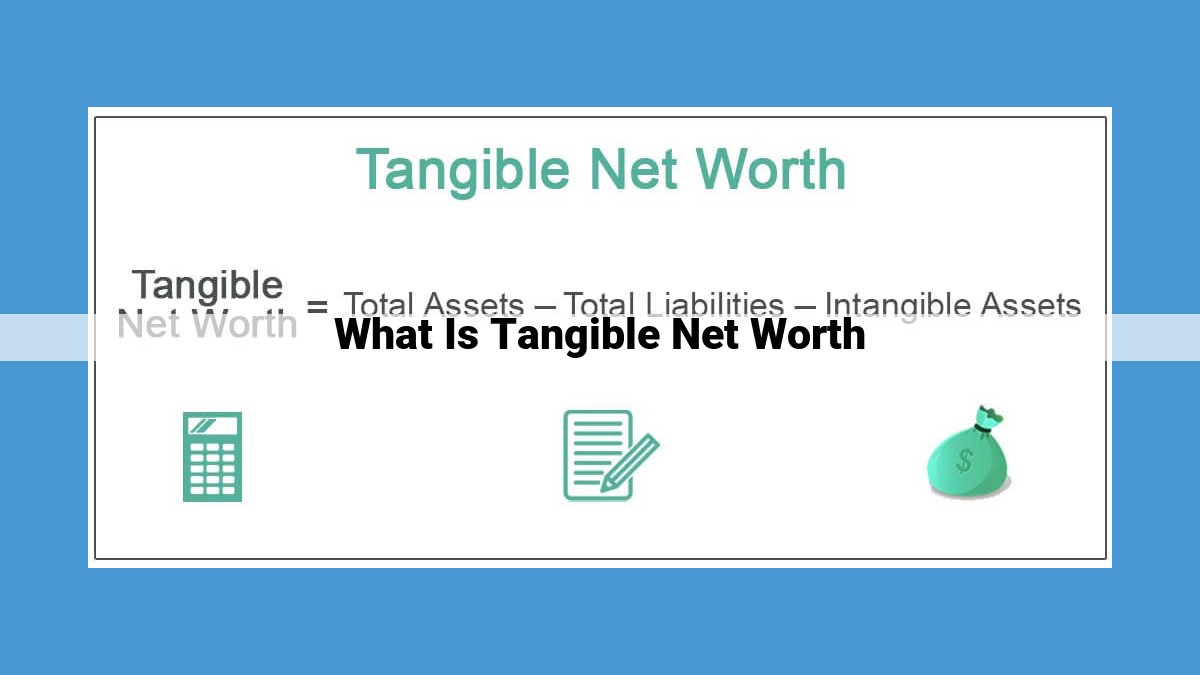

Tangible net worth refers to the value of physical assets (e.g., real estate, cash, investments) that can be easily liquidated or sold. It is calculated by subtracting liabilities (e.g., debts) from the total value of tangible assets. Tangible net worth is often considered a more conservative measure of financial stability as it focuses on assets that are less prone to fluctuations in value. It can be used for financial planning, assessing creditworthiness, and making investment decisions. However, it’s important to note that intangible assets, such as brand recognition or intellectual property, can also hold significant value and should be considered for a comprehensive financial analysis.

Understanding Assets and Liabilities

In the realm of personal finance, understanding the distinction between assets and liabilities is crucial for navigating the path to financial well-being. Assets represent anything you own that has economic value, while liabilities are debts you owe.

Tangible assets are physical possessions that can be touched and seen, such as a house, car, or jewelry. Intangible assets, on the other hand, are not physical but hold value, such as stocks, bonds, or a business. Both types of assets contribute to your net worth, which is the difference between your assets and liabilities.

Liabilities, in contrast, are obligations that reduce your net worth. Common examples include mortgages, credit card debt, and unpaid bills. Understanding the difference between these financial elements is the cornerstone of effective financial management.

Calculating Net Worth: Understanding Your Financial Health

In the realm of personal finance, understanding your net worth is crucial for assessing your financial well-being. Net worth, simply put, is the difference between what you own (assets) and what you owe (liabilities).

Formula for Calculating Net Worth

To calculate your net worth, you’ll need to gather a list of all your assets and liabilities. Assets are anything you own that has value, such as cash, investments, and real estate. Liabilities, on the other hand, are debts you owe, including mortgages, credit card balances, and student loans.

The formula for calculating net worth is:

**Net Worth = Total Assets - Total Liabilities**

Significance of Net Worth

Knowing your net worth provides a snapshot of your financial position. It can tell you if you’re on track to achieving your financial goals, whether you’re building wealth, or if you need to adjust your spending habits. Additionally, net worth can be used to determine your eligibility for certain loans, credit cards, and other financial products.

Example of Calculating Net Worth

Let’s say you have the following assets and liabilities:

- Assets:

- Cash: $5,000

- Investments: $20,000

- Real estate: $150,000

- Liabilities:

- Mortgage: $75,000

- Credit card debt: $5,000

Using the formula, your net worth would be:

**Net Worth = $5,000 + $20,000 + $150,000 - $75,000 - $5,000 = $100,000**

In this example, you have a net worth of $100,000, indicating that you have more assets than liabilities. This is a positive sign of financial health.

The Significance of Tangible Net Worth: A Foundation for Financial Stability

In the realm of personal finance, net worth serves as a crucial metric, representing the difference between your assets and liabilities. Traditionally, this calculation incorporates both tangible and intangible assets. However, there’s a compelling case to be made for focusing solely on tangible assets when assessing your financial health.

Tangible assets, like cash, real estate, and physical investments, hold a unique advantage over intangible assets, such as intellectual property or goodwill. These assets are more readily quantifiable, making it easier to determine their exact value. As a result, tangible net worth provides a more accurate snapshot of your financial standing.

Moreover, tangible assets are typically more stable and less susceptible to market fluctuations. While intangible assets may have significant potential value, they can also be more volatile and difficult to value accurately. By focusing on tangible assets, you can establish a more solid foundation for your financial planning.

Tangible net worth also offers a tangible sense of security. Knowing that you possess tangible assets that can be easily accessed in the event of an emergency can provide peace of mind and reduce financial anxiety. It’s like having a financial safety net that you can rely on when life throws unexpected curveballs.

Step-by-Step Guide to Calculating Tangible Net Worth

Your financial well-being depends on understanding your financial health, and one key indicator is your net worth. When you calculate your net worth, you’re essentially taking a snapshot of your financial situation at a specific point in time. It reveals the difference between what you own (assets) and what you owe (liabilities).

While your total net worth considers both tangible and intangible assets, your tangible net worth focuses solely on your physical and quantifiable assets. This can provide a more conservative estimate of your wealth and can be particularly valuable for certain financial planning purposes.

To calculate your tangible net worth, follow these simple steps:

-

Gather your financial records. You’ll need to have a clear picture of everything you own and owe. This includes bank statements, investment accounts, and any other financial documents.

-

Identify your tangible assets. Tangible assets are physical items that can be easily valued. Examples include cash, real estate, vehicles, and collectibles.

-

Determine the value of your tangible assets. For some assets, such as cash, the value is straightforward. For others, such as real estate, you may need to consult with an appraiser or use online resources to estimate the value.

-

Add up the value of your tangible assets. This will give you the total value of everything you own.

-

List your liabilities. Liabilities are any debts or obligations that you have. Examples include mortgages, car loans, and credit card balances.

-

Add up the amount of your liabilities. This will give you the total amount of money that you owe.

-

Subtract your liabilities from your assets. The result is your tangible net worth.

Knowing your tangible net worth can be a valuable tool for planning your financial future. It can give you a clear idea of your overall financial health and help you make informed decisions about investments and spending.

Remember, your tangible net worth is just one aspect of your financial situation. It’s important to also consider your intangible assets, such as your education and skills, as well as your overall financial goals. By taking a holistic approach to financial planning, you can create a roadmap for a secure and prosperous future.

Using Tangible Net Worth for Prudent Financial Planning

Calculating your tangible net worth is a crucial step in understanding your financial health. By focusing solely on assets that have physical value, you can gain valuable insights into your financial stability and make informed decisions for the future.

Assessing Financial Stability

Your tangible net worth serves as a gauge for your financial stability. A higher tangible net worth indicates a stronger financial foundation and a lower risk of running into financial difficulties. This information can help you prioritize your financial goals and plan for unexpected expenses or emergencies.

Making Informed Decisions

Your tangible net worth can also inform your financial decision-making. For example, if you are considering making a large purchase, such as a home or a car, knowing your tangible net worth will help you determine if you have the financial capacity to take on additional debt. It can also guide your investment strategies, as you can allocate your funds based on your current financial resources.

Example

Let’s say you have calculated your tangible net worth and it comes to $100,000. This means that you have assets with a physical value of $100,000, and you have no liabilities that are backed by those assets. This strong financial position gives you the confidence to pursue your financial goals with greater certainty.

Calculating your tangible net worth is a valuable exercise that provides you with a clear understanding of your financial health. By focusing on the tangible assets you own, you can assess your financial stability, make informed decisions, and plan for a financially secure future.

Limitations of Tangible Net Worth

While focusing solely on tangible net worth provides some advantages, it’s crucial to acknowledge its limitations. Intangible assets, such as intellectual property, customer relationships, and brand recognition, are not accounted for in this calculation. These assets can hold significant economic value and contribute to a company’s overall worth.

For instance, a technology company with a solid patent portfolio and a loyal customer base may have a high intangible asset value, yet its tangible net worth may not fully reflect this value. Over-reliance on tangible net worth can result in an incomplete assessment of a company’s financial health.

Furthermore, intangible assets can appreciate over time, while tangible assets may depreciate. Ignoring the value of intangible assets can distort the true picture of a company’s net worth growth.

It’s important to note that tangible net worth can also be difficult to determine accurately. Valuing real estate, equipment, and other tangible assets can be a subjective process, leading to potential inconsistencies in calculations.

In summary, while tangible net worth can provide some insights, it’s essential to consider the limitations of focusing solely on tangible assets. A more comprehensive financial analysis should include both tangible and intangible assets to provide a well-rounded assessment of a company’s financial position.