Operating gearing measures the sensitivity of a company’s operating profit to changes in sales volume. It is calculated as the ratio of fixed costs to variable costs. A higher degree of operating gearing indicates that the company has a higher proportion of fixed costs and is therefore more sensitive to sales fluctuations. This can impact profitability as fixed costs remain the same even when sales decline, leading to a disproportionate decrease in profits. Conversely, a lower degree of operating gearing indicates a more flexible cost structure and less susceptibility to sales fluctuations.

Understanding Operating Gearing

- Definition of operating gearing and its significance in financial analysis

Understanding Operating Gearing: A Key Metric for Profitability Analysis

In the realm of business, understanding the factors that influence a company’s profitability is essential for making informed decisions. Operating gearing is a crucial concept that provides valuable insights into a company’s sensitivity to changes in sales volume and its ability to generate profits.

Defining Operating Gearing

Operating gearing refers to the extent to which a company’s fixed costs (costs that remain constant regardless of sales volume) impact its profitability. A company with high operating gearing has a higher proportion of fixed costs relative to variable costs (costs that vary directly with sales volume). This means that even a small change in sales volume can have a disproportionate impact on profitability.

Significance in Financial Analysis

Operating gearing is a key metric in financial analysis because it helps investors and analysts assess a company’s risk profile. Companies with high operating gearing are inherently more risky because their profits are more volatile in response to changes in sales. This volatility can make it difficult for companies to maintain a stable financial performance, especially during economic downturns.

Operating gearing is a fundamental concept that provides valuable insights into a company’s financial stability and profitability. By understanding the degree of operating gearing, investors and analysts can make more informed decisions about the risks and rewards associated with investing in a particular company.

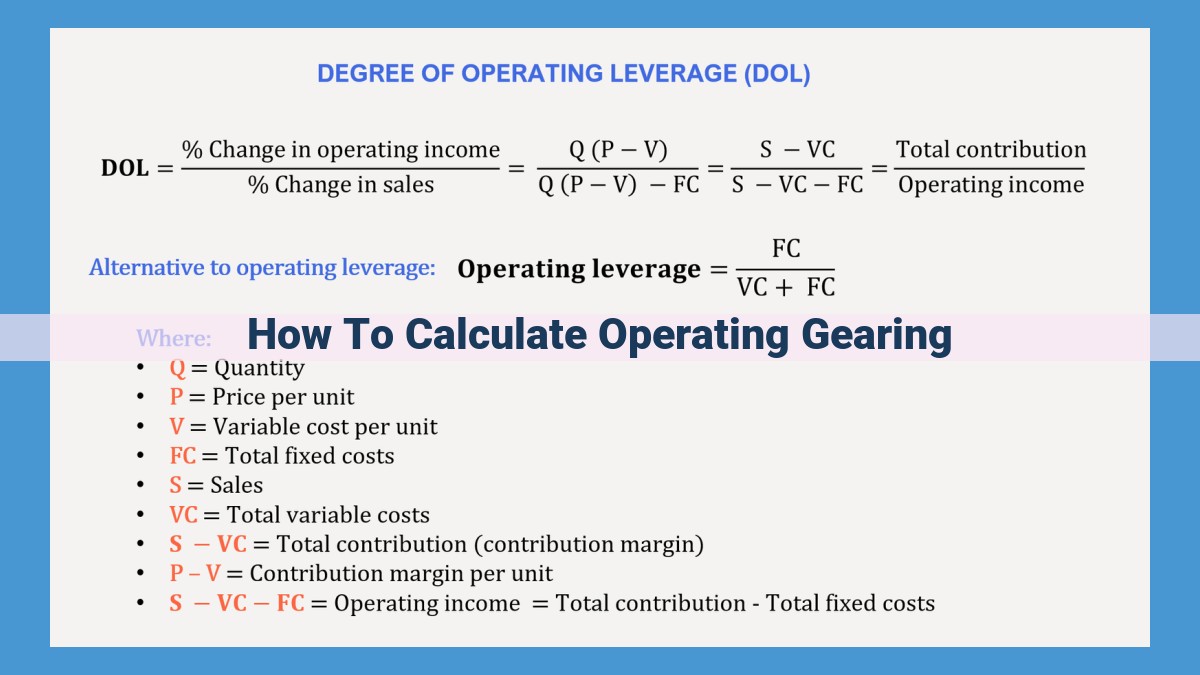

Measuring the Degree of Operating Gearing

Understanding a company’s operating gearing is crucial for evaluating its financial resilience and profitability potential. Operating gearing measures the proportionality between changes in sales revenue and changes in operating profit.

To calculate the degree of operating gearing, we can use the following formula:

Degree of Operating Gearing = **Contribution Margin / (1 – Contribution Margin)

The contribution margin is the difference between sales revenue and variable costs, expressed as a percentage of sales revenue. It represents the portion of each sales dollar that contributes to covering fixed costs and generating profit.

The (1 – Contribution Margin) term reflects the proportion of sales revenue that is absorbed by fixed costs. A higher contribution margin indicates a lower degree of operating gearing, while a lower contribution margin indicates a higher degree of operating gearing.

Interpreting the results of the operating gearing calculation provides valuable insights into a company’s fixed cost structure. A high degree of operating gearing suggests that the company has a significant proportion of fixed costs, making it more vulnerable to fluctuations in sales volume. Conversely, a low degree of operating gearing indicates a more flexible cost structure, enabling the company to absorb sales declines more easily.

Contribution Margin and Its Crucial Role in Profitability

Imagine yourself as the owner of a thriving business. You pour your heart and soul into your products or services, hoping to generate substantial profits. However, there’s one crucial factor that can make or break your profitability: your contribution margin.

Defining Contribution Margin

Contribution margin is the difference between the sales revenue generated by a product or service and the variable costs associated with producing it. Variable costs are those that change with the level of production, such as raw materials, direct labor, and commissions. By subtracting these variable costs from revenue, we get the contribution margin.

The formula for calculating contribution margin is:

Contribution Margin = Sales Revenue - Variable Costs

Significance of Contribution Margin

Why is contribution margin so important? Because it represents the amount of revenue that a company has left over to cover its fixed costs and generate profit. Fixed costs, unlike variable costs, remain constant regardless of production levels. Examples of fixed costs include rent, salaries, and insurance.

To generate a profit, a company must have enough contribution margin to cover its fixed costs. The higher the contribution margin, the more profit the company can potentially earn.

Contribution Margin in Action

Consider a hypothetical company called “Widget Wonders” that produces and sells widgets. The company’s sales revenue for the month is $100,000. The variable costs associated with producing the widgets are $50,000. Using the formula above, we calculate Widget Wonders’ contribution margin as:

Contribution Margin = $100,000 - $50,000 = $50,000

This means that for every dollar of sales revenue, Widget Wonders has $0.50 left over to cover its fixed costs and generate profit. The higher the contribution margin, the more flexible the company is in absorbing fixed costs and generating a profit.

Understanding contribution margin is essential for any business owner who wants to maximize profitability. By calculating and analyzing contribution margin, you can determine how much revenue you need to generate to cover your costs and achieve your business goals.

Fixed Costs: The Burden on Profitability

In the realm of business operations, costs play a pivotal role in determining an organization’s financial health. Among these costs, fixed costs stand out as a peculiar burden, especially during periods of declining sales. Fixed costs, unlike their variable counterparts, remain constant irrespective of sales volume, posing a significant challenge to profitability.

Understanding the nature and impact of fixed costs is crucial for any business owner or manager. These costs, typically rent, insurance, and depreciation, represent a substantial portion of a company’s operating expenses. They do not fluctuate with changes in sales, making it difficult to adjust expenses to match revenue. This inflexibility can have a stifling effect on profitability, particularly when sales are down.

The impact of fixed costs becomes especially evident during periods of economic downturn or seasonal slowdowns. When sales revenue declines, companies are unable to reduce fixed costs at the same rate, resulting in a disproportionate increase in the percentage of fixed costs as a proportion of total costs. This situation can quickly erode profitability, leading to financial distress.

Recognizing the burden that fixed costs can impose, businesses should strive to optimize their fixed cost structure. This can involve negotiating lower rents or insurance premiums, seeking alternative suppliers for fixed expenses, or exploring cost-sharing arrangements with other businesses. By reducing fixed costs, companies can enhance their flexibility and resilience, better positioning themselves to weather economic storms and maintain profitability.

Variable Costs: Flexible with Sales Volume

When it comes to business finances, understanding the nature of costs is crucial for strategic planning and profitability analysis. Variable costs are a critical component of this landscape, as they offer flexibility and a reduced burden on profitability compared to their fixed counterparts.

Defining Variable Costs

Variable costs are expenses that fluctuate directly with changes in sales volume. In other words, as your sales increase, so too do your variable costs. Examples of variable costs include:

- Raw materials: The cost of materials used to produce goods

- Commissions: Paid to salespeople based on sales volume

- Shipping costs: The price to transport goods to customers

- Labor costs: Wages and salaries paid to staff involved in production

Impact on Profitability

Unlike fixed costs that remain constant regardless of sales volume, variable costs adjust with sales levels. This flexibility provides a cushion during periods of sales decline. When sales drop, variable costs decrease proportionately, helping to minimize the impact on profitability.

For instance, if your monthly sales decrease by 10%, your variable costs, such as raw materials or shipping, would also decrease by approximately 10%. This adjustment reduces the direct impact of the sales decline on your bottom line. As such, variable costs are considered less burdensome on profitability than fixed costs, which remain fixed even as sales fluctuate.

Understanding the role of variable costs is essential for businesses of all sizes. By managing variable costs effectively, organizations can optimize profitability and weather periods of sales volatility. Embracing the flexibility of variable costs allows businesses to adapt quickly to changing market conditions, ensuring long-term financial stability.