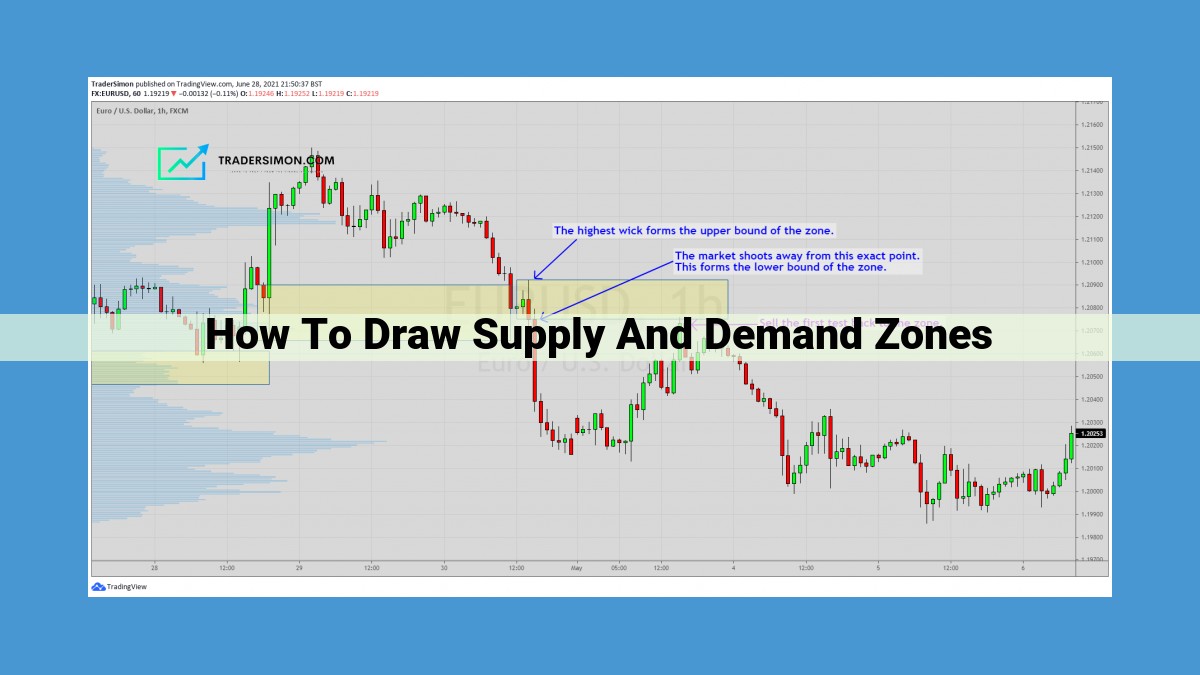

To efficiently draw supply and demand zones, begin by identifying pivotal points, moving averages, and Fibonacci retracements to determine potential support and resistance levels. Utilize volume analysis to confirm market signals and observe price action patterns to recognize trend reversals. Combine these concepts to delineate supply and demand zones, which represent areas of potential price movement and provide valuable insights for trading decisions.

Understanding Trendlines

- Definition and types of trendlines

- Significance of trendline breaks in identifying potential trend reversals

Understanding Trendlines

In the realm of trading, trendlines serve as guiding lights, illuminating the direction and momentum of market movements. These lines connect a series of highs or lows, creating a visual representation of the trend. Understanding trendlines is crucial for traders seeking to capitalize on market fluctuations.

Types of Trendlines

There are two primary types of trendlines: uptrend lines and downtrend lines. Uptrend lines connect a series of higher highs, indicating an upward trend. Conversely, downtrend lines connect a series of lower lows, signaling a downward trend.

Significance of Trendline Breaks

Trendline breaks hold immense significance in technical analysis. When prices break through a trendline, it often indicates a potential reversal or change in the prevailing trend. A break above an uptrend line suggests a bullish breakout, while a break below a downtrend line signifies a bearish breakdown. These breaks can provide valuable insights into potential market direction, prompting traders to adjust their trading strategies accordingly.

Support and Resistance Levels: A Trader’s Guide to Identifying Market Trends

In the ever-fluctuating world of trading, support and resistance levels stand as crucial pillars, guiding traders toward informed decisions and potentially profitable opportunities. These levels represent price boundaries where historical data suggests buyers (support) or sellers (resistance) have stepped in to prevent further price declines or rallies.

Identifying Support Levels:

Support levels mark the price points below which buyers have consistently stepped up to purchase an asset, preventing it from falling further. These levels often coincide with previous lows, areas of consolidation, or psychological round numbers. Identifying support levels allows traders to anticipate potential buying opportunities and set stop-loss orders to protect their trades.

Identifying Resistance Levels:

Resistance levels, on the other hand, indicate price points above which sellers have intervened, suppressing further price increases. They typically align with previous highs, areas of distribution, or important moving averages. Recognizing resistance levels helps traders identify potential selling points and manage risk by placing take-profit orders.

Using Support and Resistance Levels in Trading:

Harnessing support and resistance levels enables traders to:

- Identify potential price reversals: When the price breaks below a support level, it signals a potential downtrend. Conversely, a breakout above a resistance level suggests a possible uptrend.

- Set entry and exit points: Support and resistance levels provide ideal areas to initiate trades or set stop-loss and take-profit orders.

- Manage risk: By understanding the areas where buyers and sellers are likely to intervene, traders can effectively manage their risk exposure.

Tips for Trading Support and Resistance Levels:

- Confirm with other indicators: Use multiple indicators, such as moving averages or technical oscillators, to corroborate support and resistance levels.

- Look for multiple touches: Levels that have been tested and held multiple times tend to be more reliable.

- Beware of false breakouts: Price can sometimes pierce through support or resistance levels briefly before reversing.

- Consider market sentiment: News events or economic data can influence the strength and relevance of support and resistance levels.

Understanding support and resistance levels is a crucial skill for traders of all levels. By incorporating these concepts into their trading strategies, traders can gain a competitive edge, anticipate market trends, and make informed decisions that can lead to enhanced profitability.

Pivotal Points: Unlocking Critical Support and Resistance Levels

In the dynamic world of trading, the ability to identify key areas of support and resistance is crucial for profitable decision-making. One powerful tool that traders utilize to pinpoint these critical levels is known as pivotal points.

Understanding Pivotal Points

Pivotal points are calculated based on the high, low, and closing prices of a financial instrument over a specific period. They are designed to represent areas where the market may potentially pause or reverse its current trend. The formula for calculating pivotal points involves using mathematical operations on these three price components.

Interpretation of Pivotal Points

Once calculated, pivotal points are typically represented as a series of levels on a price chart. The most common pivotal point is the daily pivot point, which is calculated using the previous day’s trading data. Additional pivotal points can be derived using intraday data, such as hourly or 30-minute pivots.

The pivotal point acts as a central reference line, with support levels below it and resistance levels above it. Typically, the most significant support and resistance levels are found at the first and second pivot points from the central pivot. These levels represent areas where the market has encountered significant buying or selling pressure in the past.

Identifying Critical Levels

Traders use pivotal points to identify potential areas of market reversals. When the market approaches a pivotal point, it is important to observe the volume and price action taking place. A break above a resistance level with strong volume suggests a potential upward trend, while a break below a support level with high volume indicates a potential downtrend.

Combining Pivotal Points with Other Indicators

Pivotal points can be effectively combined with other technical indicators to enhance trading strategy. For instance, traders may use moving averages to establish the overall trend and then use pivotal points to identify potential entry and exit points within that trend.

Pivotal points are a versatile technical tool that can assist traders in identifying critical support and resistance levels in the market. By understanding the calculation and interpretation of pivotal points, traders can enhance their ability to pinpoint potential trading opportunities and make informed decisions based on the balance between supply and demand.

**Moving Averages: A Beginner’s Guide to Trend Analysis in Trading**

Understanding Moving Averages

Moving averages are essential tools in technical analysis, providing insights into market trends and potential reversals. They smooth out price data by calculating the average price over a specified period, enabling traders to identify the underlying trend.

Types of Moving Averages

There are various types of moving averages, each with its unique characteristics:

- Simple Moving Average (SMA): Calculates the average price over a set period.

- Exponential Moving Average (EMA): Places greater weight on recent prices, reacting faster to market changes.

- Weighted Moving Average (WMA): Assigns higher weights to more recent prices, emphasizing current market conditions.

Significance of Moving Averages

Moving averages are used to:

- Identify trends: Moving averages can visualize the general direction of the market, helping traders determine whether it’s bullish or bearish.

- Signal potential reversals: When the price crosses above or below a moving average, it can indicate a potential shift in trend.

- Confirm trading signals: Moving averages can provide confirmation for other indicators or price action patterns when they align in the same direction.

Using Moving Averages to Identify Trends and Reversals

- Bullish trend: When the price is above the moving average, and the moving average is sloping upwards.

- Bearish trend: When the price is below the moving average, and the moving average is sloping downwards.

- Potential reversal: When the price crosses above a moving average (for bullish reversals) or below a moving average (for bearish reversals), it can signal a change in trend.

Moving averages are valuable tools for technical traders, providing a clear representation of market trends and potential reversals. By understanding the different types of moving averages and their significance, traders can utilize them effectively to make informed trading decisions and improve their profitability.

Bollinger Bands

- Construction and interpretation of Bollinger Bands

- Identifying overbought and oversold market conditions using Bollinger Bands

Bollinger Bands: Unveiling Market Extremes

Navigating the volatile waters of the financial markets requires traders to identify areas where prices are likely to bounce or reverse. Enter Bollinger Bands, a versatile technical indicator that sheds light on overbought and oversold conditions, providing valuable insights into market sentiment.

What are Bollinger Bands?

John Bollinger, the creator of this popular indicator, conceived of Bollinger Bands as a tool to measure market volatility. These bands consist of three lines: a simple moving average (SMA) in the middle, and two parallel lines that form an envelope around the SMA. The width of the envelope is determined by the standard deviation of the price data over a specified period.

Overbought and Oversold Conditions

When prices rise sharply, the Bollinger Bands expand, indicating that the market may be overbought. Conversely, when prices decline significantly, the bands contract, suggesting that the market is oversold. Traders use these extreme conditions as potential entry or exit points based on the assumption that overbought conditions may lead to price corrections, while oversold conditions may trigger price rallies.

Using Bollinger Bands in Trading

Bollinger Bands can be used in isolation or in conjunction with other technical indicators to enhance trading strategies. Some common Bollinger Band trading strategies include:

- Breakouts: When prices break out of the Bollinger Bands, it can signal a potential trend reversal. Breakouts above the upper band suggest a bullish trend, while breakouts below the lower band indicate a bearish trend.

- Touches: When prices touch the Bollinger Bands and then reverse, it suggests a potential price reversal. Touches on the upper band may indicate a sell signal, while touches on the lower band may indicate a buy signal.

- Squeeze: When the Bollinger Bands contract to a narrow range, it suggests that volatility is low. A breakout from this squeeze can indicate a potential increase in volatility and a potential trading opportunity.

Bollinger Bands are a powerful technical indicator that can provide traders with valuable insights into market sentiment and identify potential trading opportunities. By understanding the concept of Bollinger Bands and how they can be used, traders can gain a competitive edge in navigating the dynamic financial markets.

Fibonacci Retracements: Unraveling Support and Resistance with Nature’s Golden Ratio

In the realm of trading, discerning the underlying harmony of the markets is akin to deciphering a secret code. Among the tools that illuminate this intricate tapestry, Fibonacci retracements hold a prominent place. Derived from the enigmatic Fibonacci sequence, these levels offer a profound insight into potential support and resistance zones.

The Fibonacci sequence, an awe-inspiring manifestation of nature’s mathematical elegance, unfolds with each number being the sum of the two preceding it. This seemingly innocuous pattern unfolds into a mesmerizing spiral, echoing the spirals found throughout the natural world, from seashells to galaxies.

When applied to trading charts, Fibonacci retracements emerge as a series of horizontal lines that delineate key price levels. These levels are calculated as percentages of a recent significant price move, often referred to as a swing high or swing low.

Fibonacci retracements, with their inherent connection to the Fibonacci sequence, unveil potential areas where price action may pause or reverse. Traders often anticipate support at Fibonacci retracement levels of 38.2%, 50%, and 61.8%. Conversely, resistance is commonly found at retracement levels of 23.6% and 78.6%.

Understanding the Fibonacci retracement levels empowers traders to identify potential entry and exit points with greater precision. By incorporating these levels into their trading strategies, traders can enhance their ability to navigate market volatility and capitalize on potential market reversals.

Example:

Consider a stock that recently rallied from $10 to $15. Applying Fibonacci retracement levels to this swing high and swing low, we obtain:

– Support levels: $12.70 (38.2% retracement), $13.50 (50% retracement), $14.20 (61.8% retracement)

– Resistance levels: $11.80 (23.6% retracement), $10.20 (78.6% retracement)

By identifying these potential support and resistance zones, traders can anticipate areas where price action may consolidate or reverse, enabling them to make informed trading decisions.

Volume Analysis: A Crucial Tool for Confirming Market Signals

Volume analysis is a cornerstone of technical trading, as it provides invaluable insights into the true intentions of market participants. Volume represents the number of shares or contracts traded within a given time frame. By studying volume, traders can assess the level of activity, market sentiment, and the strength of trends.

Importance of Volume Analysis

Volume plays a crucial role in confirming market signals derived from other technical indicators. High volume during an uptrend signals strong buying pressure, increasing the likelihood of the trend continuing. Conversely, low volume during a downtrend suggests weak selling pressure, potentially indicating a potential reversal.

How to Use Volume Data

Volume data can be used in several ways to enhance trading decisions:

- Volume Profile: The volume profile depicts the volume traded at each price level, highlighting areas of support and resistance.

- On-Balance Volume (OBV): OBV is a cumulative indicator that measures the flow of volume into or out of a market. Its divergence from price can provide clues about potential trend reversals.

- Volume at Price: This indicator shows the volume traded at a specific price point, helping traders identify areas of significant interest.

Combining Volume with Other Indicators

Volume analysis is most effective when combined with other technical indicators. For instance, high volume on a breakout above a resistance level can confirm the breakout’s validity. Conversely, low volume on a trendline break can warn of a potential false breakout.

Volume analysis is an indispensable tool for traders seeking to confirm market signals and enhance their trading decisions. By understanding the interplay between volume and price, traders can gain a deeper understanding of market activity and make more informed trading choices.

Price Action Patterns: Unlocking the Secrets of Market Behavior

In the dynamic world of trading, price action patterns serve as invaluable tools that allow us to decipher the underlying intentions of the market. These patterns are formed by the fluctuations in price over time and provide insights into potential market movements. By understanding and interpreting these patterns, traders can increase their chances of making informed decisions.

Common Price Action Patterns

The financial landscape is adorned with a myriad of price action patterns, each carrying its own significance. Among the most prominent patterns are:

-

Double Tops/Bottoms: These patterns occur when the price repeatedly tests a resistance or support level before ultimately reversing. They often signal a change in market sentiment.

-

Head and Shoulders: This pattern resembles the shape of a head and shoulders, with the “head” being the highest point and the “shoulders” being lower highs or lows. It typically suggests a trend reversal.

-

Triangles: Triangles are characterized by converging trendlines that form a triangular shape. They often indicate a period of consolidation before a breakout in the direction of the prevailing trend.

Combining Price Action Patterns with Other Indicators

While price action patterns provide valuable information on their own, their significance can be amplified when combined with other technical indicators. For instance:

-

Trendlines: Trendlines connect a series of higher highs or lower lows, providing a visual representation of the overall market direction. Price action patterns that align with trendlines gain increased validity.

-

Moving Averages: Moving averages smooth out price fluctuations, revealing the underlying trend. Price action patterns that occur near or intersect with moving averages can indicate support or resistance levels.

-

Volume: Volume analysis measures the number of shares traded over a specific period. High volume during a price action pattern can confirm the strength of the pattern and increase its reliability.

Price action patterns are indispensable tools that provide traders with a deeper understanding of market behavior. By familiarizing themselves with common patterns and combining them with other technical indicators, traders can enhance their trading strategies and make more informed decisions. Remember, the key to successful trading lies not only in identifying patterns but also in interpreting them within the broader market context, allowing traders to navigate the financial markets with greater confidence.