Calculating budget at completion involves understanding the project budget and cost estimates, tracking actual costs, estimating costs to complete, and reconciling these estimates with accounting records. This process helps identify any variances from the budgeted amount and enables proactive cost management through forecasting risks, contingency planning, and implementing corrective measures. By calculating and analyzing budget at completion, project managers can ensure cost-effective project execution and avoid budget overruns.

Understanding the Project Budget: A Foundation for Effective Cost Estimation

In the realm of project management, a comprehensive understanding of the project budget is paramount. It serves as the guiding light for cost estimation, ensuring that projects are executed within financial constraints. A well-defined budget provides a solid foundation for project planning, execution, and control.

Defining the Project Budget: The Cornerstone of Cost Estimation

A project budget is essentially a financial roadmap that outlines the estimated costs associated with a project. It plays a crucial role in cost estimation, as it establishes a benchmark against which actual costs are compared and tracked. By defining a detailed budget, project managers can anticipate potential expenses and make informed decisions to stay within financial boundaries.

Elements of a Detailed Budget: Breaking Down Project Costs

A detailed project budget should encompass a wide range of cost categories, including:

- Labor costs: Salaries, benefits, and overhead for project personnel

- Material costs: Equipment, supplies, and materials required for project execution

- Equipment costs: Rental or purchase of specialized equipment

- Travel expenses: Costs associated with project-related travel

- Administrative costs: Expenses related to project management, such as office supplies and administrative support

- Contingency fund: A reserve set aside for unexpected expenses or cost fluctuations

Funding Sources and Cost Estimation: A Comprehensive Guide

In the realm of project management, securing funding and crafting a realistic cost estimate are crucial steps towards successful project execution. Let’s delve into the world of funding sources and cost estimation to empower you with the knowledge to navigate these essential aspects.

Funding Sources: Your Project’s Lifeline

Every project requires financial support, which can be sourced from various avenues. Government grants, venture capital, and institutional loans are typical funding options for large-scale projects. Crowdfunding, bootstrapping (using personal funds), and angel investors may provide funding for smaller projects.

Identifying the most suitable funding source depends on your project’s nature, scope, and risk profile. Each source comes with its terms and conditions, such as interest rates, repayment schedules, and equity stakes. Carefully assess your options and choose the funding source that aligns with your project’s objectives.

Cost Estimation: Striking the Balance

Cost estimation involves meticulously calculating the projected costs associated with your project. This crucial exercise ensures you have a clear understanding of your financial requirements and can plan accordingly.

Start by breaking down your project into smaller tasks and estimating the cost of each task. Consider direct costs like materials and labor, as well as indirect costs such as overhead and administrative expenses. It’s essential to factor in contingencies to account for potential unforeseen costs.

Historical data, industry benchmarks, and expert advice can guide your estimates. Consult with vendors to obtain accurate quotes for materials and services. Remember, a realistic cost estimate is the foundation for informed decision-making and effective project budgeting.

Tracking Actual Costs: A Crucial Element in Project Financial Management

As project managers, staying on top of actual costs is paramount to ensuring project success and meeting bottom lines. Effective cost tracking enables us to identify deviations from the budget early on, allowing us to take corrective actions and maintain financial stability.

Importance of Cost Control Measures

Establishing robust cost control measures is crucial for reigning in project expenses. These measures involve:

- Regularly reconciling records: Comparing actual project expenses with budgeted amounts to detect discrepancies.

- Implementing cost reporting systems: Setting up mechanisms for team members to submit accurate and timely cost information.

- Enforcing budget approvals: Requiring project team members to seek approval before incurring major expenses.

Effective Cost Tracking

To track actual costs efficiently, consider the following techniques:

- Utilize project accounting software: These tools offer automated expense tracking capabilities, reducing human error and streamlining the process.

- Establish clear cost categories: Categorizing expenses according to project activities and tasks facilitates easy tracking and analysis.

- Conduct periodic cost audits: Regularly reviewing expenses for accuracy and compliance with project guidelines ensures financial integrity.

Identifying and Addressing Cost Variances

Cost variances occur when actual expenses deviate from budgeted amounts. To manage these variances effectively:

- Analyze variance causes: Determine the underlying factors contributing to the variance, such as scope changes or unforeseen circumstances.

- Implement corrective actions: Develop and implement strategies to bring costs back in line with the budget, such as reducing unnecessary expenses or renegotiating vendor contracts.

- Estimate impact on project completion: Assess the potential impact of cost variances on project timelines, deliverables, and overall budget.

Estimating Cost to Complete: A Guide to Assessing Project Completion Costs

As your project progresses, it’s crucial to accurately estimate the remaining costs to ensure successful completion. Project managers often rely on projected cost to complete (CTC) for this purpose. CTC provides valuable insights into the financial outlook of your project and aids in making informed decisions.

Assessing Project Schedule and Costs

To determine the CTC, a thorough assessment of the project schedule and costs is essential. Analyze the progress made thus far, identify any deviations, and revise the schedule accordingly. You should also gather data on actual costs incurred to date and forecast future expenses based on the remaining tasks.

Forecasting Risks and Contingency Planning

Unforeseen circumstances can arise during any project, so it’s important to forecast potential risks and allocate a contingency budget. Identifying possible challenges and their impact on costs allows you to respond promptly and mitigate any financial surprises.

Contingency funds serve as a buffer against these risks, ensuring that the project can continue without significant disruptions. By incorporating contingency planning into your cost estimation, you can increase the likelihood of project success even in the face of unforeseen events.

Calculating the Budget at Completion: A Critical Step in Project Financial Management

In the realm of project management, accurately estimating the budget at completion (BAC) is crucial for successful financial control. The BAC serves as a benchmark against which actual project costs are measured, allowing project managers to identify variances and take corrective actions to stay on track.

Defining Budget at Completion

BAC represents the total projected cost of completing a project, including all direct and indirect expenses. It encompasses all resources allocated, such as labor, materials, equipment, and overheads. By establishing a clear BAC, project managers can set realistic financial expectations for stakeholders and ensure that resources are allocated efficiently.

Techniques for Estimating Project Completion Cost

Accurate BAC estimation relies on various techniques:

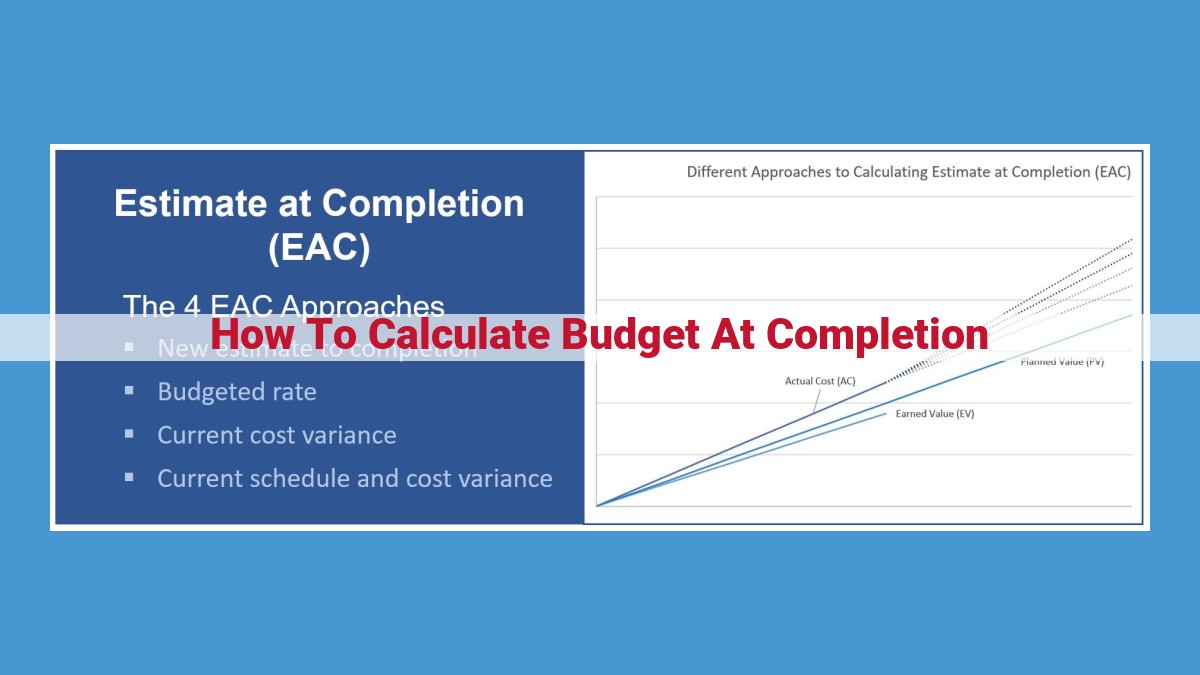

- Earned Value Management (EVM): By tracking the work completed and comparing it to the budget, EVM provides insights into the project’s cost performance.

- Analogous Estimating: Using data from similar past projects, this technique allows project managers to establish a baseline for cost estimation.

- Parametric Estimating: This method calculates costs based on historical data and project-specific factors, such as project size and complexity.

Reconciling Accounting Records with Budget Projections

Once the project is underway, it’s essential to reconcile accounting records with budget projections regularly. This involves comparing actual costs incurred to the estimated costs in the BAC. Reconciling these records helps identify variances, which can be positive (underruns) or negative (overruns).

Importance of BAC in Project Management

BAC serves as a foundational element for:

- Measuring Performance: By comparing actual costs to BAC, project managers can assess whether the project is on track financially.

- Identifying Risks: BAC helps project managers identify potential cost overruns by assessing the difference between estimated and actual costs.

- Making Informed Decisions: Armed with accurate BAC information, project managers can make informed decisions about resource allocation, schedule adjustments, and potential cost-saving measures.

Calculating the budget at completion is a vital aspect of project financial management. By establishing a clear BAC, employing appropriate estimation techniques, and reconciling accounting records, project managers can ensure that projects are completed within the approved budget. This not only enhances project success but also empowers them to make data-driven decisions that drive positive financial outcomes.

Analyzing Variance:

- Define budget variance and its importance in project management.

- Discuss how to identify budget overruns and underruns.

- Explain the steps involved in examining cost overruns and implementing corrective measures.

Analyzing Variance: The Key to Project Budget Success

In the realm of project management, budget variance reigns supreme as a critical indicator of financial health. It’s the difference between the projected budget and the actual costs, revealing whether your project is flying high within budget or requiring urgent attention.

Identifying budget overruns and underruns is crucial. Overruns can signal potential pitfalls and financial distress, while underruns may indicate inefficient resource allocation or missed opportunities. To avoid these perils, regular monitoring and vigilant analysis are essential.

When faced with cost overruns, it’s imperative to pause and examine the situation thoroughly. Delve into the reasons behind the discrepancies, identifying areas where expenses exceeded projections. Armed with this knowledge, implement corrective measures to prevent further deviations from the budget.

Corrective measures can range from adjusting timelines and resources to renegotiating contracts and exploring alternative suppliers. It’s crucial to act swiftly and decisively, ensuring that the project remains on track financially.

In closing, analyzing variance is not merely an accounting exercise but a vital component of successful project management. Through meticulous monitoring, timely identification of budget deviations, and prompt corrective action, you can steer your project towards financial success.