Reagan’s first budget significantly increased the national debt, primarily due to the substantial spending cuts he implemented. By reducing government expenditures, revenue streams were diminished, leading to a higher fiscal deficit. The administration’s focus on reducing government intervention in the economy through deregulation and privatization further contributed to the debt, as these measures had a negative impact on tax revenue and increased the need for government borrowing.

Reagan’s Budget Cuts: Reshaping Government Spending

- Explain the significant budget cuts and austerity measures implemented.

- Discuss the specific areas of government expenditures that were reduced.

Reagan’s Budget Cuts: Reshaping Government Spending

In the early 1980s, President Ronald Reagan embarked on an ambitious mission to reshape the role of government in the American economy. Central to his vision was a bold plan to slash government spending and realign the nation’s fiscal priorities.

Reagan’s budget cuts, implemented in 1981, were sweeping in their scope. The government reduced discretionary spending by 10%, a significant reduction in the funding for programs not mandated by law, such as social welfare initiatives and infrastructure projects. Additionally, Reagan enacted a freeze on federal hiring, reducing the size of the government bureaucracy.

The specific areas of government expenditures targeted by Reagan’s cuts included:

- Domestic programs: Social welfare programs such as food stamps and Medicaid faced significant reductions, with the goal of limiting government assistance and encouraging self-reliance.

- Education: Funding for education programs was also curtailed, as Reagan believed that state and local governments should assume a greater role in education funding.

- Environmental protection: Regulatory agencies such as the Environmental Protection Agency saw their budgets reduced, reflecting Reagan’s view that businesses should be granted more flexibility to operate.

Reagan’s budget cuts sparked controversy and debate. Supporters argued that the cuts were necessary to reduce government spending and rein in a growing national debt. Critics, however, maintained that the cuts disproportionately affected the neediest in society and undermined essential government services.

Tax Hikes and Reforms: Boosting Government Revenue

In response to mounting budget deficits, the Reagan administration implemented a series of tax increases and reforms aimed at boosting government revenue. These measures played a significant role in shaping the economic landscape of the 1980s.

Tax Increases

- Personal income tax: The highest marginal tax rate was raised from 70% to 50%. This aimed to incentivize savings and investment while reducing tax avoidance.

- Corporate income tax: The corporate tax rate was increased from 46% to 50%. This aimed to generate revenue from businesses that had benefited from tax loopholes.

- Excise taxes: Taxes on specific goods, such as cigarettes and alcohol, were implemented or increased. These taxes were seen as a way to fund social programs without overburdening taxpayers.

Tax Reforms

- Tax loophole closures: A number of tax loopholes were closed, including those allowing for tax deductions on state and local taxes and charitable contributions. This aimed to make the tax system more equitable and reduce tax avoidance.

- Simplification of tax system: The Tax Reform Act of 1986 simplified the tax code, reducing the number of tax brackets and introducing a standard deduction. This made it easier for taxpayers to file their returns and understand their tax obligations.

Impact on Government Revenue

The tax increases and reforms implemented by the Reagan administration had a significant impact on government revenue. By closing tax loopholes, increasing tax rates, and taxing specific goods, the government was able to generate substantial additional funds. This revenue was used to finance government spending, reduce the budget deficit, and fund social programs.

The tax reforms also had a lasting impact on the tax system. The simplification of the tax code made it easier for taxpayers to comply with their tax obligations. The closure of tax loopholes made the tax system more equitable and reduced opportunities for tax avoidance. These changes laid the foundation for the modern tax system that is in place today.

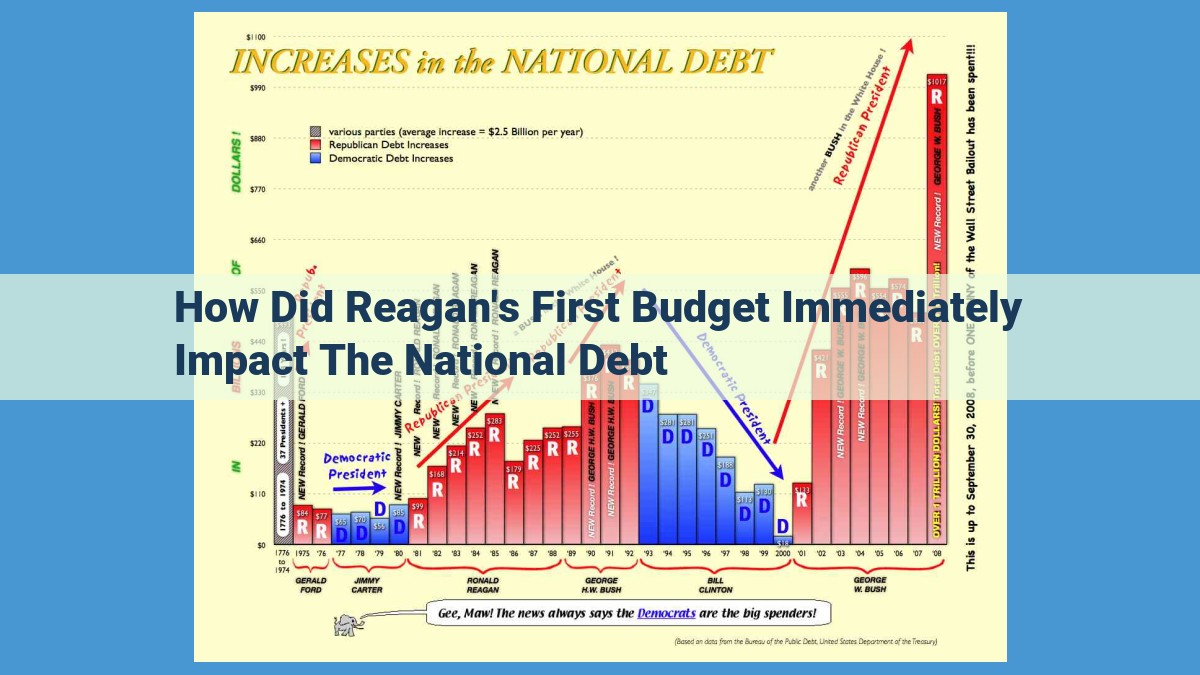

The Rising National Debt: Financing Budget Imbalances

The Reagan administration’s ambitious agenda of budget cuts, tax hikes, and military spending led to a significant increase in the national debt. The government’s fiscal deficit—the gap between spending and revenue—ballooned during this period, necessitating increased borrowing.

Financing the budget deficit required the government to issue bonds, which are essentially loans from investors. These bonds carry interest payments, further increasing the national debt. The Reagan administration’s policies exacerbated this trend, contributing to a debt spiral as the government borrowed more to cover interest payments on existing debt.

The public debt grew rapidly under Reagan, reaching $2.8 trillion by the end of his presidency. This increase placed a fiscal burden on future generations, as the government would need to raise taxes or cut spending in the future to repay the debt.

The need to finance budget imbalances also limited the government’s ability to invest in other areas. With a large portion of the budget earmarked for debt repayment, there were fewer resources available for social programs, infrastructure, and other public services.

The Reagan administration’s fiscal policies, while aimed at stimulating economic growth, had the unintended consequence of increasing the national debt and constraining future government spending.

Constrained Social Programs: Welfare Cuts and Entitlement Reform

In the era of Ronald Reagan’s presidency, the nation embarked on a transformative fiscal journey. Welfare cuts and entitlement reforms emerged as pivotal measures aimed at reducing government spending and promoting self-sufficiency.

Welfare Cuts:

Reagan’s administration implemented drastic cuts to Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). These programs, designed to provide income support to the disabled, elderly, and low-income Americans, underwent significant reductions. Eligibility criteria were tightened, and benefits were lowered.

Entitlement Reform:

Medicare and Medicaid, two critical entitlement programs providing healthcare coverage to the elderly and low-income populations, faced substantial reforms. Reagan worked to introduce co-insurance and deductibles, increasing the financial burden on beneficiaries. Furthermore, changes were made to limit the growth of these programs’ expenditures.

Limitations on Social Welfare Spending:

These cuts and reforms aimed to address the rising national debt and promote fiscal responsibility. By constraining government spending, Reagan’s policies intended to shift the responsibility of providing social support to non-profit organizations, charities, and families.

However, the impact on vulnerable populations was severe. Low-income Americans, the disabled, and the elderly faced increased economic hardships as their safety nets were diminished. Critics argued that these reforms exacerbated poverty and widened the income gap.

Reagan’s welfare cuts and entitlement reforms remain a contentious topic today. While some argue that they promoted fiscal discipline and economic growth, others contend that they compromised the social safety net and left vulnerable populations in a precarious position.

Economic Growth: Stimulating Business Activities

In an effort to revitalize the sluggish economy, the Reagan administration implemented a series of fiscal stimulus measures and macroeconomic policies. These initiatives aimed to accelerate business activities, increase investment, and generate jobs.

One key component of the economic growth strategy was a significant reduction in federal taxes. By lowering the tax burden on businesses and individuals, the government aimed to stimulate economic activity and encourage investment. This led to a surge in entrepreneurship and private enterprise, resulting in a proliferation of new businesses and job creation.

Additionally, the Reagan administration pursued deregulation policies designed to minimize government interference in the economy. By reducing antitrust laws and market regulations, the government encouraged competition and allowed businesses to operate more freely. This spurred innovation and increased efficiency, resulting in lower prices for consumers and higher productivity for businesses.

To further stimulate economic growth, the government implemented targeted fiscal stimulus measures. These included increased spending on infrastructure projects, such as road construction and public works. By investing in these projects, the government aimed to create jobs and boost overall economic activity.

The combined effect of these pro-growth policies was a surge in economic activity. Businesses responded to the reduced tax burden and deregulation by investing more, expanding operations, and hiring additional workers. This job creation led to increased consumer spending, further fueling economic growth.

As a result of these economic growth policies, the revenue generated by businesses increased, resulting in higher tax revenues for the government. Additionally, the growth in the economy led to lower unemployment rates and higher wages for workers.

Overall, the Reagan administration’s economic growth strategy, centered around fiscal stimulus measures, deregulation, and tax cuts, proved successful in stimulating business activities and boosting economic activity. These policies contributed to job creation, increased investment, and higher consumer spending, ultimately leading to a sustained period of economic growth.

Enhanced Military Spending: Strengthening America’s Defense

The Reagan era marked a significant shift in the government’s fiscal priorities, with a substantial increase in military spending. This strategic move was driven by a deep-seated belief in the importance of national security and the need to counter perceived threats from the Soviet Union and other adversaries.

The Reagan administration recognized that robust defense capabilities were essential for safeguarding American interests at home and abroad. By committing to a sizable increase in the defense budget, the government aimed to modernize and expand its armed forces, ensuring their readiness to respond to potential conflicts.

The funds allocated for weapons procurement played a crucial role in this military buildup. The government invested heavily in cutting-edge technologies, from advanced aircraft and missiles to sophisticated surveillance systems. These acquisitions were intended to bolster the nation’s defense posture and deter potential aggressors.

Prioritizing defense also extended to the expansion of military personnel. The size of the armed forces was increased to provide the necessary manpower for a more assertive foreign policy. This investment in human capital signaled a commitment to maintaining a well-trained and highly capable military force.

The rationale behind this military buildup was threefold. First, the Reagan administration saw the Soviet Union as a formidable threat to American security, and it sought to build a military that could match or surpass Soviet capabilities. Second, the administration believed that increased military spending would stimulate economic growth by creating jobs and supporting defense industries. Third, the administration argued that a strong military would help to promote American interests and values around the world.

Deregulating Industries: Unleashing Market Forces

In the tapestry of government policies, deregulation stands as a pivotal thread, woven with the intent of promoting market competition and stimulating economic growth. During the Reagan era, deregulation emerged as a potent force, transforming industries and reshaping the landscape of business.

Unveiling Antitrust Laws and Market Competition Measures

The Reagan administration sought to liberate industries from the constraints of government oversight, paving the way for market forces to flourish. Antitrust laws, designed to prevent monopolies and promote fair competition, were strengthened. This legal framework established a more level playing field, where businesses could compete on merit rather than regulatory advantage.

Empowering the Private Sector: Reducing Government’s Grip

Deregulation not only removed barriers to entry but also eased the burden of government regulations on existing businesses. By streamlining regulations, the government reduced compliance costs and accelerated decision-making, enabling companies to respond swiftly to market demands.

Industry Impacts: A Tale of Transformation

The impact of deregulation varied across industries. The airline industry experienced a surge in competition, as new entrants challenged established carriers. Deregulation allowed airlines to set their own fares and routes, increasing consumer choice and lowering airfares.

In the telecommunications sector, the monopoly of AT&T was shattered, opening the door for new players in the industry. Competition fostered innovation and spurred investment, ultimately benefiting consumers with a wider range of services and lower costs.

Balancing Regulation and Competition

While deregulation aimed to boost competition, it also posed challenges. To ensure that market forces did not lead to unfair practices or market failures, the government maintained a balance between deregulation and regulation. Regulatory agencies continued to monitor industries, ensuring that competition remained fair and markets operated efficiently.

The deregulation measures of the Reagan era left an enduring imprint on the American economy. By promoting market competition and reducing government interference, deregulation spurred innovation, lowered consumer costs, and widened consumer choice. It remains a testament to the power of unleashing the forces of competition to drive economic growth and prosperity.

Privatizing Government Assets: Transferring Ownership

The Reagan Revolution and Privatization

Privatization was a significant aspect of Ronald Reagan’s economic policies, aimed at reducing government spending and stimulating economic growth. The Reagan administration implemented a comprehensive privatization program that involved public-private partnerships and the sale of government-owned assets to private entities.

Public-Private Partnerships (PPPs)

PPPs are collaborative arrangements between the government and private companies to jointly finance and operate public infrastructure projects. Under Reagan, PPPs were encouraged in various sectors, including transportation, energy, and healthcare. By leveraging private sector capital and expertise, PPPs allowed the government to reduce its financial burden while maintaining or improving the quality of public services.

Divestment of Government Assets

The Reagan administration also privatized a substantial number of government-owned assets, including businesses, utilities, and real estate. The sale of these assets generated significant revenue for the government and reduced its direct involvement in the economy. Privatization was particularly prevalent in industries where private sector competition was seen as beneficial, such as airlines, telecommunications, and postal services.

Benefits of Privatization

Privatization proponents argued that it had several benefits:

- Reduced government spending: By transferring ownership of assets and services to the private sector, the government could free up funds for other priorities.

- Increased efficiency: Private companies often operate with greater efficiency and innovation than government agencies, leading to lower costs and improved services.

- Stimulated economic growth: Privatization opened up new investment opportunities for the private sector, creating jobs and boosting economic activity.

Concerns about Privatization

However, privatization also raised some concerns:

- Loss of public control: Once assets are privatized, they are no longer subject to public oversight and accountability.

- Increased inequality: Privatization can lead to wealth disparities as private entities profit from the sale of public assets.

- Potential for monopolies: In some cases, privatization can result in the creation of monopolies, where a single private company controls a significant portion of a market.

Overall Impact

Privatization under the Reagan administration had a significant impact on the size and role of government in the economy. It reduced government spending, stimulated economic growth, and increased the involvement of the private sector in public services delivery. However, it also raised concerns about the loss of public control and potential negative social consequences. The debate over the benefits and drawbacks of privatization continues to this day.