Net Accounts Receivable, calculated as Accounts Receivable (AR) minus Bad Debt Expense, reflects the expected cash flow from AR. This amount is crucial as it indicates the value of outstanding customer invoices reduced by the estimated uncollectible portion. To estimate Bad Debt Expense, businesses use methods like the percentage of sales method or aging of accounts receivable method. Managing net AR involves monitoring AR balances, implementing stricter credit policies, and regularly reviewing customer accounts to prevent excessive bad debt expense. Effective management improves cash flow predictability and profitability.

Definition of Net Accounts Receivable:

- Explain the accounts receivable balance after deducting bad debt expense.

Understanding Net Accounts Receivable: A Guide to a Key Financial Metric

In the realm of finance, net accounts receivable stand as a crucial indicator of a company’s financial health. It’s a metric that reflects the financial standing of a business with respect to its customer relationships and ability to collect outstanding payments.

Net accounts receivable is calculated by deducting bad debt expense from the gross accounts receivable balance. Simply put, it’s the amount of money that customers owe the business after accounting for any expected uncollectible accounts.

Accounts receivable are the amounts owed to a business by its customers for goods or services that have been sold on credit. Bad debt expense, on the other hand, represents the estimated amount of accounts receivable that are unlikely to be collected and will be written off as a loss. The deduction of bad debt expense from accounts receivable gives us net accounts receivable, which represents the amount of money that the business expects to collect from its customers.

This metric is significant because it provides insights into a company’s cash flow prospects. A healthy net accounts receivable balance indicates that the business is efficiently managing its customer relationships and effectively collecting payments. It implies that the company has a robust cash flow, which is essential for meeting operational expenses, making investments, and ensuring long-term viability. Conversely, a low or negative net accounts receivable balance could signal potential liquidity issues and warrant immediate attention.

Understanding Key Concepts in Net Accounts Receivable

In the financial world, it’s crucial to grasp the concepts that underpin critical metrics like net accounts receivable. This metric provides a clear picture of the expected cash flow a business can anticipate from credit sales. To fully understand net accounts receivable, it’s essential to break down its constituent concepts:

Accounts Receivable

Accounts receivable represents the amount owed to a business for goods or services it has provided on credit. This balance signifies that customers haven’t yet made payments for their purchases.

Sales

Sales refer to the total revenue generated by a business from the sale of goods or services. This figure forms the basis for calculating the amount of accounts receivable.

Sales Returns and Allowances

Sales returns and allowances arise when customers return purchased goods or receive a discount on their purchases. These deductions are subtracted from sales to determine the net sales revenue.

Bad Debt Expense

Bad debt expense reflects the estimated uncollectible portion of accounts receivable. This expense represents the amount of credit sales that the business anticipates it will not recover.

Cash Received

Cash received refers to the actual payments made by customers for their purchases. Tracking cash received is essential for managing accounts receivable effectively and estimating future cash flow.

Understanding these concepts in tandem provides a comprehensive framework for comprehending net accounts receivable and its importance in financial analysis and decision-making.

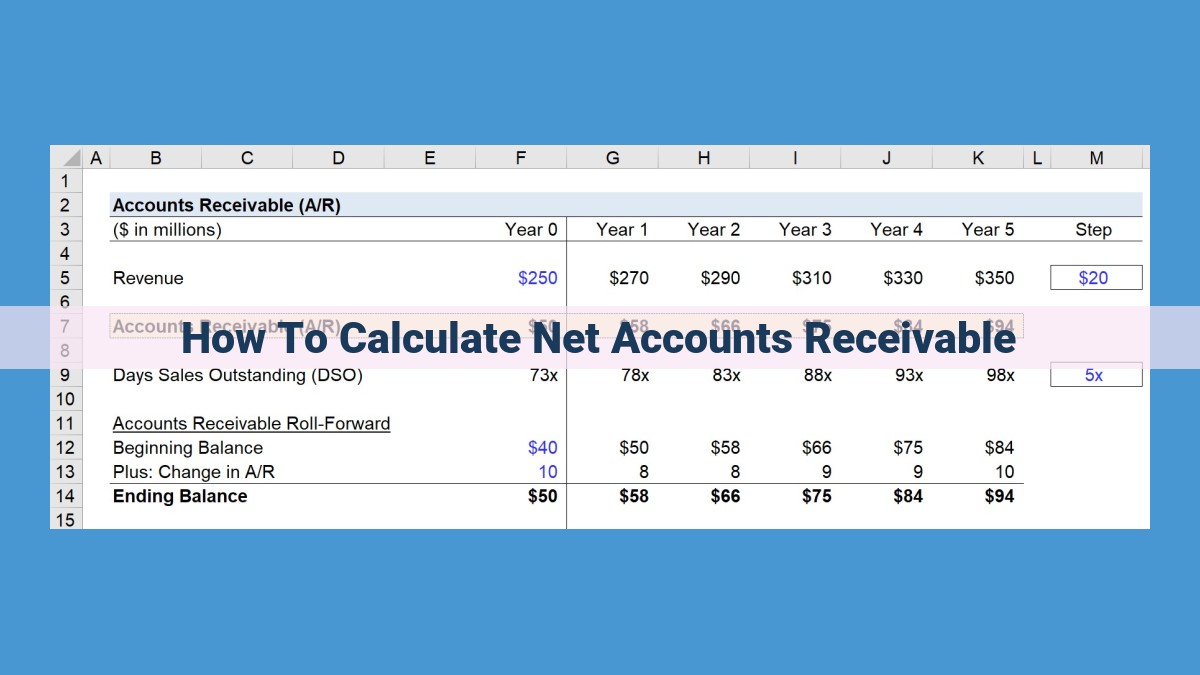

Calculating Net Accounts Receivable: A Simple Guide

Understanding and calculating net accounts receivable is crucial for businesses to assess their financial health and predict future cash flow. Let’s dive into a simplified explanation of how to calculate this important metric.

The formula for calculating net accounts receivable is straightforward:

Net Accounts Receivable = Accounts Receivable, End of Period – Bad Debt Expense

Accounts Receivable, End of Period represents the total amount owed to your business for products or services that have been sold but not yet paid for. This balance is found on your balance sheet.

Bad Debt Expense is an estimate of the amount of accounts receivable that will likely not be collected. This expense is recorded on your income statement.

Now, let’s put this formula into practice. Suppose your company has $100,000 in accounts receivable at the end of the period. You estimate that $5,000 of this amount will be uncollectible due to customer bankruptcies or other factors. Your net accounts receivable would be calculated as follows:

Net Accounts Receivable = $100,000 – $5,000 = $95,000

This result indicates that you expect to collect $95,000 from your customers, after considering the estimated bad debt expense.

The Significance of Net Accounts Receivable: A Lens into Expected Future Cash Flow

In the intricate tapestry of business finance, understanding the health of your receivables is crucial. Net accounts receivable, the balance remaining after deducting estimated uncollectible accounts from total accounts receivable, holds profound significance as a bellwether for your company’s future cash flow.

Predicting Incoming Funds

Accounts receivable represent sales made on credit that have yet to be collected. By subtracting bad debt expense, net accounts receivable provides a clearer picture of the expected cash flow that will materialize from these sales. This information is invaluable for businesses that rely heavily on credit sales, as it helps them forecast the amount of cash they can anticipate in the near term.

Gauging Financial Stability

A high net accounts receivable balance can indicate a company’s strong financial position. It suggests that customers are confident in the company’s ability to deliver on its commitments and are willing to extend credit terms. Conversely, a low net accounts receivable balance may raise concerns about the company’s liquidity and creditworthiness.

Evaluating Creditworthiness

Creditors and investors often scrutinize a company’s net accounts receivable when assessing its financial health. A high net accounts receivable balance relative to sales can indicate that the company has lax credit policies or that customers are not paying their bills in a timely manner. This can raise red flags about the company’s ability to manage its receivables effectively and may make it more difficult to obtain financing.

In summary, net accounts receivable is a critical metric that provides valuable insights into a company’s expected future cash flow and overall financial stability. By closely monitoring and managing net accounts receivable, businesses can optimize their cash flow, mitigate risks, and enhance their creditworthiness.

Factors Affecting Net Accounts Receivable

Credit Policies:

The terms of your credit policies, such as the credit limit, payment due date, and penalties for late payments, can have a significant impact on your net accounts receivable. More lenient policies can lead to higher receivables, while stricter policies can result in lower receivables.

Customer Payment Patterns:

The payment habits of your customers can also affect your net accounts receivable. If customers tend to pay their invoices promptly, your receivables will be lower compared to customers with a history of delayed payments.

Economic Conditions:

Economic conditions can influence customer behavior and, consequently, your net accounts receivable. During economic downturns, customers may be more likely to delay payments or become insolvent, leading to an increase in bad debts and higher net accounts receivable.

Estimating Bad Debt Expense: A Critical Guide

Estimating the amount of accounts receivable that will ultimately be uncollectible is a crucial aspect of managing net accounts receivable. Two widely used methods for estimating bad debt expense are the percentage of sales method and the aging of accounts receivable method.

Percentage of Sales Method

The percentage of sales method assumes that a certain percentage of sales will eventually become uncollectible. This percentage is typically based on historical experience or industry averages. To calculate the bad debt expense using this method, businesses multiply the percentage by their total sales revenue.

For example, if a business has estimated that 2% of its annual sales will be uncollectible, and its total sales revenue for the year was $1,000,000, the bad debt expense would be calculated as:

Bad Debt Expense = 0.02 x $1,000,000 = $20,000

Aging of Accounts Receivable Method

The aging of accounts receivable method takes into account the length of time that accounts receivable have been outstanding. The assumption is that older accounts are more likely to be uncollectible.

Businesses divide their accounts receivable into different age categories, such as:

- Current (within 30 days)

- Over 30 days

- Over 60 days

- Over 90 days

They then assign a different percentage of bad debt expense to each age category based on historical experience or industry averages.

For example, a business might estimate that 1% of current accounts receivable will be uncollectible, 2% of accounts receivable over 30 days will be uncollectible, and so on.

To calculate the bad debt expense using this method, businesses multiply the percentage for each age category by the balance in that category and then sum the results.

Example:

| Age Category | Balance | Percentage | Bad Debt Expense |

|---|---|---|---|

| Current | $500,000 | 1% | $5,000 |

| Over 30 days | $200,000 | 2% | $4,000 |

| Over 60 days | $100,000 | 5% | $5,000 |

| Over 90 days | $50,000 | 10% | $5,000 |

Total Bad Debt Expense: $19,000

The aging of accounts receivable method is generally considered to be more accurate than the percentage of sales method, as it takes into account the time factor. However, it can be more complex and time-consuming to implement.

Managing Net Accounts Receivable: A Guide to Improving Your Cash Flow

Net accounts receivable, representing the amount of money owed to your business by customers for goods or services sold on credit, can greatly impact your cash flow and financial health. Here’s how to effectively manage net accounts receivable to enhance your profitability:

Implement Stringent Credit Policies

- Establish clear guidelines for extending credit, ensuring that customers meet certain criteria (e.g., credit history, payment patterns).

- Conduct thorough credit checks before approving credit applications to minimize the risk of bad debts.

Offer Incentives for Timely Payments

- Implement early payment discounts to encourage customers to make payments before the due date.

- Consider offering loyalty programs or other incentives for customers who consistently make timely payments.

Regularly Review Customer Accounts

- Monitor customer payment patterns regularly to identify any potential problems.

- Contact customers who are overdue on payments promptly and remind them of their outstanding balances.

- Consider offering payment plans or other arrangements to help customers catch up on their payments.

Foster Strong Customer Relationships

- Build strong relationships with your customers by providing excellent service and support.

- Communicate clearly about your payment terms and expectations.

- Be willing to negotiate payment terms if necessary, while protecting the interests of your business.

Improve Communication and Transparency

- Send clear and detailed invoices to customers promptly.

- Provide online access to customer accounts for easy monitoring and payment submission.

- Regularly remind customers of their upcoming due dates and any outstanding balances.

Consider Outsourcing Accounts Receivable Management

- If you lack the resources or expertise to effectively manage your accounts receivable, consider outsourcing to a specialized firm.

- They can handle tasks such as invoicing, payment processing, and collections, freeing up your time to focus on other aspects of your business.

By implementing these strategies, you can optimize your net accounts receivable, reduce the likelihood of bad debts, accelerate cash flow, and improve your overall profitability.