In oligopolies, companies have market power, enabling them to influence prices. They use strategies like collusion (aligning prices) and price leadership (following a dominant firm’s pricing). Game theory models like the Cournot and Bertrand models analyze oligopolistic pricing behavior based on output or price competition, respectively. The kinked demand curve theory suggests price stability despite marginal cost changes. Pricing strategies include collusive pricing, price leadership, Cournot competition, and Bertrand competition. Oligopolies can set higher prices than competitive markets, potentially reducing output, innovation, and consumer welfare.

Market Power in Oligopolies

In the realm of economics, where competition reigns supreme, there exists a unique market structure known as an oligopoly. Here, a select few dominant firms vie for control, wielding considerable market power.

Understanding Market Power

Market power is the ability of a firm or group of firms to influence the price and output of goods or services in a market. In an oligopoly, this power stems from the limited number of competitors. By acting strategically, these firms can manipulate market dynamics to their advantage.

Gaining Market Power

Oligopolists employ various strategies to gain and maintain market power. They may:

- Control significant market share: By owning a large portion of the market, firms can influence prices and output.

- Create barriers to entry: High startup costs, patents, or exclusive access to raw materials can make it difficult for new competitors to enter the market.

- Engage in strategic alliances: Forming partnerships or mergers with other firms can increase size and market influence.

Exercising Market Power: Collusion and Price Leadership

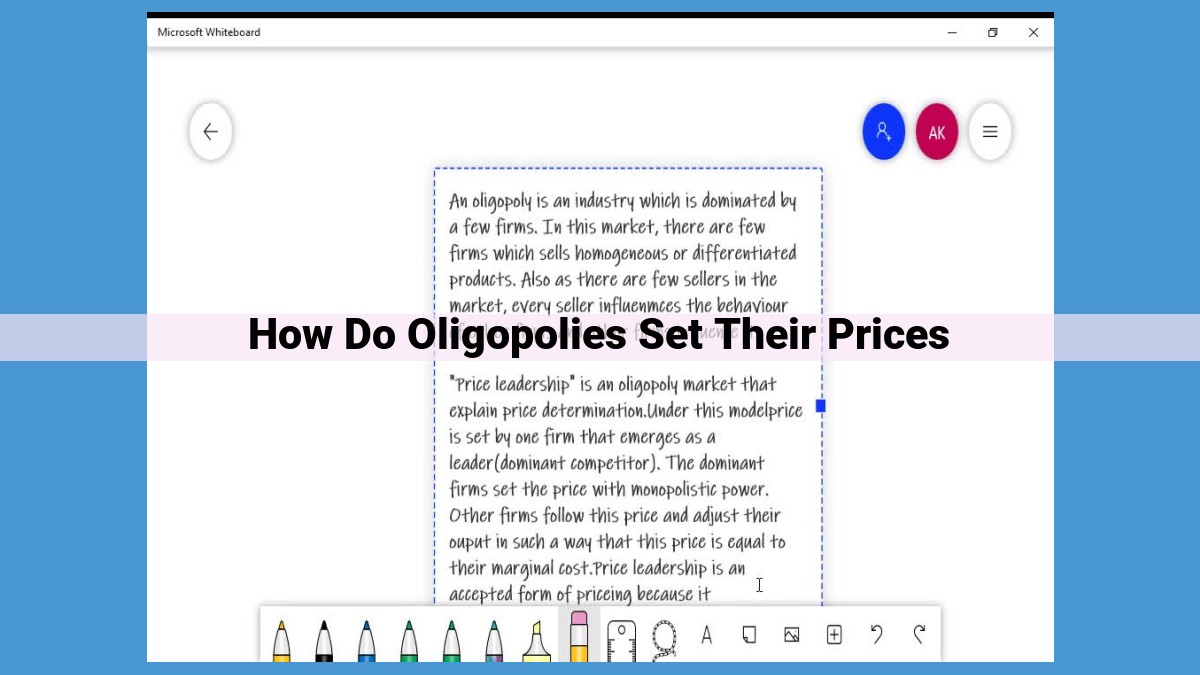

Collusion is an informal or formal agreement among oligopolists to restrict competition. By coordinating their actions, they can fix prices, allocate market shares, or limit output.

Price leadership is when one dominant firm sets prices, which other firms then follow. This strategy minimizes competition and stabilizes market prices.

Implications of Market Power

The concentration of market power in an oligopoly can have significant implications for consumers and the economy:

- Higher Prices: Oligopolists may raise prices above competitive levels, exploiting their limited competition.

- Reduced Output: Competition can drive innovation and efficiency. However, in oligopolies, firms may reduce output to maintain high prices.

- Barriers to Innovation: Market power can discourage new entrants and innovation, as potential competitors face high barriers to entry.

Game Theory and Nash Equilibrium in Oligopolies

In the world of economics, understanding the dynamics of oligopoly markets is crucial. Oligopolies are markets dominated by a few large firms controlling a significant market share, leading to unique pricing strategies and market outcomes.

Game theory emerges as a powerful tool to analyze these complex interactions. It allows economists to simulate the thought processes and strategic decision-making of oligopolists, predicting their likely behavior and its impact on the market.

One of the key concepts in game theory is Nash equilibrium. This occurs when each player in a game makes optimal decisions given the choices of other players. In oligopolies, this means that each firm sets its prices and output levels to maximize its profit, taking into account the potential responses of its rivals.

Nash equilibrium helps explain why oligopolists often engage in collusive behavior, such as setting prices above competitive levels or limiting output to maintain market share. When Oligopolists collude, they can increase their profits by acting collectively rather than competing fiercely.

Similarly, price leadership can occur in oligopolies. One firm establishes prices that other firms follow to avoid price wars that would erode profits. This leadership may be based on factors such as market share, reputation, or cost advantages.

Understanding Nash equilibrium and game theory is essential for comprehending the dynamics of oligopolies. These concepts help economists analyze market behavior, predict pricing strategies, and assess the potential impact of market power on consumer welfare.

Oligopoly Models: Unveiling the Strategies of Market Dominance

In the realm of economics, oligopolies stand out as markets dominated by a few powerful firms. To understand how these firms exert their market power, economists have developed sophisticated models that capture the complexities of their behavior.

Cournot Competition: Battling for Output

The Cournot competition model assumes that oligopolists compete by setting their output levels, knowing that other firms will react to their decisions. Each firm aims to maximize its profit, taking into account the output choices of its rivals.

The beauty of the Cournot model lies in its simplicity and applicability to real-world markets. By predicting the output levels of each firm, it sheds light on the overall market outcome and the extent of market power.

Bertrand Competition: A Price War

In contrast to the Cournot model, the Bertrand competition model assumes that oligopolists compete through price setting. Firms engage in a price war, slashing prices to attract customers and maximize market share.

The key difference between the two models is the nature of competition. In Cournot, firms compete on quantity, while in Bertrand, they battle on price. Both models provide valuable insights into how oligopolists strive for dominance.

Kinked Demand Curve: The Price Conundrum

The kinked demand curve is a unique concept that arises in certain oligopoly markets. It suggests that if a firm raises its price above a certain point, its competitors will not follow suit, but if it lowers its price, its competitors will quickly match it. This kink in the demand curve has significant implications for oligopoly pricing strategies.

Firms with a kinked demand curve are hesitant to raise prices, as they fear losing market share. On the other hand, they may be reluctant to lower prices, as their competitors will follow suit, eroding their profit margins. This phenomenon helps explain why oligopolists often maintain stable prices despite changing market conditions.

Pricing Strategies in Oligopolies

- Analyze collusive pricing and its impact on market outcomes.

- Explain how price leadership can influence pricing decisions.

- Describe the Cournot competition and Bertrand competition models and discuss their implications for pricing.

Pricing Strategies in Oligopolies

In the realm of oligopolies, where a handful of dominant firms control a significant market share, pricing strategies play a crucial role in shaping market outcomes. Oligopolists, unlike their counterparts in competitive markets, possess market power, granting them the ability to influence prices to their advantage.

Collusive Pricing

Collusion, a form of cooperation among oligopolists, involves an agreement to set prices above the perfectly competitive level. This strategy effectively restricts output, creating an artificial scarcity that drives up prices. However, collusion is inherently unstable as individual firms may have incentives to cheat on the agreement to maximize their own profits.

Price Leadership

Another common pricing strategy in oligopolies is price leadership. Here, a dominant firm sets the price, while other firms follow the leader. This strategy can help maintain price stability within the industry, especially when demand is inelastic. However, the price leader must possess significant market power and the ability to credibly commit to a price strategy.

Oligopoly Models

To analyze pricing strategies in oligopolies, economists employ mathematical models such as the Cournot competition model and the Bertrand competition model.

-

Cournot Competition: In this model, firms compete in terms of quantity produced, strategically choosing output levels to maximize their profits, given the output choices of their rivals. This model predicts that oligopolists will produce less output and charge higher prices compared to a competitive market.

-

Bertrand Competition: In contrast, this model focuses on price competition. Firms compete by setting their prices below their rivals, leading to a race to the bottom. Equilibrium occurs when all firms charge the marginal cost of production.

Implications for Pricing

These oligopoly models have profound implications for pricing. Collusive pricing can result in higher prices for consumers, while price leadership can lead to price rigidity within the industry. Cournot competition typically leads to higher prices and lower output compared to Bertrand competition due to the lack of price rivalry.

Understanding pricing strategies in oligopolies is essential for policymakers, consumers, and firms alike. By recognizing the unique characteristics and challenges of oligopoly markets, we can effectively address issues of market power, consumer welfare, and economic efficiency.

The Impact of Market Power on Pricing in Oligopolies

In competitive markets, the invisible hand of supply and demand dictates prices. But what happens when a handful of dominant players hold sway over an industry? Enter the realm of oligopolies, where market power reigns supreme and its effects on pricing can be far-reaching.

Soaring Prices: A Consequence of Market Dominance

Oligopolists, with their collective control over market share, enjoy a unique advantage over firms in competitive markets. They can orchestrate pricing strategies that maximize their profits, often resulting in prices that soar above those found in competitive environments. This is because oligopolists can restrict output, creating an artificial scarcity that drives prices upward.

Stagnant Innovation and Reduced Output: Stifled Market Dynamics

The pursuit of profit maximization in oligopolies often comes at the expense of innovation and output. With a commanding market share, oligopolists have less incentive to invest in new products or processes that could potentially disrupt their established positions. This lack of competition leads to a stagnant market where consumers are deprived of the benefits of innovation and progress.

Consumer Harm: The Unfortunate Fallout

The negative consequences of market power ultimately trickle down to consumers. Higher prices mean reduced purchasing power, making it more difficult for consumers to access essential goods and services. Moreover, the lack of competition and innovation in oligopolies can lead to lower-quality products and services, further eroding consumer welfare.