Unapplied cash payment income refers to customer payments that have been received but not yet matched to specific invoices. It arises when payments are made without clear references or when invoices are not yet generated. This unapplied cash temporarily increases the company’s balance sheet assets until it’s properly allocated. Timely reconciliation of unapplied cash with invoices and customer records is crucial to ensure accurate accounts receivable balances and prevent potential discrepancies in financial reporting.

- Define unapplied cash payment income and its significance in accounting.

Unapplied Cash Payment Income: A Vital Key in Accounting

In the realm of accounting, unapplied cash payment income stands as a crucial factor, playing a pivotal role in maintaining the accuracy of financial records. It refers to payments received from customers that cannot be immediately matched to specific outstanding invoices, creating a temporary discrepancy in the company’s books.

Understanding Unapplied Cash

Unapplied cash arises when a customer makes a payment but fails to provide clear instructions or documentation linking it to a particular invoice. This can occur due to human error, payment processing delays, or other reasons. The unapplied cash payment is then recorded as a temporary asset on the company’s balance sheet until it can be matched to the corresponding invoice.

Invoices and Customer Payments

Invoices serve as the backbone for tracking customer payments and generating unapplied cash payment income. Each invoice represents a detailed record of goods or services sold, along with the payment terms and due date. When a customer makes a payment, the amount is applied to the oldest outstanding invoice first. If the payment exceeds the outstanding balance on that invoice, the remaining amount is applied to the next oldest invoice, and so on.

Impact on Accounts Receivable

Unapplied cash payment income directly affects the company’s accounts receivable balance. Accounts receivable represents the amount of money owed to the company by its customers for goods or services sold on credit. When unapplied cash payments are not promptly reconciled, they can lead to overstated or understated accounts receivable balances, potentially impacting financial reporting and decision-making.

Sources and Reasons for Unapplied Cash

Unapplied cash can originate from various sources, including customer payments, refunds, overpayments, or even cash received without an accompanying invoice. It can occur for several reasons, such as incomplete or missing purchase orders, data entry errors, or outdated customer records.

Customer Payment and Unapplied Cash

Unapplied cash payment income, often encountered in accounting, arises primarily from customer payments. When customers make payments, they often accompany their remittances with payment stubs, checks, or online payment references that link the payment to a specific invoice. However, in some instances, these references may be missing or incorrect, making it difficult to determine which invoice the payment should be applied to.

Consequently, the customer payment is recorded as unapplied cash until it can be matched to a specific invoice. This matching process involves examining customer records, payment details, and open invoices to identify the appropriate invoice. Once a match is established, the unapplied cash is applied to the invoice, reducing the customer’s outstanding balance and clearing the unapplied cash account.

Invoices and Unapplied Cash

The Role of Invoices

Invoices serve as vital documents in the accounting world, playing a crucial role in tracking customer payments and facilitating the identification of unapplied cash payment income. When a customer receives goods or services, an invoice is issued, outlining the details of the transaction, including the amount due and the payment terms.

Tracking Customer Payments

Upon receiving payment from a customer, the accounting team matches it against the corresponding invoice. This process ensures that payments are accurately allocated and applied to the appropriate accounts. By comparing invoices to payments, accountants can determine the amounts still outstanding and identify any discrepancies.

Generating Unapplied Cash Payment Income

In certain scenarios, customer payments may not be immediately matched to an invoice. This occurs when a payment is received without a clear reference to a specific invoice or when the payment amount does not match an existing invoice. In such cases, the payment is recorded as unapplied cash payment income.

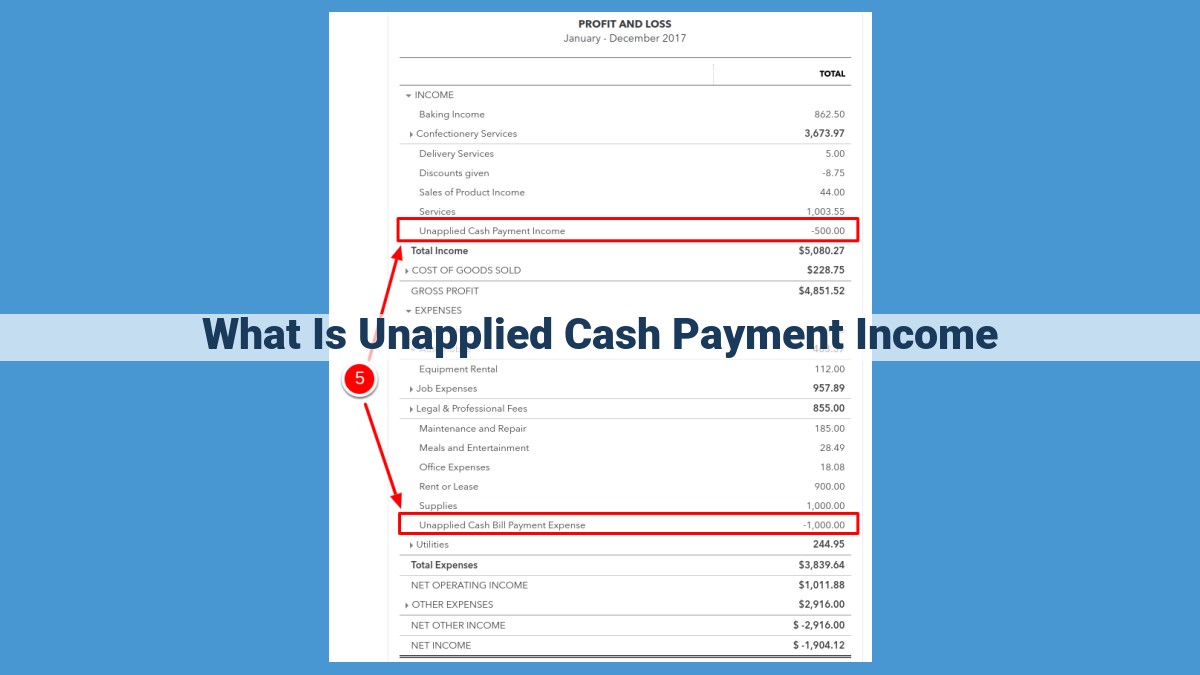

Impact of Unapplied Cash

Unapplied cash payment income can have a significant impact on financial records. If not properly reconciled, it can lead to errors in accounts receivable balances and misstatements in financial reports. Reconciling unapplied cash is essential to ensure that the accounts are accurate and reflective of the actual financial position of the company.

Accounts Receivable and Unapplied Cash

Unapplied cash payment income has a direct impact on your accounts receivable balances. When a customer makes a payment, it’s crucial to apply it to the correct invoice promptly. If the payment is not applied, it will remain as unapplied cash. This can lead to inaccuracies in your accounts receivable reports.

For instance, if you have an invoice for $1,000 that is not yet applied, your accounts receivable balance will be overstated by $1,000. This can give you a false impression of your company’s financial health. Additionally, if you are using your accounts receivable balance to make decisions about credit extension or collection efforts, inaccurate balances can lead to poor decision-making.

Therefore, it’s essential to reconcile your unapplied cash regularly. This will help you to identify and correct any discrepancies and ensure that your accounts receivable reports are accurate. By maintaining accurate accounts receivable records, you can make better financial decisions and improve your company’s overall financial health.

**Unapplied Cash: Its Sources and Causes**

When running a business, it’s crucial to track every penny that flows in and out. However, there may be times when you receive payments that don’t quite add up, leaving you with unapplied cash.

What is Unapplied Cash?

Unapplied cash refers to payments received from customers that haven’t yet been matched to a specific invoice. It’s like having a pile of money in your hands without knowing where it came from.

Sources of Unapplied Cash

Unapplied cash typically stems from the following sources:

- Customer payments: These are payments received from customers that haven’t been matched to an invoice yet.

- Refunds: Sometimes, customers may return products or request refunds. These payments will create unapplied cash if not applied to a correct invoice.

- Overpayments: Customers may occasionally make payments that exceed the invoice amount, resulting in overpayments.

Reasons for Unapplied Cash

Several factors can lead to unapplied cash:

- Data entry errors: When processing customer payments, data entry errors can occur, resulting in unmatched payments.

- Lack of invoice detail: If invoices don’t provide sufficient information (e.g., customer reference numbers), matching payments to invoices can be challenging.

- Multiple payment methods: Accepting payments through various channels (e.g., online, by mail) can increase the likelihood of unapplied cash if payment tracking is not centralized.

- Human error: Manual processes can introduce human error, leading to unmatched payments.