journey of linking your Cash App and Chime accounts is as simple as it gets:

-

Open the Cash App: Launch the Cash App on your smartphone or tablet.

-

Navigate to the Banking tab: Tap on the “Banking” tab at the bottom of the screen.

-

Select “Link a Bank”: Locate and tap on the “Link a Bank” option.

-

Input Chime account information: Enter your Chime account number and routing number.

-

Verify account: Cash App will initiate a micro-deposit into your Chime account. Note the amount and enter it in the verification field in Cash App.

-

Confirm the link: Once verified, Cash App and Chime will be successfully linked.

Benefits of Linking Cash App and Chime

The synergy created by linking Cash App and Chime offers an array of benefits:

-

Seamless fund transfers: Transfer funds between your Cash App and Chime accounts with effortless ease.

-

Direct Deposit capability: Receive your paycheck or government benefits directly into your Chime account and seamlessly access them through Cash App.

-

Mobile banking convenience: Manage your finances on the go, wherever you are, with the convenience of Cash App’s mobile app.

-

Debit card usage: Enjoy the freedom to use your Chime debit card for purchases and cash withdrawals, all conveniently managed through Cash App.

-

Enhanced fraud protection: Both Cash App and Chime prioritize security, safeguarding your financial information and transactions from unauthorized access.

Benefits of Linking Cash App to Chime: Enhanced Financial Flexibility and Convenience

In today’s digital finance landscape, linking your financial accounts is essential for seamless money management. Here are the compelling benefits you’ll enjoy by syncing your Cash App with Chime:

Seamless Fund Transfers:

With linked accounts, you can effortlessly transfer funds between Cash App and Chime, eliminating the hassle of waiting for traditional bank transfers. Say goodbye to delays and unexpected fees, and gain instant access to your funds whenever you need them.

Direct Deposit Capability:

Connect your Cash App to Chime and reap the benefits of direct deposits. Get paid faster and directly into your Chime account, ensuring timely access to your earnings. This streamlines your payroll process and gives you peace of mind knowing that your hard-earned money is readily available.

Mobile Banking Convenience:

Linking Cash App and Chime grants you unrivaled mobile banking convenience. Manage your finances on the go from your smartphone, making lightning-fast transactions, checking balances, and managing your accounts with ease and efficiency. Embrace the freedom and flexibility of mobile banking today.

Debit Card Usage:

Unlock the power of your Chime debit card by linking it to Cash App. Use your Chime card for secure payments at physical and online stores, withdraw cash at ATMs, and make anytime purchases with confidence. Enjoy the convenience and versatility of a traditional debit card backed by the security and innovation of Cash App and Chime.

Enhanced Fraud Protection:

Protect your hard-earned money with the combined security measures of Cash App and Chime. By linking your accounts, you elevate your fraud protection, reducing the risk of unauthorized access and safeguarding your financial well-being. This multi-layered security gives you peace of mind that your finances are shielded from malicious activity.