To find net fixed assets, start with gross fixed assets (e.g., buildings, equipment) and subtract accumulated depreciation, which represents the wear and tear over time. This gives you net fixed assets, a key measure of a company’s asset base. Depreciation expense reduces net fixed assets annually, while capital expenditures increase it. Understanding net fixed assets is crucial for financial analysis, as it provides insights into a company’s ability to generate cash flow and repay debt.

Defining Net Fixed Assets

- Explain the concept of net fixed assets and its significance in financial analysis.

Understanding Net Fixed Assets: A Key Metric in Financial Analysis

Imagine you’re a business owner, and you’re evaluating your company’s financial health. One crucial aspect you need to examine is your net fixed assets. These assets represent the core of your business’s long-term investments, and they play a vital role in determining your financial stability and growth potential.

What are Net Fixed Assets?

Net fixed assets are simply the difference between the gross fixed assets your company owns and the accumulated depreciation that has been charged against those assets over time. In essence, they reflect the value of your tangible, long-term investments after taking into account their decline in value due to usage and the passage of time.

Gross Fixed Assets: The Building Blocks

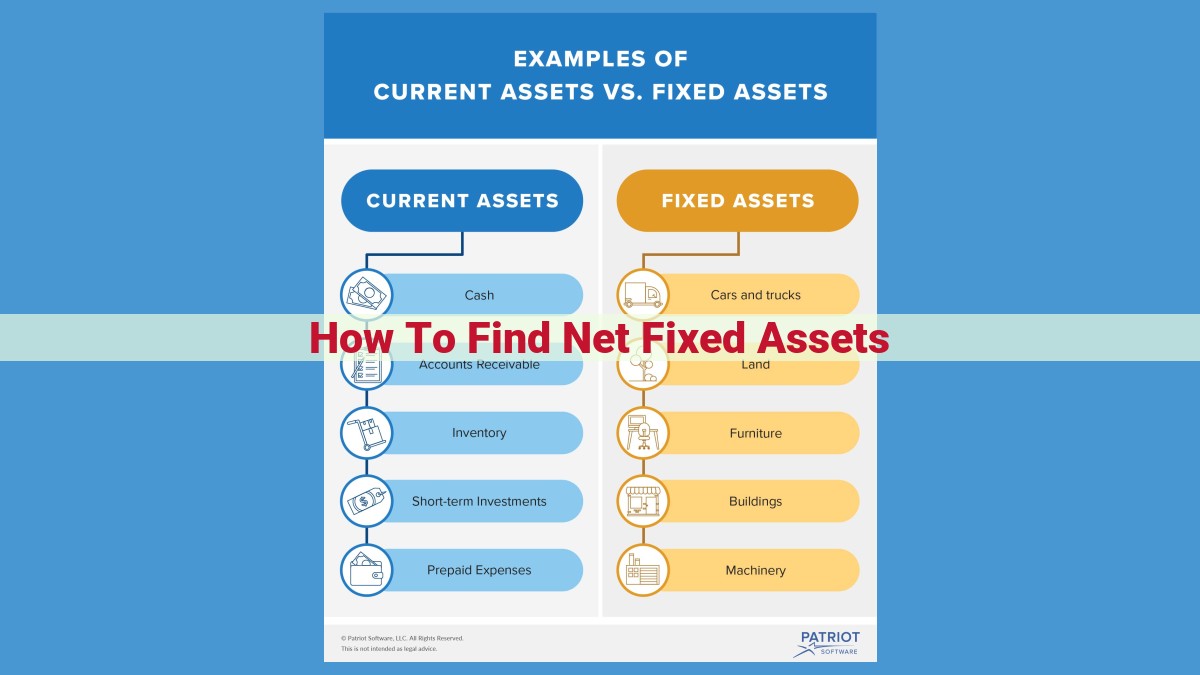

Gross fixed assets are the physical assets your company uses to generate revenue. They include tangible items such as land, buildings, machinery, vehicles, and equipment. These assets are often referred to as property, plant, and equipment (PP&E).

Accumulated Depreciation: The Reducing Factor

As your fixed assets are used, they gradually lose value due to wear and tear. To account for this decline, companies charge a portion of the asset’s cost as depreciation expense each accounting period. This expense is accumulated over time in an account called accumulated depreciation.

Calculating Net Fixed Assets

To determine your net fixed assets, you simply subtract the accumulated depreciation from the gross fixed assets:

Net Fixed Assets = Gross Fixed Assets - Accumulated Depreciation

Importance of Net Fixed Assets

Net fixed assets provide a snapshot of your company’s capital intensity. They indicate the amount of capital your business has invested in long-term assets. Higher net fixed assets generally imply a higher investment in operations and future growth potential. Lenders and investors often scrutinize this metric to assess the stability and profitability of your business.

Gross Fixed Assets: Laying the Foundation

Gross fixed assets, often referred to as tangible assets, constitute the physical, non-current assets that form the operational bedrock of a company. These assets are not easily liquidated and are utilized in the day-to-day operations of the business.

Examples of gross fixed assets include land, buildings, machinery, equipment, and vehicles. It’s crucial to note that these assets are initially recorded at their acquisition cost. However, as they are utilized over time, their value decreases due to depreciation, which we will explore shortly.

The relationship between gross fixed assets and accumulated depreciation is intertwined. Accumulated depreciation represents the cumulative reduction in the value of fixed assets due to usage and obsolescence. It serves as a contra-asset account that offsets the gross fixed asset balance on the balance sheet.

Accumulated Depreciation: The Reducing Factor

Every asset, no matter how durable, degrades over time due to wear and tear, obsolescence, or other factors. This decline in an asset’s value is known as depreciation. Accumulated depreciation is the cumulative total of depreciation charges that have been recorded against an asset over its useful life.

To calculate accumulated depreciation, businesses use various methods such as straight-line, double-declining balance, or units-of-production. Straight-line depreciation allocates the cost of an asset evenly over its estimated lifespan. For instance, if an asset costing $10,000 has a useful life of 5 years, $2,000 will be depreciated each year.

Accumulated depreciation is recorded as a contra-asset account on the balance sheet, meaning it reduces the value of the corresponding gross fixed asset account. This ensures that the asset’s book value, or net carrying amount, reflects its current worth. For example, if an asset with a gross value of $100,000 has accumulated depreciation of $30,000, its net fixed asset value is $70,000.

Understanding accumulated depreciation is crucial because it helps financial analysts and investors assess a company’s asset base and financial health. A high level of accumulated depreciation indicates that the company has invested in its fixed assets, but it also suggests that these assets may be nearing the end of their useful lives and may need to be replaced soon. This information is vital for making informed decisions about capital expenditures and long-term investment strategies.

Net Fixed Assets: The True Asset Value

- Provide the formula for calculating net fixed assets: Gross Fixed Assets – Accumulated Depreciation.

- Highlight the importance of net fixed assets in determining a company’s asset base and financial health.

Net Fixed Assets: The True Asset Value

In the realm of financial analysis, net fixed assets emerge as a crucial metric, shedding light on a company’s asset base and financial well-being. To fully grasp this concept, we embark on a journey that begins with gross fixed assets, the foundation upon which net fixed assets are built.

Gross Fixed Assets: The Foundation

Envision a company’s fleet of machinery, buildings, and other tangible assets that contribute directly to its operations. These assets, collectively known as gross fixed assets, represent the backbone of a company’s physical resources. However, as time takes its toll, these assets gradually deteriorate due to wear and tear.

Accumulated Depreciation: The Reducing Factor

To account for this inevitable decline, companies employ accumulated depreciation. This concept recognizes the portion of gross fixed assets that has lost value over time. It acts as a ‘sinking fund’ that indicates the extent to which an asset has been used up. By deducting accumulated depreciation from gross fixed assets, we arrive at the net fixed assets.

Net Fixed Assets: The True Asset Value

The formula for calculating net fixed assets is straightforward: Gross Fixed Assets – Accumulated Depreciation = Net Fixed Assets. This value represents the true, undepreciated worth of a company’s physical assets. It is a critical indicator of the company’s asset base, providing insights into its ability to generate future cash flows and maintain operations.

Importance of Net Fixed Asset Analysis

Understanding net fixed assets is paramount for informed financial decision-making. It helps determine:

- Asset Base: Net fixed assets constitute a significant portion of a company’s total assets, providing a foundation for its operations and financial stability.

- Financial Health: The relationship between net fixed assets and other financial metrics can reveal the company’s ability to generate profits, pay debts, and withstand economic downturns.

- Investment Decisions: Investors and analysts often rely on net fixed assets to assess a company’s long-term growth potential and make informed investment decisions.

By understanding the concept of net fixed assets and its significance, we gain a deeper appreciation for the financial health and asset base of a company. It is a metric that unveils the true value of a company’s physical resources and plays a vital role in financial analysis and decision-making.

Depreciation Expense: The Time-Based Reduction on Net Fixed Assets

Understanding Depreciation Expense

Depreciation expense is a non-cash accounting charge that represents the gradual reduction in an asset’s value over its useful life. It acknowledges that fixed assets, such as buildings, machinery, and equipment, deteriorate and lose their economic value over time due to wear and tear, technological advancements, and obsolescence.

Impact on Net Fixed Assets

Depreciation expense directly impacts net fixed assets. The formula for calculating net fixed assets is:

Net Fixed Assets = Gross Fixed Assets – Accumulated Depreciation

As depreciation expense is recognized, it accumulates in the Accumulated Depreciation account, which is a contra-asset account that reduces the gross fixed asset balance. This reduction in the gross fixed asset balance results in a lower net fixed asset value.

Calculating and Allocating Depreciation Expense

Depreciation expense is calculated using various methods, including the straight-line method, declining balance method, and units-of-production method. The chosen method determines how the asset’s value is allocated over its useful life.

Regardless of the method used, the total amount of depreciation expense recognized over an asset’s useful life should equal its cost or fair value. Depreciation expense is then allocated to each period based on the estimated useful life of the asset.

Importance of Accurate Depreciation Expense

Accurate depreciation expense calculation is crucial for several reasons:

- Financial Reporting: It ensures that the financial statements reflect the true economic value of fixed assets.

- Taxation: Depreciation expense is a tax-deductible expense, so accurate calculations can optimize tax savings.

- Investment Analysis: Investors and analysts use net fixed assets to assess a company’s asset base and financial health. Accurate depreciation expense calculations provide a fair representation of the company’s fixed asset value.

Capital Expenditure: Expanding Net Fixed Assets

In the realm of financial analysis, comprehending net fixed assets is crucial for evaluating a company’s financial health. One significant factor that contributes to the growth of net fixed assets is capital expenditure.

Defining Capital Expenditure

Capital expenditure, often referred to as “capex,” represents the funds invested in acquiring or improving long-term assets. These assets include tangible items like property, plant, and equipment that are essential for the company’s operations. Capital expenditure is a key indicator of a company’s commitment to growth and its ability to maintain and enhance its competitive advantage.

The Relationship with Leasehold Improvements

Leasehold improvements are capital expenditures made to enhance rented assets. When a company leases a property, it may invest in renovations or alterations to make the space more suitable for its business needs. These improvements become part of the company’s gross fixed assets, as they increase the value of the leased asset.

Impact on Net Fixed Assets

Capital expenditure directly increases net fixed assets by adding to the company’s gross fixed assets. As the company acquires or improves new assets, the value of its gross fixed assets increases. This, in turn, leads to a higher net fixed asset value when accumulated depreciation is deducted.

Capital expenditure plays a vital role in expanding a company’s net fixed assets. By investing in long-term assets, a company can enhance its operational efficiency, expand its capacity, and stay competitive in the market. Understanding the impact of capital expenditure on net fixed assets is crucial for financial analysts and investors seeking to accurately evaluate a company’s financial performance.

Leasehold Improvements: Enhancing Rented Assets

When a company rents a commercial space, it may invest in permanent improvements to the property to make it more suitable for its business operations. These enhancements, known as leasehold improvements, are capital expenditures that increase the value of the rented asset.

Leasehold improvements differ from operating expenses in that they are expected to provide economic benefits over several years. Examples of leasehold improvements include renovations, partitions, and installations of fixtures or appliances.

Impact on Net Fixed Assets

Leasehold improvements have a direct impact on the calculation of net fixed assets. Since they are classified as capital expenditures, they are added to the gross fixed assets. The resulting increase in gross fixed assets is offset by a corresponding increase in accumulated depreciation over the estimated useful life of the improvements.

As a result, the net fixed assets (gross fixed assets minus accumulated depreciation) increase, reflecting the improved value of the rented property. This increase enhances the company’s asset base and contributes to its overall financial health.

Leasehold improvements are a strategic investment for companies that lease commercial spaces. By making these improvements, businesses can enhance the functionality and value of their rented assets, ultimately contributing to the growth and success of their operations. Accurate accounting and analysis of leasehold improvements is essential for determining a company’s net fixed assets and making informed financial decisions.

Construction-in-Progress: The Foundation of Tomorrow’s Assets

In the realm of accounting, there’s a special category of assets that hold the promise of future growth and prosperity: Construction-in-Progress (CIP). These are assets that are still under construction, taking shape with every brick laid and every piece of equipment installed. Unlike finished buildings or machinery, CIP represents a work in progress, a tangible manifestation of a company’s plans for expansion and innovation.

As part of gross fixed assets, CIP is a valuable asset that will eventually contribute to a company’s productive capacity. However, its inclusion in this category is not without its nuances. While traditional fixed assets are typically recorded on the balance sheet once they are complete and ready for use, CIP is recognized even during its construction phase.

Timing: When Construction Begins, Accounting Follows

The timing of recording CIP on the balance sheet is crucial. As soon as construction commences, the company incurs costs that contribute to the asset’s value. These costs, such as materials, labor, and equipment, are capitalized and added to the CIP account. This process continues throughout the construction period until the asset is complete and ready for operation.

By recognizing CIP early on, companies can track its progress and monitor its impact on their financial position. It also allows them to spread the costs of construction over the asset’s useful life, providing a more accurate picture of its profitability and efficiency.

Disposals: Reducing Net Fixed Assets

- Define disposals and their impact on construction-in-progress.

- Explain the accounting treatment of asset disposals.

Disposals: Shedding Fixed Assets

Fixed assets, like loyal companions, accompany companies throughout their journeys. However, like all relationships, there comes a time when some must end. Disposals are the bittersweet moments when companies part ways with their fixed assets.

Impact on Construction-in-Progress

Construction-in-progress, the eager apprentice in the fixed asset family, may sometimes find itself affected by disposals. When a company disposes of an asset that was under construction, the costs incurred up to that point may be recognized as a loss. It’s as if the company had to cut its investment short.

Accounting Treatment

When a fixed asset is disposed of, a company must perform accounting acrobatics to reflect the change. The original cost of the asset is removed from the gross fixed asset account. Simultaneously, accumulated depreciation associated with that asset is also removed.

This delicate dance leaves behind a bittersweet reminder – a gain or loss on disposal. A gain occurs if the disposal proceeds exceed the net book value (original cost minus accumulated depreciation). Conversely, a loss arises when the proceeds fall short of the net book value.

The resulting gain or loss is then booked as income or expense in the company’s income statement. It’s a poignant moment, marking the end of an asset’s life and the impact it had on the company’s financial well-being.