To obtain a Personal Security Investigation (PSI) report, individuals can request a self-report directly from the provider or authorize their employer to obtain it. Methods include online portals, mail, or phone. Fees and processing times vary depending on the provider. It’s important to review the report carefully, identifying red flags or inaccuracies that may affect personal decisions, such as employment or housing applications.

Understanding Pre-Sentence Investigation (PSI) Reports: Unraveling Their Significance

In the realm of justice, Pre-Sentence Investigation (PSI) reports play a pivotal role in shaping sentencing decisions and ensuring fair and informed outcomes. PSI reports provide a comprehensive account of an individual’s background, empowering judges to make enlightened choices regarding punishment, treatment, and rehabilitation.

What is a PSI Report and Why is it Important?

PSI reports are meticulously compiled documents that offer insights into an individual’s life trajectory. They serve as an invaluable tool for judges, helping them understand the context of a crime, assess the risk of recidivism, and design tailored sentences that promote rehabilitation and public safety.

Essential Elements of a PSI Report

A comprehensive PSI report typically encompasses several key elements:

-

_Background Check:_ An in-depth exploration of an individual’s criminal record, driving history, and social media activity.

-

_Credit Report:_ A review of an individual’s credit history and score, providing insights into their financial responsibility.

-

_Employment History:_ A detailed record of previous job positions, employers, and references.

-

_Education History:_ A chronicle of an individual’s educational achievements and institutions attended.

-

_Professional Licenses:_ A list of valid licenses and certifications held by the individual.

Elements of a PSI Report

(SEO-optimized subheading)

PSI reports, an essential part of many employment and background checks, offer a detailed snapshot of an individual’s personal and professional history. These comprehensive reports encompass a wide range of elements, providing valuable insights into the candidate’s background.

Background Check

(Subheading tag)

A thorough background check delves into an individual’s criminal and driving records, revealing any past offenses, traffic violations, or other relevant legal matters. In today’s digital age, it also includes a review of social media profiles to assess the candidate’s online presence and any potential red flags.

Credit Report

(Subheading tag)

The credit report section of a PSI report provides a financial history of the candidate. It includes details of credit accounts, payment history, and credit score. This information helps employers evaluate the candidate’s financial responsibility and the potential for financial risk.

Employment History

(Subheading tag)

The employment history section outlines the candidate’s past work experiences, including job titles, employers, and references. This information allows employers to assess the candidate’s work ethic, skills, and professional development.

Education History

(Subheading tag)

The education history section highlights the candidate’s academic credentials and the institutions they attended. This information provides insights into the candidate’s intellectual abilities, learning history, and any specialized knowledge or expertise.

Professional Licenses

(Subheading tag)

For many professions, valid licenses and certifications are essential. The professional licenses section of a PSI report lists the candidate’s current and valid licenses or certifications, demonstrating their qualifications and adherence to industry standards.

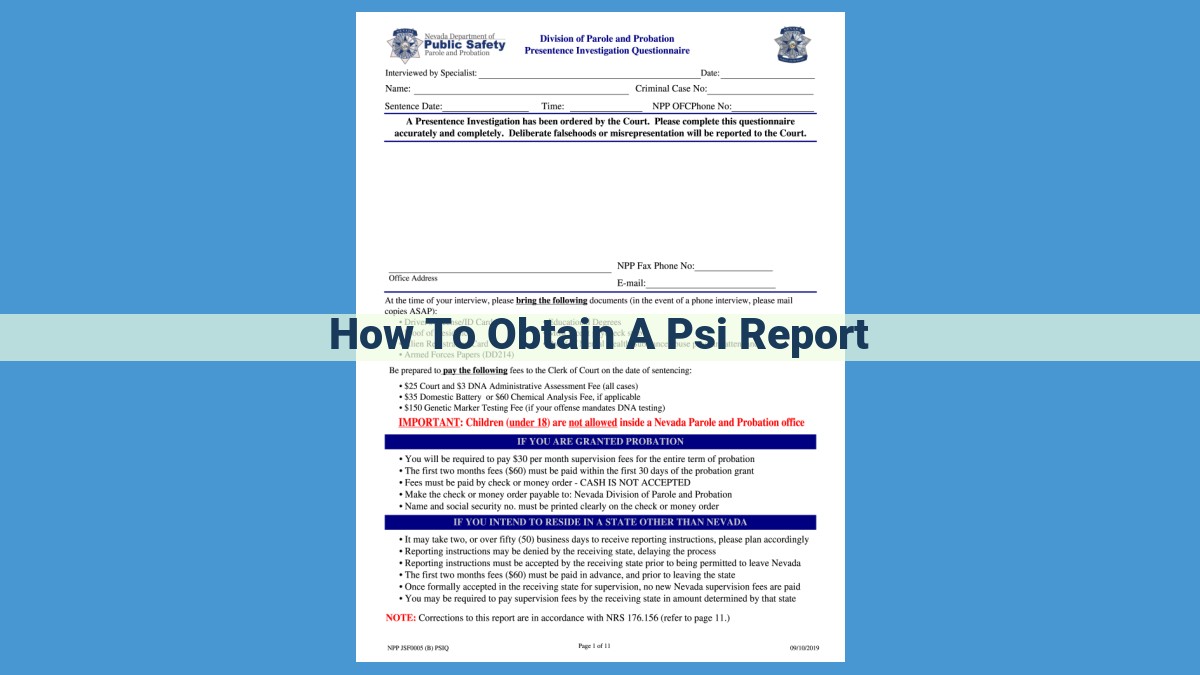

Obtaining a PSI Report: Demystifying the Process

Understanding Pre-Sentence Investigation (PSI) reports is crucial for navigating crucial life decisions. If you require a PSI report, knowing how to obtain one can empower you.

Who Can Request a PSI Report?

PSI reports are typically requested by criminal justice authorities as part of the sentencing process. However, individuals may also self-request a report for various purposes, such as employment applications or housing decisions.

Methods for Obtaining a PSI Report

You can obtain a PSI report in two ways:

- Self-Request: Contact the court or agency that conducted the investigation. Be prepared to provide identification and proof of purpose.

- Employer Authorization: If you are applying for a job that requires a PSI report, your employer will initiate the request. They will need your written authorization.

Fees and Processing Times

The fees and processing times for PSI reports vary depending on the jurisdiction and the method of obtaining the report.

- Self-Request: Fees can range from free to several hundred dollars. Processing times typically take several weeks or longer.

- Employer Authorization: Employers may cover the fees, and processing times are often expedited to meet hiring needs.

Tips for a Smooth Process

- Identify the Purpose: Clearly state the purpose for requesting the report to facilitate the process.

- Prepare Documentation: Gather necessary documents such as ID, proof of address, and employment verification.

- Be Patient: Allow ample time for processing, especially during peak periods.

- Follow Instructions: Adhere to the specific requirements of the court or agency regarding fees, forms, and submission methods.

Interpreting a PSI Report: Decoding the Details

Understanding a PSI report can be daunting, but it’s crucial for navigating its implications. Here’s a guide to help you decipher the key findings:

Identifying Red Flags and Key Findings

Your PSI report may contain information on criminal records, driving violations, and social media profiles. Pay attention to any negative or unusual entries. For instance, a criminal conviction could raise concerns about your reliability or safety. Similarly, gaps in employment or questionable social media activity may warrant further investigation.

Consequences of Inaccurate or Negative Information

Inaccuracies or negative information in a PSI report can have far-reaching consequences. Employment opportunities may be denied, housing applications rejected, or financial transactions delayed. It’s essential to address any errors or disputes promptly to prevent these adverse effects.

Addressing and Correcting Errors

If you find errors in your PSI report, take action immediately. Contact the reporting agency and provide them with the correct information. They are legally obligated to investigate the dispute and make necessary corrections. You can also file a formal complaint with the Federal Trade Commission (FTC) or the Fair Credit Reporting Act (FCRA) if the issue is not resolved satisfactorily.

Remember, PSI reports are snapshots of your personal and professional history. By carefully interpreting the findings, you can ensure that the information presented is accurate and does not hinder your opportunities or reputation.

Using a PSI Report

In various aspects of our lives, Personal Status Inquiry (PSI) Reports play a significant role. Beyond job screening, they’re indispensable for housing decisions, financial transactions, and ensuring personal verification.

Employment Screening:

Employers scrutinize PSI reports to assess an applicant’s suitability for specific positions. These reports provide an objective overview of a candidate’s background, criminal history, and employment record. This information helps recruiters make informed decisions, ensuring the safety and integrity of their organizations.

Housing Decisions:

Landlords and property managers often request PSI reports to screen potential tenants. The reports reveal critical insights into an individual’s rental history, financial stability, and any history of criminal behavior. This assessment allows landlords to gauge a tenant’s responsibility and potential risk to the property.

Financial Transactions:

In certain financial dealings, such as loans and credit card applications, lenders may require PSI reports to verify an applicant’s identity, creditworthiness, and any potential fraud concerns. The information gathered through these reports assists lenders in making responsible lending decisions.

Personal Verification and Identity Theft Prevention:

PSI reports help prevent identity theft by providing a comprehensive review of an individual’s personal information. Individuals can obtain their own PSI reports to verify their identity and safeguard against unauthorized access to their sensitive data.

Establishing Trust and Credibility:

In business and personal relationships, PSI reports play a pivotal role in establishing trust and credibility. By providing independent verification of an individual’s background and qualifications, PSI reports foster confidence and reliability. They reassure others that the information they possess is accurate and trustworthy.

In conclusion, PSI reports fulfill a multitude of purposes, empowering individuals to make informed decisions, protect their identities, and establish trust. Their thorough analysis of personal information provides valuable insights, ensuring that the right people are placed in the right positions and that transactions are conducted with integrity and confidence.

Additional Considerations

Privacy Concerns

When it comes to personal information, privacy is paramount. PSI reports contain sensitive data, so it’s crucial to understand how it’s handled. Legitimate companies adhere to strict privacy regulations, ensuring the secure storage and responsible use of your information.

Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) empowers you with rights regarding credit reports. It outlines your ability to access your report, dispute errors, and limit who can obtain it. Understanding your rights under FCRA helps you maintain the accuracy and privacy of your credit information.

Dispute Resolution

If you identify errors or inaccuracies in your PSI report, don’t hesitate to initiate a dispute. You can contact the reporting agency directly or use a dispute resolution service. Follow the proper procedures and provide supporting documentation to rectify any incorrect information. Accurate and up-to-date reports ensure fair and informed decisions.