Activity rate is calculated through activity-based costing (ABC), a method that allocates indirect costs to activities and then assigns those costs to products or services. To calculate activity rate, first define the activity cost pool (e.g., production setup) and cost object (e.g., product line). Identify the activity driver (e.g., machine hours) and assign costs (e.g., labor, materials) to the pool. Divide the total cost by the total activity driver quantity to calculate the activity rate. This rate is used to assign indirect costs to cost objects, identify cost-saving opportunities, and enhance decision-making by providing a more accurate understanding of activity-related costs.

Unveiling the Power of Activity Rates: A Comprehensive Guide

In the intricate world of cost accounting, activity-based costing (ABC) stands out as a revolutionary technique that unravels the hidden secrets of indirect costs. ABC empowers businesses with the ability to pinpoint the true cost of activities that drive their operations. By meticulously calculating activity rates, ABC provides a roadmap to allocate these costs accurately to products, services, and customers.

Imagine a tapestry where each thread represents an activity. ABC meticulously untangles these threads, revealing the interdependencies and resource consumption associated with each activity. By assigning costs to these activities, businesses gain unprecedented visibility into the cost structure of their operations. Armed with this knowledge, they can make informed decisions that optimize resource allocation, identify cost-saving opportunities, and enhance profitability.

The calculation of activity rates is a pivotal step in the ABC framework. It allows businesses to quantify the cost per unit of activity, serving as a powerful tool for cost planning, budgeting, and strategic decision-making. Understanding the concepts of time-driven and general ledger ABC is essential for calculating accurate activity rates and unlocking the full potential of ABC.

Understanding Time-Driven and General Ledger Activity-Based Costing

Activity-based costing (ABC) is a valuable tool for organizations seeking to accurately assign indirect costs to products or services. It effectively allocates costs based on the activities that truly drive them.

Time-Driven ABC

Emphasizes the relationship between time and costs.

* Tracks time spent on specific activities and uses this data to calculate activity rates.

* More accurate in capturing the actual costs of activities.

* Requires detailed time tracking and can be time-consuming.

General Ledger ABC

- Relies on existing financial data in the general ledger.

- Allocates costs based on historical relationships.

- Less accurate than time-driven ABC due to reliance on assumptions.

- Simpler to implement and requires less data collection.

Similarities

- Both methods identify cost pools and cost objects.

- Both methods calculate activity rates to assign indirect costs.

Differences

- Data collection: Time-driven ABC requires detailed time tracking, while general ledger ABC uses existing financial data.

- Accuracy: Time-driven ABC is more accurate, as it directly measures the time spent on activities.

- Simplicity: General ledger ABC is simpler to implement, as it does not require extensive time tracking.

Choosing the Right Method

The choice between time-driven and general ledger ABC depends on the organization’s:

- Cost accuracy requirements

- Data availability

- Resources

Organizations seeking the highest level of cost accuracy should consider time-driven ABC. However, organizations with limited time and resources may find general ledger ABC to be a more practical option.

Understanding the differences between these two ABC methods allows organizations to make informed decisions and select the approach that best meets their specific needs.

Calculating Activity Rate: A Comprehensive Guide

Understanding Activity-Based Costing (ABC)

Before delving into activity rate calculation, it’s essential to grasp the concept of Activity-Based Costing (ABC). ABC is a methodology that assigns indirect costs to specific activities or processes within a company, enabling businesses to allocate these costs more accurately to their cost objects (products/services). By doing so, ABC provides a more precise picture of the true cost of each activity, thus facilitating better decision-making and cost optimization.

Steps Involved in Calculating Activity Rate

To calculate activity rate, follow these steps:

1. Define Activity Cost Pool and Cost Object:

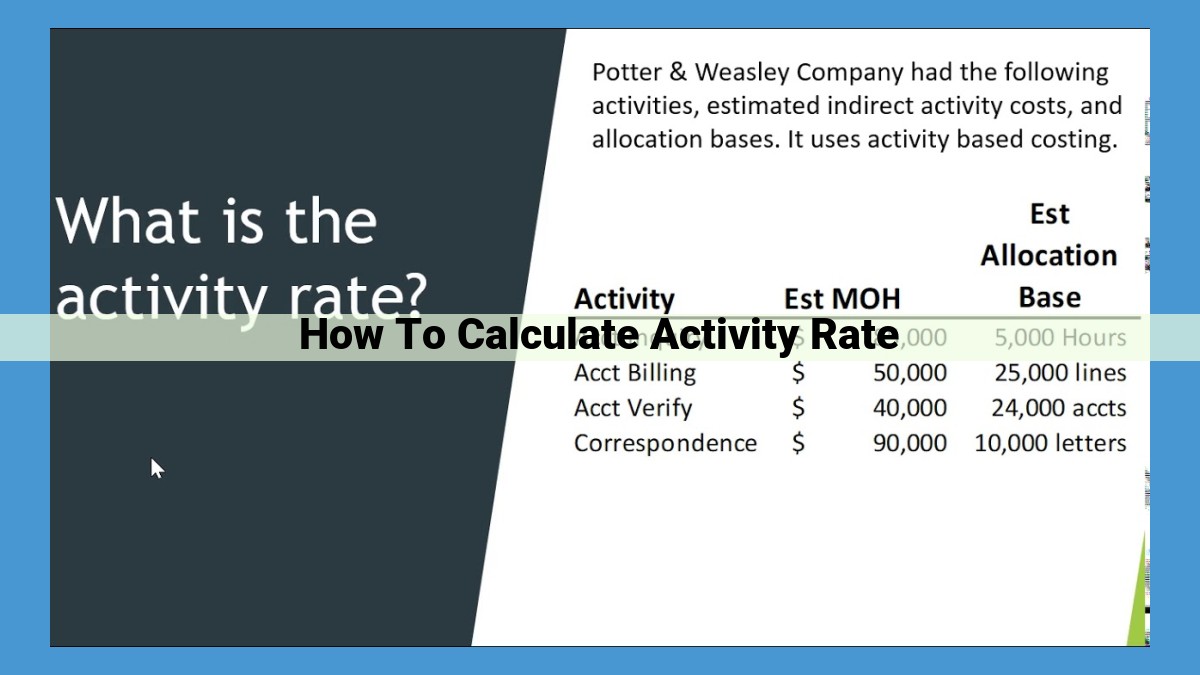

An activity cost pool is a grouping of indirect costs associated with a particular activity (e.g., manufacturing, marketing). A cost object is the product, service, or process that consumes the activity.

2. Identify Activity Driver:

An activity driver is a factor that best measures the level of activity and how costs are consumed by the cost object. It could be units produced, hours worked, or any other relevant metric.

3. Assign Costs to Activity Cost Pool:

Gather all indirect costs related to the activity and assign them to the appropriate cost pool. This may include expenses such as labor, materials, and equipment.

4. Calculate Activity Rate:

The activity rate is calculated by dividing the total costs in the activity cost pool by the total units of the activity driver. This rate represents the average cost per unit of activity.

Applications of Activity Rates

Calculated activity rates hold significant value for businesses:

-

Assigning Indirect Costs Accurately: ABC utilizes activity rates to assign indirect costs to products/services based on their actual consumption of activities, providing a more accurate cost picture.

-

Identifying Cost-Saving Opportunities: By analyzing activity rates, businesses can pinpoint activities that consume excessive costs and explore ways to optimize them, leading to potential cost reductions.

-

Enhancing Decision-Making: Armed with accurate activity rates, managers can make informed decisions regarding product pricing, process improvements, and resource allocation, driving profitability and efficiency.

Applications of Activity Rate

Activity rates, a cornerstone of activity-based costing (ABC), play a pivotal role in the accurate allocation of indirect costs and strategic decision-making. Here’s how activity rates are leveraged in various business applications:

Assigning Indirect Costs to Products/Services

In traditional costing methods, indirect costs are often distributed haphazardly across products or services. However, ABC employs activity rates to precisely assign these costs based on the consumption of activities by each product or service. This granular approach ensures that costs are fairly attributed, revealing the true drivers of profitability.

Identifying Cost-Saving Opportunities

Activity rates offer a keen insight into the relationship between activities and costs. By analyzing these rates, businesses can pinpoint areas with excessive resource consumption and high costs. This knowledge empowers _managers to identify and eliminate non-value-added activities, streamline processes, and optimize resource utilization._ As a result, cost-saving initiatives can be targeted and implemented effectively.

Enhancing Decision-Making

Activity rates provide a robust foundation for informed decision-making. By understanding the costs associated with various activities, businesses can assess the financial implications of strategic choices. For instance, activity rates can be used to evaluate the viability of new products, optimize marketing campaigns, and determine the most cost-effective production methods. In this way, _activity rates serve as invaluable tools for driving business optimization and maximizing shareholder value.