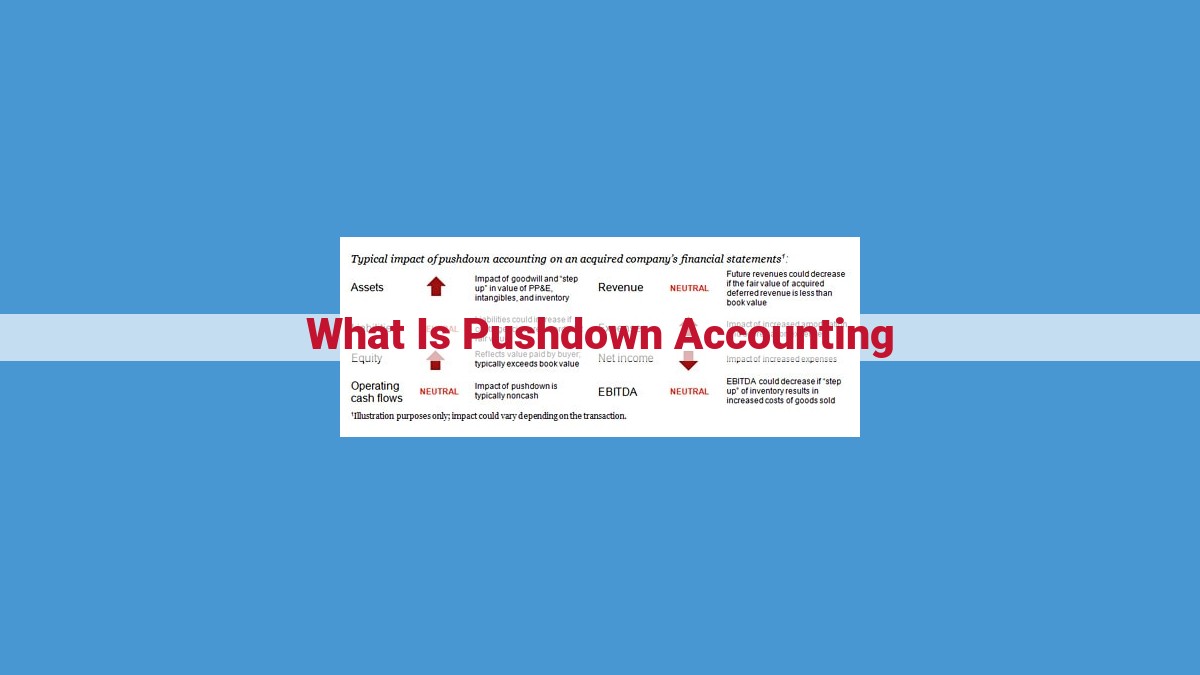

Pushdown accounting is a process that assigns a fair market value to the assets and liabilities of an acquired company by adjusting their book values to reflect their fair values. This method improves the accuracy of financial reporting by ensuring that the acquired assets are recorded at their actual value and that the acquired liabilities are recorded at their present obligation.

Pushdown Accounting: Unleashing the True Value of Acquired Assets

In the realm of mergers and acquisitions, pushdown accounting emerges as an indispensable tool for portraying the fair value of acquired assets. This technique allows companies to recalculate the value of acquired assets on their balance sheet to reflect their current market worth. By doing so, pushdown accounting ensures that the acquiring company’s financial statements accurately represent the true value of its newly acquired assets.

Unveiling the Essence of Pushdown Accounting

Pushdown accounting is an accounting practice employed by the acquirer in a business combination to adjust the carrying amounts of the acquiree’s assets and liabilities to their fair values as of the acquisition date. The pooling-of-interests method of accounting does not require the acquirer to perform pushdown accounting, as the assets and liabilities of the acquiree are recorded at their book values on the date of the combination.

Unveiling the Advantages of Pushdown Accounting

Embracing pushdown accounting offers a plethora of advantages. It significantly enhances the accuracy of the acquired asset and liability representation on the acquiring company’s financial statements. This enables investors, lenders, and other stakeholders to make informed decisions based on a more realistic assessment of the company’s financial position.

Furthermore, pushdown accounting ensures the proper expensing of costs in the periods in which they are incurred. By precisely allocating costs to the appropriate accounting periods, this method prevents the distortions that can arise from deferring or accelerating expenses.

Exploring the Disadvantages of Pushdown Accounting

While pushdown accounting offers numerous benefits, it is not without its drawbacks. Its implementation can be complex and time-consuming, requiring a thorough understanding of accounting principles and the intricacies of the acquired business.

Additionally, pushdown accounting may lead to a deviation from the actual benefits received from the acquired assets. This is because the fair values assigned to the assets may not always align perfectly with their future performance.

Lastly, there is a risk of over- or under-valuing assets and liabilities during pushdown accounting. This can lead to financial misstatements that can impact the reliability of the company’s financial reporting.

Despite its potential disadvantages, pushdown accounting remains a crucial tool for accurately reflecting the value of acquired assets and ensuring the integrity of financial statements. By carefully considering its advantages and disadvantages, companies can effectively utilize pushdown accounting to enhance the transparency and reliability of their financial reporting.

Related Concepts: Depreciation, Amortization, and Depletion

Depreciation is the process of spreading out the cost of a tangible asset over its useful life. Capitalization is the process of recording the cost of an asset on the balance sheet, and useful life is the estimated period over which an asset is expected to be used. When depreciating an asset, the cost of the asset is divided by its useful life to determine the annual depreciation expense. This expense is then recorded on the income statement.

Amortization is similar to depreciation, but it is used for intangible assets. Intangible assets are assets that do not have a physical form, such as patents, trademarks, and goodwill. Goodwill is the excess of the purchase price of a company over the fair value of its identifiable assets. Amortization is recorded on the income statement over the useful life of the intangible asset.

Depletion is the process of allocating the cost of a natural resource over the period in which it is extracted. Natural resources are assets that are found in nature, such as oil, gas, and timber. Extractive industries are industries that extract natural resources from the earth. Depletion is recorded on the income statement over the period in which the natural resource is extracted.

Methods of Depreciation: Exploring the Techniques for Allocating Asset Costs

When it comes to accounting for fixed assets, depreciation plays a crucial role in matching expenses to revenue and fairly representing the value of assets over their useful life. One of the key considerations for businesses is the choice of depreciation method. Let’s delve into the three primary methods used to allocate asset costs: straight-line, accelerated, and units-of-production.

Straight-Line Method: Uniform Expense Over Asset Life

The straight-line method is the most straightforward and widely used depreciation method. It allocates the asset’s cost evenly over its estimated useful life, resulting in a uniform expense each period. This method is often preferred for its simplicity and ease of application.

Accelerated Methods: Allocating More Costs in Early Years

Accelerated depreciation methods, such as the double-declining balance and sum-of-the-years’-digits methods, allocate a higher proportion of costs to the earlier years of an asset’s life. These methods are often used when assets are expected to generate more revenue in their initial years.

The double-declining balance method applies a higher depreciation rate to the asset’s undepreciated balance each period. The sum-of-the-years’-digits method uses a fraction based on the remaining useful life to determine the depreciation expense.

Units-of-Production Method: Expense Based on Output

The units-of-production method allocates depreciation costs based on the number of units produced or extracted. This method is particularly useful for assets that are used in production processes and have a variable lifespan. As more units are produced, a greater portion of the asset’s cost is expensed.

Choosing the Right Depreciation Method

The choice of depreciation method depends on the nature of the asset, expected usage patterns, and business objectives. For example, straight-line depreciation may be suitable for assets with a relatively constant usage rate, while accelerated methods may be more appropriate for assets that are expected to generate higher revenue in early years. The units-of-production method is ideal for assets that have a directly measurable output.

By understanding and applying the appropriate depreciation method, businesses can accurately expense asset costs, fairly represent asset values, and track the financial performance of fixed assets.

Advantages of Pushdown Accounting

Pushdown accounting offers numerous advantages that enhance the accuracy and integrity of financial reporting. Let’s explore these benefits in detail:

Improved Accuracy of Acquired Asset and Liability Representation

When a company acquires another entity, it’s crucial to ensure that the acquired assets and liabilities are reflected at their fair values. Pushdown accounting enables this by adjusting the carrying values of these items to align with their actual worth at the acquisition date. This results in a more accurate representation of the company’s financial position.

Proper Expensing of Costs in the Incurred Periods

Pushdown accounting ensures that costs are consistently and appropriately expensed in the periods in which they are incurred. This adherence to the matching principle prevents distortions in financial statements and provides a clearer understanding of the company’s performance and profitability.

Facilitation of Consolidated Financial Statement Creation

For companies that acquire subsidiaries, pushdown accounting is essential for preparing consolidated financial statements. By adjusting the subsidiary’s accounting records to conform with the parent company’s accounting policies, pushdown accounting enables the accurate combination of financial balances and results. This consolidated view provides a comprehensive overview of the entire group’s financial health.

Disadvantages of Pushdown Accounting

While pushdown accounting offers numerous benefits, it also comes with some drawbacks that businesses should consider before implementation.

1. Complexity and Time Investment

Pushdown accounting is a complex process that can be time-consuming to implement. It involves the meticulous valuation of acquired assets and liabilities, as well as the allocation of costs over their estimated useful lives. This can be particularly challenging for businesses with a large number of acquisitions or those operating in industries with rapidly changing technology.

2. Deviation from Actual Benefits

Pushdown accounting allocates costs based on estimated useful lives and fair values. However, these estimates may not always align with the actual benefits received from the acquired assets. This can lead to overstated or understated expenses, which can impact a company’s financial performance and decision-making.

3. Risk of Over- or Under-Valuation

Pushdown accounting relies on subjective judgments when valuing acquired assets and liabilities. This can result in over- or under-valuation of these items, which can have significant implications for a company’s financial statements and its ability to attract investors.

4. Potential for Distortion of Financial Results

Pushdown accounting can lead to a distortion of financial results in the early years of an acquisition. This is because acquired assets and liabilities are often revalued to a higher or lower value than their historical cost, which can impact profit margins and other financial metrics.