An accumulated deficit is the cumulative debt owed by a government, resulting from persistent budget deficits where spending exceeds revenue. It arises from annual shortfalls and represents the total amount of funds borrowed to cover the difference. Accumulated deficits have significant implications, including higher interest payments, reduced public spending, and potential negative impacts on currency value and credit ratings. Managing accumulated deficits involves fiscal policies aimed at reducing the deficit and ultimately balancing the budget or achieving a surplus to ensure long-term fiscal sustainability.

Understanding the Accumulated Deficit: A Tale of Government Spending and Debt

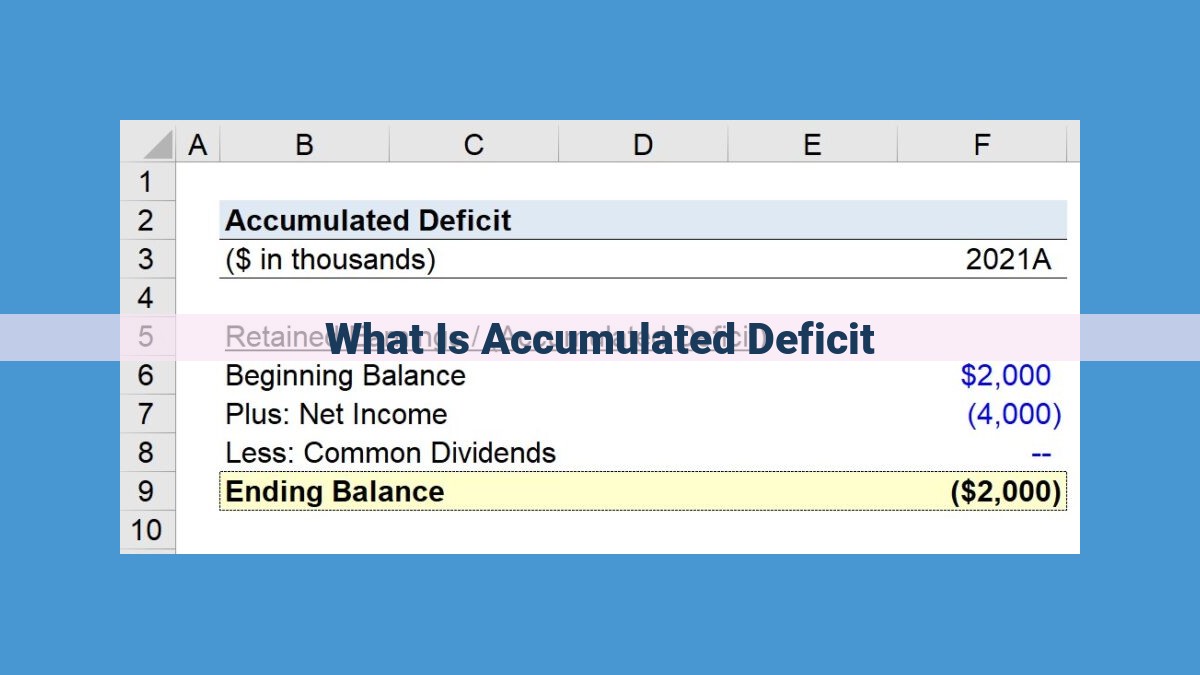

In the realm of government finance, the term accumulated deficit looms like a financial shadow, representing the cumulative weight of past budget deficits. Simply put, it’s the total debt that a government owes.

The seeds of an accumulated deficit are sown when a government’s spending outstrips its revenue. This shortfall, known as a budget deficit, occurs when the government spends more than it takes in. Think of it as your household budget, where spending beyond your paycheck leads to mounting debt.

Over time, these annual budget deficits pile up, creating a staggering mountain of debt known as the accumulated deficit. It’s a sobering reminder of the government’s past financial indiscretions.

Understanding the Complexities of Accumulated Deficit

When governments spend more than they earn, they incur a budget deficit. Over time, these shortfalls accumulate to create an accumulated deficit, or what we commonly refer to as the national debt. This debt is the total obligation that a government owes.

Understanding Related Concepts:

Essential to comprehending accumulated deficits are several key concepts:

-

Budget Deficit: The yearly difference between government spending and government revenue. Spending is the allocation of funds for goods, services, and programs, while revenue encompasses income from sources such as taxes, fees, and fines.

-

Fiscal Year: The designated time span for budgeting.

-

Public Debt: Money borrowed by governments to finance their operations. This debt must be repaid with interest.

Accumulation and Impact of Deficits:

Accumulated deficits are born from the repetitive borrowing to cover budget deficits. As these deficits persist, the debt burden increases. High levels of debt can have dire consequences:

- Interest payments soar, consuming an increasing share of government revenue.

- Funds are diverted from essential services and programs to service the debt.

- Currency value and credit rating can be adversely affected.

Addressing Accumulated Deficits:

Managing accumulated deficits effectively is crucial. Governments employ various fiscal policies, such as:

- Spending cuts: Reducing government expenses to lower the deficit.

- Tax increases: Boosting revenue to offset spending.

- Budget balancing: Aiming for revenue and spending to be equal in a fiscal year.

- Budget surplus: Generating more revenue than is spent, allowing for debt reduction and investment.

By understanding these concepts and their implications, we can engage in informed discussions about the complex issue of accumulated deficits and the policies that shape our financial future.

Accumulation and Consequences of Accumulated Deficit

How Budget Deficits Accumulate Over Time

An accumulated deficit, or national debt, is the cumulative result of persistent budget deficits. When a government spends more than it collects in revenue during a fiscal year, it runs a budget deficit. Over time, these annual deficits add up, creating a significant debt burden for the country.

Impact of Unsustainable Debt Levels

High debt levels can have severe consequences for a nation’s economy. Interest payments on the accrued debt can become a significant drain on the government’s financial resources, diverting funds away from critical programs and investments. Moreover, excessive debt can lead to unsustainable fiscal policy, as the government struggles to balance its budget and meet its financial obligations.

Effects on Currency Value and Credit Rating

Accumulated deficits can also impact a country’s currency value. A weak fiscal position can undermine confidence in the nation’s financial stability, causing investors to sell off its currency. This can lead to a depreciation in its value, making it more expensive to import goods and services. Furthermore, credit rating agencies may downgrade the country’s sovereign debt rating, which can affect its ability to borrow at favorable interest rates.

Managing Accumulated Deficits

Grappling with Mounting Debts:

Accumulated deficits, the colossal debts amassed by governments over time, pose a formidable challenge that requires deft management. Governments strive to mitigate these deficits, which have dire consequences if left unchecked. The goal is to reduce the burden imposed by unsustainable debt levels, ensuring the nation’s financial stability.

Fiscal Remedies: A Balancing Act

To tame accumulated deficits, governments employ various fiscal policies. These policies aim to shrink the gap between government spending and revenue, thereby reducing the deficit. One strategy involves spending cuts, reducing government expenditures by prioritizing essential programs and eliminating unnecessary costs. Alternatively, governments may opt for tax increases, generating more revenue to offset expenses. In many cases, a combination of spending cuts and tax increases is deemed most effective.

Balancing the Budget: A Coveted Goal

Striving for budget balance or, ideally, achieving a surplus is paramount in managing accumulated deficits. Governments aim to balance their budgets by ensuring that spending does not exceed revenue, thus preventing further debt accumulation. A budget surplus, where revenue surpasses spending, can significantly reduce the accumulated deficit over time. Achieving these goals fosters economic stability, enhances investor confidence, and safeguards the nation’s financial future.