To calculate the present value (PV) of lease payments, determine the discount rate, the lease term, and the breakdown of payments into interest expense and principal repayment. The PV formula considers each future payment discounted back to its current value using the discount rate raised to the power of the number of periods remaining in the lease term. By summing the discounted payments, you obtain the PV of the lease payments, which represents their total cost in today’s dollars, allowing you to compare lease options and make informed financial decisions.

What is Present Value?

- Definition and importance for financial planning

What is Present Value?

In the realm of financial planning, present value is a crucial concept that bridges the gap between future and present monetary values. It’s like having a time machine that allows you to evaluate the worth of future cash flows today. Imagine you have a winning lottery ticket that promises to pay you a million dollars in ten years. Instead of waiting, you can use present value to determine how much that future windfall is worth to you right now.

Why is present value so important? Because money has a habit of losing value over time due to inflation. A dollar today will not buy you as much as it will a decade from now. Present value accounts for this by adjusting the value of future cash flows to their current equivalent. It allows you to make informed financial decisions, whether it’s planning for retirement, investing in real estate, or evaluating business opportunities. By understanding present value, you can ensure that your financial choices today pave the way for a secure and prosperous tomorrow.

Understanding Lease Payments: Breaking Down the Key Terms

When you lease a car, an apartment, or any other asset, it’s crucial to have a clear understanding of the lease payments you’re making. These payments are composed of two distinct components: interest expense and principal payment.

The lease term defines the duration of the lease and the number of payments required. It’s important to determine the lease term that aligns with your financial situation and the expected life of the asset.

Interest expense represents the cost of borrowing money to finance the asset. This portion of the payment goes towards the lender’s profit. Principal payment is the reduction of the loan balance. Over the course of the lease, the principal payments accumulate, eventually covering the total cost of the asset.

Understanding these key terms empowers you to make informed decisions about your lease arrangements. By knowing the composition of your payments, you can assess their impact on your cash flow and overall financial well-being.

The Role of the Discount Rate: Time Value of Money in Lease Calculations

Understanding the concept of present value is crucial for navigating the complexities of lease agreements. Central to this understanding is the discount rate, a fundamental factor that plays a pivotal role in calculating the present value of future lease payments.

What is the Discount Rate?

The discount rate represents the interest rate used to discount future cash flows back to their present value. It reflects the opportunity cost of investing in the lease as opposed to other potential investments. A higher discount rate indicates a greater opportunity cost and thus results in a lower present value for the lease payments. Conversely, a lower discount rate leads to a higher present value.

Impact on Present Value Calculations

The discount rate has a profound impact on the calculation of the present value of lease payments. A higher discount rate results in faster discounting of future payments, making them less valuable in present terms. This, in turn, leads to a lower present value for the lease as a whole. Conversely, a lower discount rate translates into a slower discounting of future payments, resulting in a higher present value.

Importance for Lease Decision-Making

Understanding the role of the discount rate is paramount for making informed lease decisions. By considering the impact of different discount rates, businesses can evaluate the true financial implications of the lease. A higher discount rate may indicate a higher cost of borrowing, which could make the lease less attractive. Conversely, a lower discount rate may lead to a lower effective cost of the lease, making it a more viable option.

Calculating Lease Term: Factors to Consider

Determining the lease term is a crucial aspect of any lease agreement. It represents the duration for which you will have possession of the leased asset. When calculating the lease term, several important considerations come into play:

Business Requirements

The primary driver of the lease term should be your business’s specific needs. Consider the expected lifespan and intended use of the leased asset. For example, if you’re leasing a vehicle for your delivery business, you’ll want to determine the optimal lease period based on your projected mileage and usage patterns.

Asset Depreciation

The lease term should align with the expected depreciation schedule of the leased asset. Depreciation refers to the gradual decline in an asset’s value over time due to use and obsolescence. By matching the lease term to the asset’s depreciation period, you can avoid paying rent on an asset that has already substantially depreciated.

Market Conditions

External market conditions can also influence your decision. In a highly competitive market, you may find shorter lease terms more favorable as they offer greater flexibility to adjust to changing business dynamics. Conversely, in a stable market, longer lease terms may provide cost savings through locked-in rates and reduced renewal expenses.

Renewal Options

Some lease agreements include renewal options, which allow you to extend the lease beyond the initial term. Carefully consider the potential benefits and drawbacks of renewal options. While they provide flexibility, they may also limit your ability to adjust the lease terms or negotiate a lower rate in the future.

Financial Implications

The lease term has significant financial implications. Shorter lease terms typically result in higher monthly payments but lower overall costs. Conversely, longer lease terms lead to lower monthly payments but higher total lease costs over the entire term. It’s essential to weigh these financial implications against your business’s financial situation and long-term goals.

By thoughtfully considering these factors, you can calculate a lease term that meets your business’s needs, aligns with the asset’s lifecycle, and optimizes your financial position. A well-calculated lease term ensures a mutually beneficial arrangement for both you and the lessor.

Interest Expense vs. Principal Payment: Understanding the Heart of Lease Payments

When it comes to leasing, it’s crucial to understand the two key components that make up each payment: interest expense and principal payment. These components play distinct roles in shaping the true cost of your lease and must be carefully considered.

Interest Expense: The Cost of Borrowing

The interest expense represents the cost you pay to the lender for borrowing the money used to finance the lease. This expense is calculated as a percentage of the outstanding principal balance and is typically expressed as an annual percentage rate (APR). The higher the interest rate, the more you’ll pay in interest over the life of your lease.

Principal Payment: Reducing the Debt

In contrast to the interest expense, the principal payment goes towards reducing the amount of money you owe on the loan. With each payment, a portion is applied to the principal balance, resulting in a smaller debt over time. The faster you pay down the principal, the sooner you’ll own the asset outright.

Balancing the Two for Optimal Lease Valuations

Understanding the roles of interest expense and principal payment is essential for determining the true cost of a lease. A higher interest rate means higher interest payments, while a higher principal payment can reduce the amount of interest you pay over time. It’s a delicate balance that must be carefully considered when evaluating lease options.

By grasping the distinction between interest expense and principal payment, you’ll be better equipped to make informed decisions about your lease financing. Remember, these two components are the driving forces behind the lease payment amount and the true cost of your borrowed money.

Calculating the Present Value of Lease Payments: Unlocking Financial Clarity

When it comes to making sound financial decisions, understanding the present value of lease payments is crucial. This concept allows you to compare the total cost of a lease agreement over its entire term to other financing options.

The formula for calculating the present value of lease payments is a powerful tool that helps you do just that. It incorporates the time value of money, which recognizes that a dollar today is worth more than a dollar in the future.

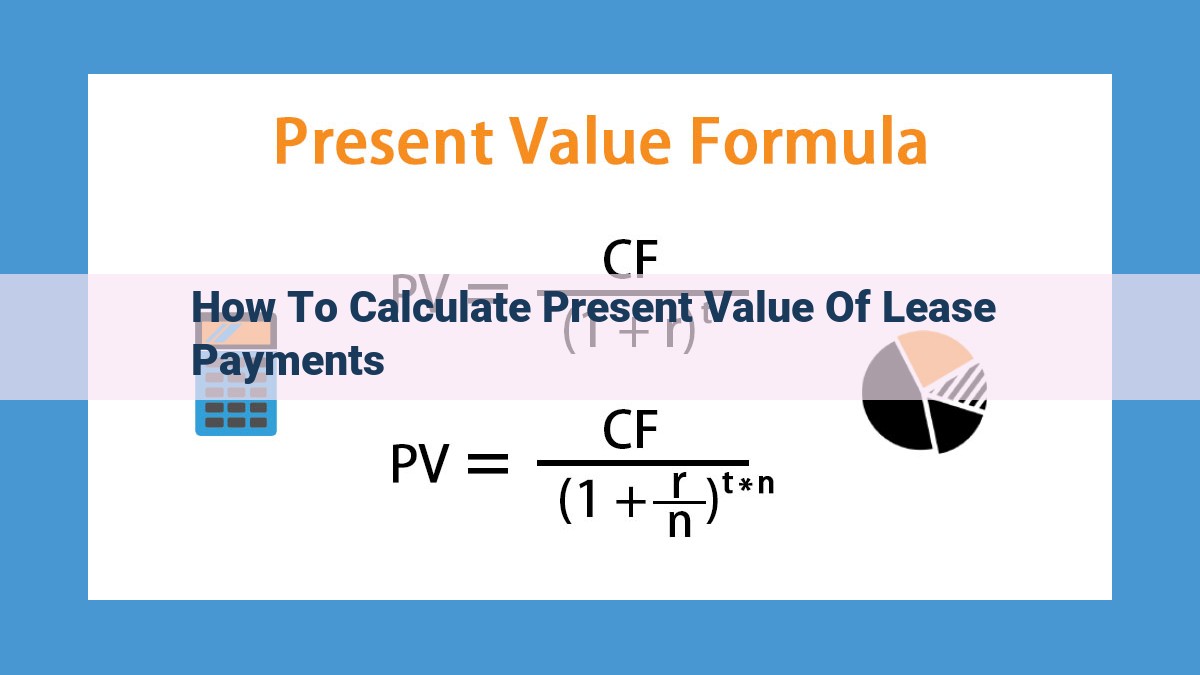

The formula is as follows:

Present Value = Lease Payment * ((1 - (1 + Discount Rate)^-Lease Term) / Discount Rate)

Breaking Down the Formula:

- Lease Payment: The fixed amount you pay each period (e.g., monthly or annually).

- Discount Rate: The rate that reflects the opportunity cost of investing the lease payments instead of making them.

- Lease Term: The total number of periods over which you’ll be making lease payments.

Applying the Formula:

To use the formula, simply plug in the values for these variables. For example, suppose you’re considering a 5-year lease with monthly payments of $1,000 and a discount rate of 5%.

Present Value = $1,000 * ((1 - (1 + 0.05)^-60) / 0.05)

Present Value = $1,000 * (43.294)

Present Value = $43,294

This means that the present value of the lease payments over the 5-year term is $43,294. This figure represents the total cost of the lease agreement, which you can then compare to other financing options to make an informed decision.

Remember:

- A higher discount rate will result in a lower present value.

- A longer lease term will result in a higher present value.

By understanding the formula for the present value of lease payments, you can confidently evaluate lease agreements and make the best financial decisions for your business or personal finances.

Understanding Lease Payments: A Comprehensive Guide

Leasing is an increasingly popular option for individuals and businesses seeking flexibility and affordability in acquiring assets. However, grasping the financial implications of lease payments is crucial for sound financial decision-making. This guide will delve into the key concepts and formula involved in calculating the present value of lease payments, empowering readers to navigate lease agreements with confidence.

What is Present Value?

Present value refers to the current monetary value of a future sum of money. It incorporates the time value of money, acknowledging that a dollar today is worth more than a dollar in the future due to the potential for earning interest. Understanding present value is essential for evaluating long-term financial commitments, such as lease payments.

Understanding Lease Payments

Lease payments typically consist of two components: interest expense and principal payment. Interest expense represents the cost of borrowing the leased asset, while the principal payment reduces the outstanding balance owed. These components vary over the life of the lease, with interest expense decreasing and principal payment increasing as the balance diminishes.

The Role of the Discount Rate

The discount rate plays a pivotal role in calculating the present value of lease payments. It represents the rate of return that could be earned on an alternative investment with similar risk. A higher discount rate results in a lower present value, as future payments are discounted more heavily. Conversely, a lower discount rate yields a higher present value.

Calculating Lease Term

Determining the lease term is crucial for accurately assessing present value. The lease term should align with the expected useful life of the leased asset, considering factors such as depreciation schedules and market trends. A longer lease term typically results in lower monthly payments but higher overall costs due to extended interest charges.

Interest Expense vs. Principal Payment

Distinguishing between interest expense and principal payment is essential for understanding the financial impact of lease payments. Interest expense is tax-deductible, while principal payments are not. As the lease progresses, the proportion of interest expense in each payment decreases, while the principal payment increases.

Formula for Present Value of Lease Payments

The formula for calculating the present value of lease payments is as follows:

PV = PMT * [1 - (1 + r)^-n] / r

Where:

- PV is the present value

- PMT is the lease payment amount

- r is the discount rate

- n is the number of lease payments

Practical Example

Consider a five-year lease agreement with monthly payments of $500 and a discount rate of 5%. Using the formula above, the present value of the lease payments can be calculated as:

PV = $500 * [1 - (1 + 0.05)^-60] / 0.05

PV = $24,314.67

This means that the present value of the lease payments is $24,314.67, which represents the current monetary value of the entire lease obligation.

Calculating the present value of lease payments provides valuable insights into the true cost of leasing. By understanding the concepts outlined in this guide, individuals and businesses can make informed decisions when evaluating lease agreements, ensuring financial stability and maximizing the value of their leasing arrangements.